Build Finserv Experiences That Keep Customers Coming Back

More engagement. More transactions. More loyal customers.

Build unified banking experiences people can’t get enough of

Amplitude delivers the insights your teams need to build digital finserv products consumers love.

2x*

Improvement in mobile click-through rates for .

10%

Increase in activation for .

20%

Boost in user retention for .

Forrester names Amplitude a Leader and a Customer Favorite

Looking to align product and marketing teams on one powerful self-serve analytics platform? Amplitude delivers. See how we earned 5/5 scores across 21 criteria in The Forrester Wave™: Digital Analytics Solutions, Q3 2025.

Real-time insights into the evolving customer journey

Optimize your digital experiences to acquire, retain, and monetize more customers.

Understand which key milestones drive users to their first—or fiftieth—transaction. Quickly test and measure to reduce friction and get your offers to convert.

Identify behaviors, cohorts, and user paths that lead to cross-sells, upsells, and customer loyalty.

Shift offline customers to digital with with targeted and personalized experiences.

Create digital experiences customers want to use

Increase digital product adoption when you decode customer journeys and build finserv products that are easy to onboard and delightful to use.

The leading Digital Analytics Platform to drive profitable growth

Our commitment to data privacy and security is embedded in every part of our business. Maintain compliance with best-in-class security certifications and tools to meet privacy regulations.

Great data is the foundation of digital analytics—and with Amplitude, you’ll have everything you need to integrate sources, resolve identities, and control customer and product data.

Amplitude gets you to the heart of what drives behavior. With self-serve insights, teams can answer questions about the customer journey and take actions that drive engagement and growth.

Finances are personal. Your digital experience should be too.

Deliver personalized digital experiences to customers every step of the way with Amplitude's fully integrated platform.

See the big picture at a glance

Visualize common pathways within your cross-channel user journey to find friction points and optimize for the seamless experience your customers expect.

- Compare users groups that convert to those that drop off

- See how many customers sign up, then open a checking account

- Segment by user attributes or actions to see which customers convert

- Discover high-value onboarding actions at a glance

Identify what’s working

Compare product engagement between user groups to see exactly how campaigns, channels, and feature adoption impacts your downstream metrics.

- See your top-performing campaigns, channels, and messaging at a glance

- Build lookalike audiences to find more customers interested in top products

- Pair with experimentation to optimize funnels with new features and messaging

Map your customer journey

Visualize any number of user journeys in one timeline. See events in sequence to learn where users drop off, and why.

- Identify user journeys that lead to conversion, multiple transactions, or drop-off

- Group users into cohorts for targeted offers that increase conversions

- Link business decisions to outcomes by measuring new product experiences

Drive user action and engagement

Encourage users to take key financial actions with personalized experiences based on behavioral insights.

- Guide users through financial milestones to boost engagement.

- Prompt users to explore new features and promotions to reduce churn.

- Test targeted upsell messages to increase conversions and revenue.

Learn how to reduce churn

Segment user groups to discover the actions and pathways that correlate with high lifetime value, using insights to optimize experiences and drive retention.

