The Future of Finance: 6 Ways Financial Services Can Use Machine Learning

Learn key insights about machine learning in financial services from our AWS webinar.

In recent years, the financial services (finserv) sector, like many other industries, has undergone a significant transformation. Widespread adoption of the public cloud has driven down the cost of computing and storage. The barriers to adoption are lower, and machine learning (ML) is now accessible to all—from small fintech startups to large traditional banks.

Data has also changed. Transitioning from relational structured databases to NoSQL data and from batch data ecosystems to real-time data streams has helped machine learning models become more powerful. Companies are excited about AI because it helps them understand their customers better and create hyper-personalized experiences.

But making the most of the technology available is challenging.

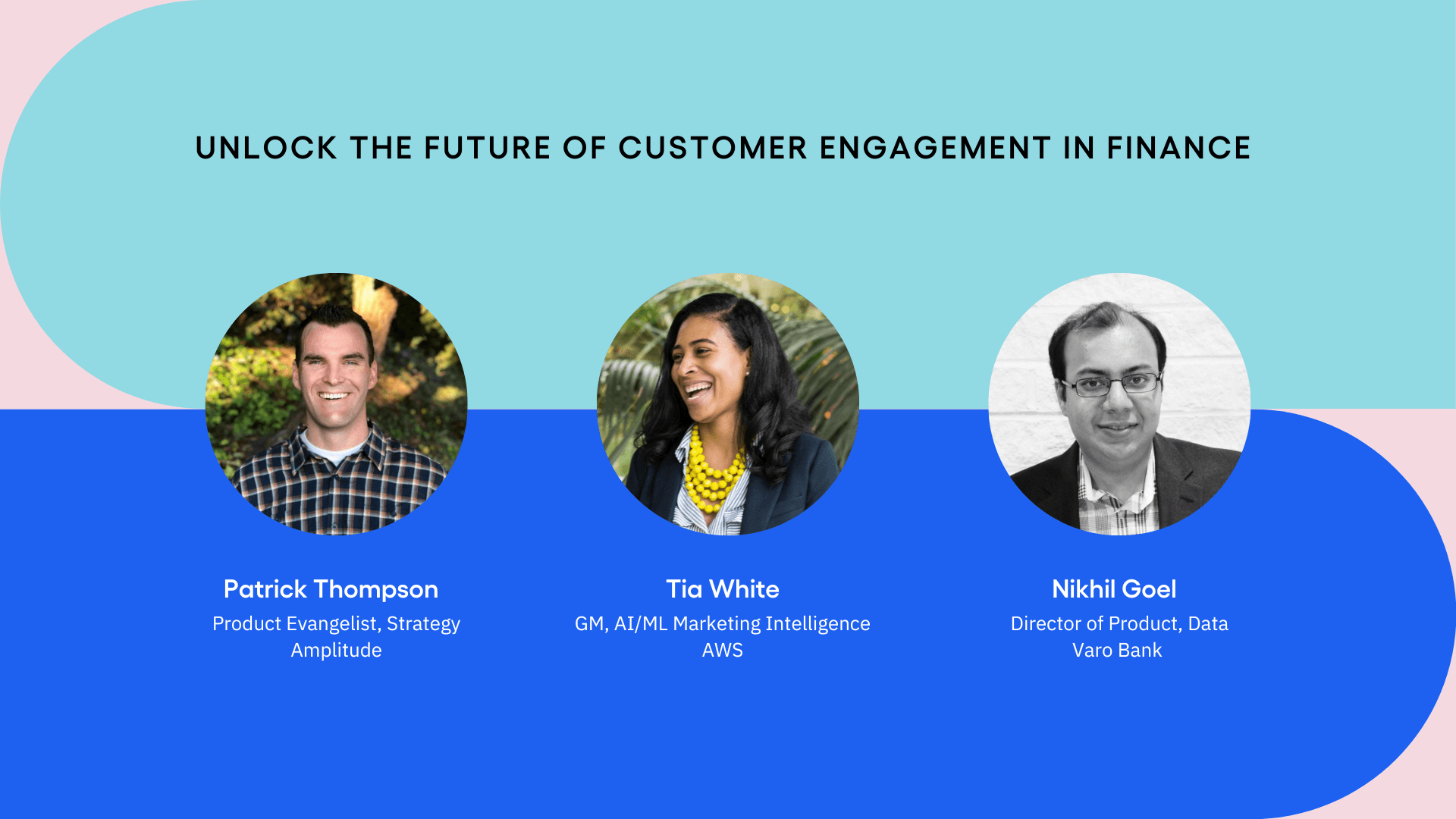

Amplitude recently hosted a webinar to demystify finance companies' challenges in this new ML landscape. Director of product management at Amplitude, Patrick Thompson, was joined by:

