The Ultimate Guide to Analytics for Financial Services

Learn how fintech analytics allows companies to gain insight into customer behavior and make data-driven decisions to optimize growth.

The financial services (finserv) industry has experienced some big changes in the last few years. Digital technology has disrupted traditional financial institutions like banks, insurance companies, and credit unions as financial technology (fintech) firms have entered the market. Neobanks, robo-advisory tools, peer-to-peer lending solutions, and other fintech solutions have pulled the market in their direction, offering clients more customer-centric, personalized experiences.

It’s no surprise that the fintech industry saw an impressive 337% increase in daily active users between January 2020 and August 2021. Since then, however, market conditions have changed as inflation worsens and customers fear a recession. Both traditional and digital financial service institutions are bracing themselves for a bumpy road ahead. To do this, they are increasingly recognizing the value of data analytics.

In order to weather the storm of economic uncertainty and changing customer expectations, finserv and fintech companies need to give customers “fine-tuned digital products influenced by behaviors as opposed to demographics.” They must lean on analytics to optimize their offerings and make data-informed decisions that will ensure continued success.

Key takeaways

- After unprecedented growth in 2021, the fintech industry has seen a significant dip since 2022 due to inflation and recession fears.

- Finserv and fintech companies must use analytics to gain better insights into their customer behaviors and optimize their products through data-driven decisions.

- There are a number of useful metrics you should analyze throughout the customer journey, starting from acquisition all the way to long-term loyalty.

The benefits of using analytics for finserv

Traditional financial services organizations had been struggling for years as digital fintech products created massive disruptions in the sector. The fintech industry received an unprecedented $121.6 billion in annual funding in 2021. This equated to a 153% year-over-year increase in global venture capital deal value.

By Q2 2022, however, funding had plummeted to $20.4 billion, or a 33% quarter-over-quarter decline. The level of growth and investment in 2021 was so high that it was unsustainable, and a drop was inevitable. Factors like inflation and recession fears accelerated the decline even further.

Finserv and fintech organizations must harness analytics if they want to navigate the turbulence that the market is currently experiencing. The insights gained will help companies create a stronger experience for their customers as well as enjoy decreased costs and increased revenue.

- Obtain a 360-degree view of your customers—data analytics provides companies with insights to develop a fuller, clearer picture of who their customers are. This includes their preferences, the touchpoints and channels they use, and their behaviors. Knowing the typical user journey of your high-value customers can help you optimize your product for better performance. Reinforce what’s working and improve upon what isn’t.

- Create personalized experiences—research shows that 71% of customers have come to expect personalized experiences from the brands they interact with. Analyzing user behavior gives you a clear picture of their intents, their pain points, and their needs. This insight puts companies in a better position to offer personalized experiences and marketing campaigns.

- Predict future outcomes and mitigate risk—companies can leverage predictive analytics to obtain data-driven market forecasts. By marrying historical data and machine learning, companies can predict how customers will react to a new product and the likelihood of its success. This also helps future-proof organizations as they become better prepared to face sudden fluctuations in the market.

- Gain competitive advantage—data analytics uncovers gaps in the market and unmet customer needs that your competitors still haven’t identified.

What metrics to analyze for finserv

The nature of digital products means that companies collect an abundance of data and insights that can be measured, analyzed, and used to make business decisions. The trick is understanding what metrics provide value and which are simply vanity metrics. To understand which metrics are important, look at the customer journey and ask yourself what you need to find out at each stage in order to collect actionable information.

Core user data

You will first need to contextualize the data you will collect by obtaining as much information as possible about your current customer base. Some key metrics that will help with this include:

- Demographic information, such as your consumers’ age, gender, and level of education.

- App access, which tells you how they access your product (mobile, desktop, tablet, etc.) and through which operating systems (Android, Apple, etc.).

- Bounce rate, which tells you how many people visit your landing page and leave immediately without taking further steps, such as visiting another page or starting the sign-up process.

You can gain an even deeper understanding of your audience by looking at user behavior:

- Monitor the time elapsed for a customer to make a first deposit or payment from the time they create an account.

- Study features commonly used by your power users (these are users who are most loyal and frequently use your services). Identifying and optimizing these features will help you retain users and will also give you insight into how to attract more customers by highlighting their value in campaigns and resources.