- See who returns after an event like opening a checking account, and how often

- Find which product features and experiences lead to retention—or churn

- Identify your power users and their shared attributes

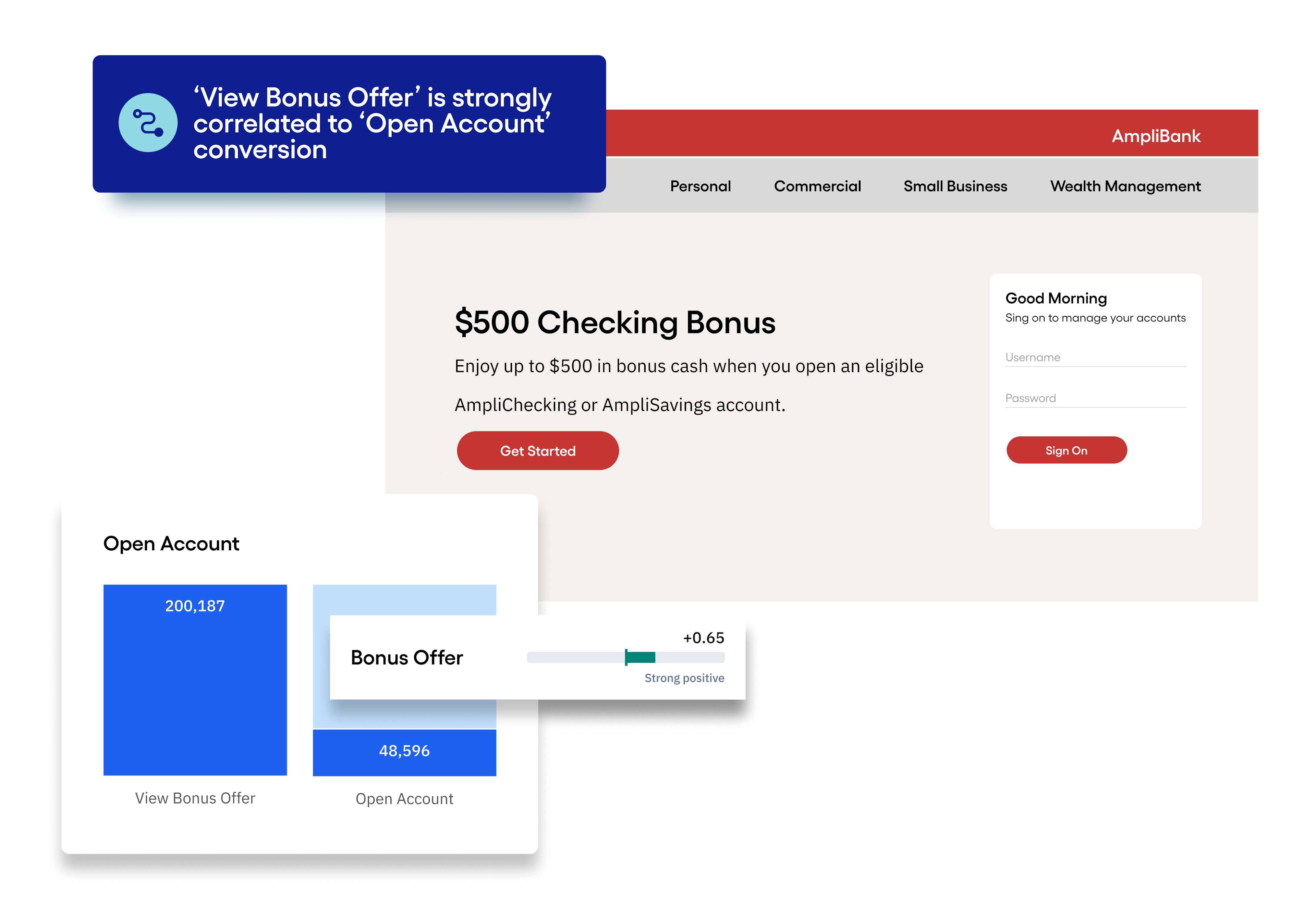

Optimize with machine learning

Surface significant opportunities with Amplitude’s self-serve recommendation engine—a machine learning tool that uses predictive analysis to find hidden patterns in data.

- Target an outcome, add user preferences, and receive data-driven recommendations

- Optimize your product experience for conversion, upsells, and cross-sells

- Democratize insights within a single shared dashboard

Test experiences at any scale

Use built-in A/B testing to measure impact, validate possibilities, and drive growth with confidence. All your product data is natively-integrated, so insights come seamlessly.

- Create metrics then test exactly what you need—without analyst support

- Refine personalization, improve onboarding, and boost conversions with real-time insights

- Discover what users like best, then double down on what works

Learn more about how financial services companies use Amplitude

Learn key insights about machine learning in financial services from our AWS webinar.

Learn how finserv platforms can leverage analytics to acquire and onboard new customers.

Learn how fintech analytics allows companies to gain insight into customer behavior and make data-driven decisions to optimize growth.

Get started with financial services analytics

Deliver the modern product experience your customers want today—and whatever comes next—with actionable insights anyone can access with a few clicks.

Frequently asked questions

Yes, Amplitude offers , with more on the way. Turnkey integrations include CRM platforms like Salesforce and Hubspot, marketing platforms like Marketo, Braze, and Mailchimp, as well as ad platforms like Facebook and Google Ads.

Amplitude lets you track and measure real-time data from the entire omnichannel customer journey. Our platform ingests customer data from marketing platforms, data warehouses, customer data platforms, digital channels, IoT devices, attribution vendors, and many more. Every unique data point combines in Amplitude to give you a 360-view of your customers.

Amplitude offers a usage-based pricing model based on your number of monthly tracked users (MTUs). Choose from . If you have more than 1 million MTUs, our accounts team can help you with event-based pricing that scales depending on how many events you'd like to send per month.

See Amplitude in action

Explore our financial services notebook to see how finserv customers use Amplitude to acquire, retain, and monetize their customers.