- Tia White, General Manager, AI/ML Marketing Intelligence at AWS

- Nikhil Goel, Director of Product, Data at Varo Money

In this recap, we share actionable insights from the discussion to help finserv companies use machine learning to their advantage.

Key topics

- The unique challenges finserv companies face with machine learning

- Democratizing data in a heavily regulated industry

- How to decide when to build vs. buy

- Why the culture of your internal team matters

- How to use machine learning to turn cost centers into revenue sources

- Why machine learning initiatives start with a customer problem and a business metric

Read a recap of the key insights from the discussion below or tune in to the full webinar: Unlock the Future of Customer Engagement in Finance with Amplitude and AWS.

Challenges companies in the financial industry face when adopting ML

Transformation is never easy, but the financial industry faces an added layer of difficulty.

Regulation

Compliant machine learning projects are privacy-preserving and adhere to strict regulations. “I think that's what makes things different for financial services, especially when it comes to AI ML models,” explains Nikhil. Data hygiene is paramount. Leading finserv companies make sure data is highly secured and auditable while being accessible to those who have a right to use it.

Data at scale

Established financial institutions have massive amounts of historical data—think about all your interactions with your financial institution of choice in a given month. Tia says that when banks make acquisitions or other changes, it can be difficult to stitch together the rich customer history they need to understand their customers.

Culture

Tia and Nikhil emphasize that a cultural shift is another challenge. Many businesses are used to working in silos, which doesn't work in ML. “It's not just about the processes, it's not just about the technology. . . . Half the battle to evolving and getting there and being successful is the cultural mindset,” says Tia.

6 ways financial service organizations can make the most of ML

Based on their experience in the industry, our panelists shared their advice for financial services companies.

1. Get on top of data process and governance

To do machine learning well, working with high-quality and well-prepared data is crucial. Regulators also require that finserv companies process data in a compliant way. But it's a balance between security and access.

Tia explains that companies want to ensure their data is secure, safe, rich, and diverse. But sometimes, financial companies maintain security in a way that slows them down.

“I've seen projects and products delayed by months because of the rigor of the data governance,” says Tia. Leading companies keep data secure while allowing access to those who are authorized.

In a world without cookies, where data on clicks and views is decreasing, it makes sense for two partners to share data. But doing so in a secure way is tricky. Last year, AWS previewed Clean Rooms, a way for companies to collaborate on data safely and securely.

Nikhil highlights the challenge of collecting behavioral data to provide inputs for your models and managing it correctly: “How do you build this in your technology stack when it comes to data governance, data quality checks, [and] anomaly detection?”

The team at Varo relies heavily on Amplitude, which enables them to collect and measure the data they need and helps with fraud prevention. “If I can get an early signal on day zero or hour zero of something that potentially might go bad, I can prevent it,” Nikhil says.

2. Build a diverse, data-driven team

A diverse team and a culture of experimentation are key to building machine learning initiatives that serve your customers.

Tia explains that with ML, we often think about the importance of the diversity of data. Diverse data helps mitigate bias—generally, the more diverse the data you input, the better the model performs. But the diversity of your team is also immensely important. It's crucial to be inclusive in recruiting and retention to boost innovation and profits.

If you don't have diversity of thought, diversity of gender, diversity of background, diversity of socioeconomic status . . . then how do you know how to design [your product] so it meets the masses and not the few?

Tia White

Nikhil emphasizes that the culture of your team is also important. When experimentation is part of that culture, it drives smart decision-making and helps you measure success.