- Analyze common paths used by users who make a deposit or payment for the first time and users who keep returning on a daily or weekly basis.

Acquisition and activation

To get a holistic overview of a finserv product, it’s important to track how users first find out about your product.

Acquisition metrics help you understand more about the initial touchpoints and experiences new customers have with your product. They provide insight into which marketing channels are most effective. Activation metrics then shed light on the moment when a user realizes that your product is valuable to them and becomes a customer.

Some questions you should be asking at this stage are:

- Which marketing channels show higher conversion into sign-ups? Knowing which marketing channels are more effective allows you to create more efficient and cost-effective marketing campaigns. You can eliminate the channels that aren’t working and focus on those with the most potential.

- Where is the highest drop-off during Know Your Customer (KYC) checks? These checks are a regulatory process that, while necessary, can cause potential customers to abandon the onboarding process. Use analytics to find out which areas of your KYC checks cause the most annoyance and streamline them for better acquisition rates.

- What is the conversion from opening an account to making three money transfers? Signing up or opening a new account doesn’t necessarily mean you’ve obtained a customer that will bring value. They need to understand the value of your product and move on to carry out a key action (such as making three transfers). You want to know just how many new sign-ups proceed to become customers.

Some important acquisition and activation metrics include:

- Number of new sign-ups or qualified leads—a measure of high-intent users who are more likely to convert to customers.

- Activation rate—the rate at which customers carry out a specific behavior that converts them into active customers of yours who bring value to your business. This could be signing up for a premium account or making their first deposit.

- Time to activate—how long it takes to move users through the onboarding flow from acquisition to activation.

Engagement and retention

Next, you’ll need to learn more about how often activated users are coming back to your product and performing critical behaviors, such as making transactions. Engagement metrics tell you how much and how often users are interacting with your product and, therefore, which are considered active users.

Retention metrics help you understand how many active users have been active for a predetermined period of time. They even help you identify your power users—those with high value and who are most likely to recommend your product to others. In other words, these metrics help you understand how sticky your product is.

At this stage, some helpful questions to ask are:

- What is the percentage of users that have used accounts with more than two currencies in the last 30 days? These are the sorts of behaviors that show that your customers are engaging with your product on a regular basis.

- How often do users engage with other product features? Another important aspect of engagement and retention is just how much your customers are exploring and benefiting from the different features of your product. You want to know if they have explored the totality of the value you can offer them.

- What events in the app correlate with users churning? Identifying any problem areas in your product experience early can help you hold on to more customers. Once you’ve identified the issues, you can take the necessary steps to remedy them.

Some important engagement and retention metrics include:

- Monthly, weekly, or daily active users (MAU/WAU/DAU)—the number of active users who use your app on a monthly, weekly, or daily basis. To know your active users, you must first define what constitutes an active user. It should be more than simply opening your app. You need to identify the critical events that customers carry out which define them as active. For an insurance app used by agents, critical events could be carrying out risk assessments.

- Feature usage—helps you identify which features your customers use most. You can use it to obtain a clearer understanding of the depth of user engagement.

- Retention rate—measures how often a user comes back to engage with your product. This can be measured in a few different ways:

- N-day retention: how many of your users came back on a certain day.

- Bracketed retention: used to understand product use within specific intervals. For example, you can measure retention for days 0-7, days 0-14, and days 0-21. Users who come back during any of those three time periods are considered retained.

- Unbounded retention: this is best suited for apps that may be used infrequently, such as a loan app. You take a measurement every time a user returns to your app. It is essentially the opposite of your churn rate.

- Churn rate—how many users stopped returning to your product.

- Customer lifetime value (CLV)—the value a customer brings to your business throughout their entire relationship with your company.

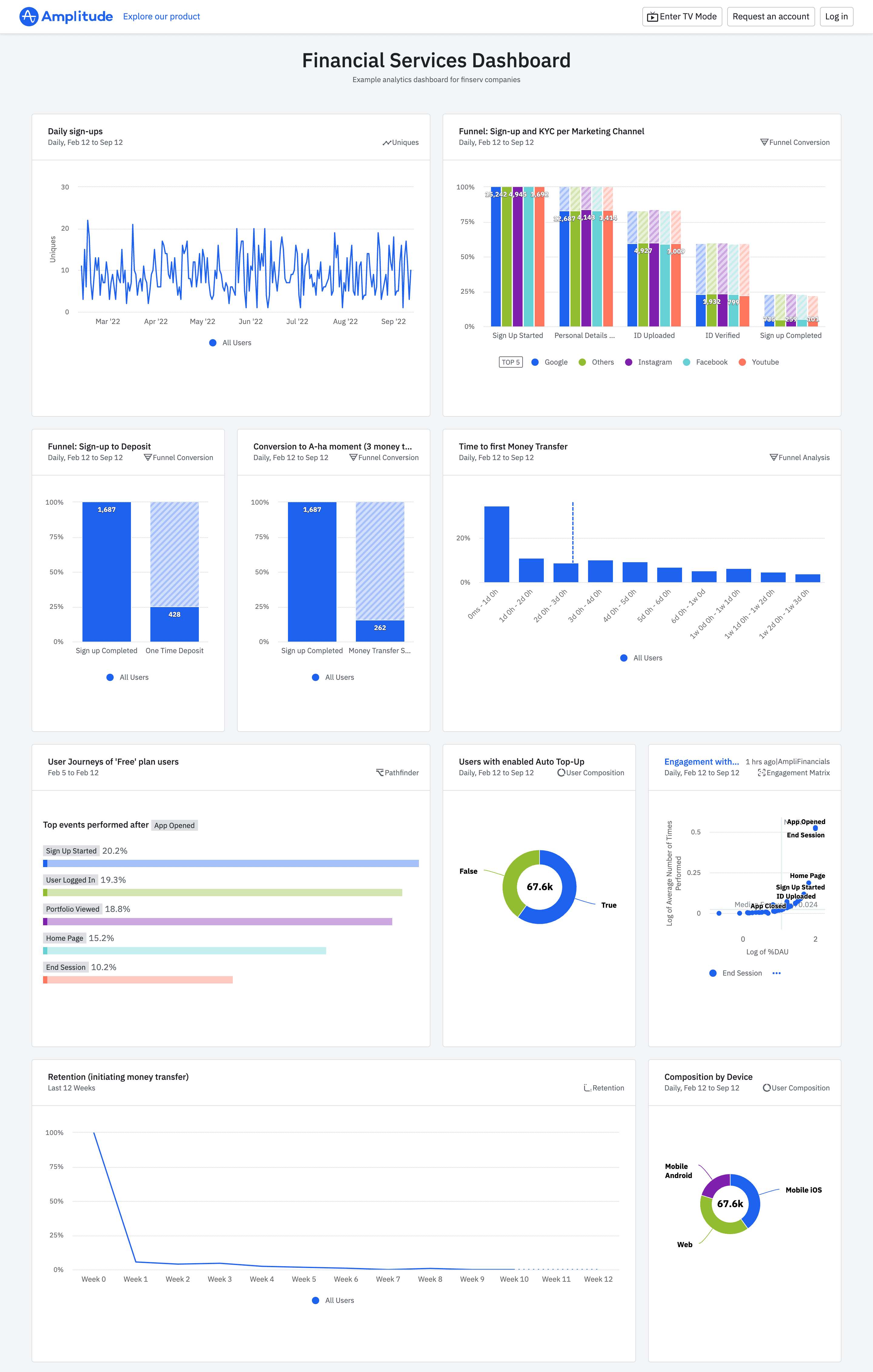

Obtain actionable self-service insights with Amplitude

Amplitude Analytics empowers finserv teams with self-serve insights into the customer journey to make data-driven decisions, enhance the customer experience, and boost revenue. Explore Amplitude’s finserv dashboard to gain insight into everything from marketing campaigns bringing in new customers to understanding loyal customers.

Start tracking your finserv analytics with a free Amplitude account, or read the Financial Services Survival Guide to learn more.

Maja Gocevska

Senior Solutions Architect, Amplitude

Maja Gocevska is a Senior Solutions Architect on the Professional Services team at Amplitude. She is passionate about empowering clients to harness the full capability of Amplitude and gain valuable insights into their customer behavior using trusted data. Previously, Maja supported customers with various tools that increase productivity for product and engineering teams.

More from Maja