At Varo, experimentation is at the core of their operations, especially ML. When you're deploying models into production, it’s beneficial to constantly iterate. Nikhil explains that experimentation is the only way to get an incremental lift.

Patrick adds that he loves seeing organizations with a high velocity of experimentation culture. Experimenting helps you test your main ideas and improve your instincts to build better digital experiences.

3. Prioritize customer delight

Financial services products work best when they focus on solving customer problems and prioritize customer needs over technology. It's about using machine learning to serve your customers better rather than for the sake of it.

Tia discusses how some companies focus on building “cool things” or beating competitors without listening to customers. It’s important that finserv companies learn:

- Who they're delighting

- Why they're delighting them

- Where their customers are on their journey

- How to remove friction on that journey

Nikhil agrees, explaining that Vero's customer mission—financial inclusion and serving the underserved—drives everything they do.

Analyzing behavior is one way to learn from your customers. Here, identity resolution is key. Identity resolution combines data points to create customer profiles, for example, to recognize one customer across multiple email addresses.

Tia says it's important to safely and securely connect profiles, like a family, for group personalization. AWS launched its identity and entity resolution service earlier this year, which will “be a game changer for personalization.”

4. Know when to build versus buy

Financial services companies often think they must build all their technology instead of using off-the-shelf solutions strategically. But that’s not always the most effective use of resources. “Why would I, even as a CIO of a Fortune 20 company, spend fifty to a hundred engineers and scientists and resources building [a Customer Data Platform] when I can go purchase it, gain value very quickly, and integrate it into my tech stack?” asks Tia.

Where there are high-quality off-the-shelf solutions that can integrate seamlessly into a tech stack, companies can use them. Then, they can invest the saved resources into the ML and AI work that is proprietary to their business and sets them apart from their competitors.

Tia explains that the decision to build or buy depends on your business. Companies maintain a competitive edge by making a trade-off. Tia recommends balancing resource availability with criticality to the business to make a decision.

If it's a commodity and you can go purchase it, go purchase it. If it's something that's going to create stickiness for your customers or become a game changer in the market and you have the resources, invest the time to build it.

Tia White

Patrick agrees. He shares that in his time at Atlassian, they spent a lot of resources building tools in-house (think: audience management segmentation and experimentation capabilities) when they could have used a lot of off-the-shelf software to get the job done.

5. Measure success via business impact.

When measuring the success of machine learning initiatives, look at the business impact they ultimately have.

Sometimes, businesses overly focus on the scientific metrics that measure the efficacy of an ML model, such as accuracy, precision, and recall. While those metrics matter, “really, it's about business impact,” says Tia. She recommends defining the business KPIs ML work should impact before you start.

Let's say you want to use ML for audience generation. You want to determine the impact of the audience you generated with an ML approach versus a legacy rules-based approach. In that case, you can measure a metric like return on ad spend to see if it increases or decreases with the two methods.

6. Turn cost centers into profit centers

ML can help reduce or improve what you already do—for example, it can make fraud prevention more efficient and effective. It can also enable you to monetize in new ways.

Tia gives a customer service example. At the lowest level of maturity, contact centers answer basic questions about things like accounts or spending limits. Customer service is a cost center.

But as you mature, customer service becomes a way to cross-sell and upsell. ML enables you to monetize your customer service by creating a hyper-personalized experience. Imagine pulling data from all the channels customers use to interact with you to create a 360-degree view, then sharing it with customer service agents in a regulated way.

Agents could say things like, “Hey, I noticed that you're making a trip. Have you looked at how you could leverage your rewards points for that? Have you thought about switching your mortgage to us?” explains Tia. You evolve your contact center into a department that makes money.

Tia says Amplitude's Digital Analytics Platform and AWS products like Amazon Personalize provide the data power you need for evolution. “You're delighting your customers, but you're now also helping your bottom line,” says Tia. Machine learning and AI enable you to do that at scale.

Watch the full webinar Unlock the Future of Customer Engagement in Finance with Amplitude and AWS to dive into more detail.

Julia Sholtz

Former Group Product Marketing Manager, Amplitude

Julia is a former product marketer at Amplitude. She focuses on go-to-market solutions for enterprise customers.

More from Julia