What’s Growing Faster: Apps or Websites?

Exclusive data from Amplitude Labs shows exactly where app and website usage is taking off across six different industries.

Search for “app vs. website” and the immediate results will tell you to invest more in building an app. “Web is dead.” “Apps are faster.” “Users spend more time on apps.”

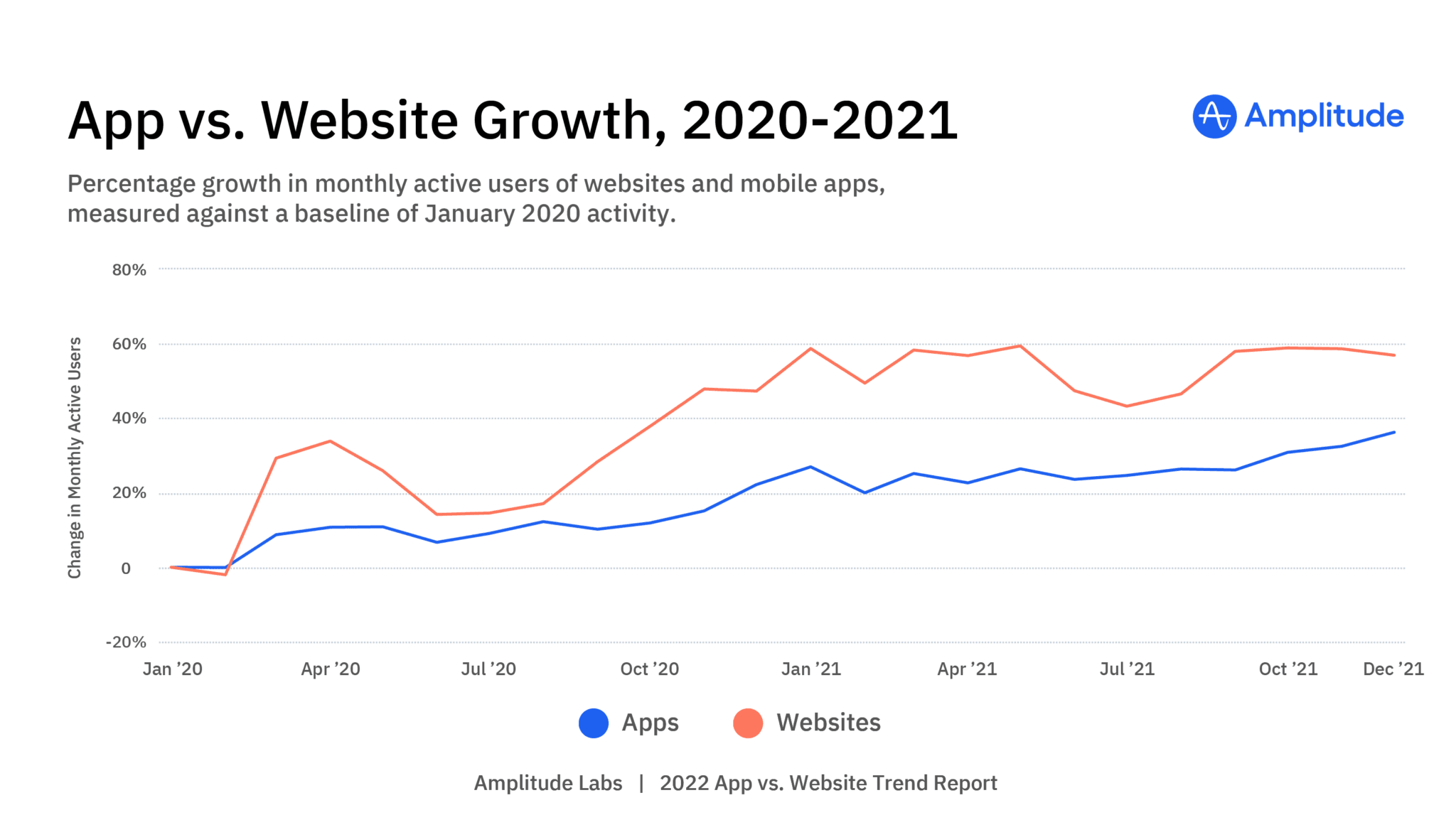

New data from Amplitude Labs shows the answer isn’t so black and white. The web experience is not dead—in fact, website usage grew at a higher rate than mobile app usage in 2020 and 2021.

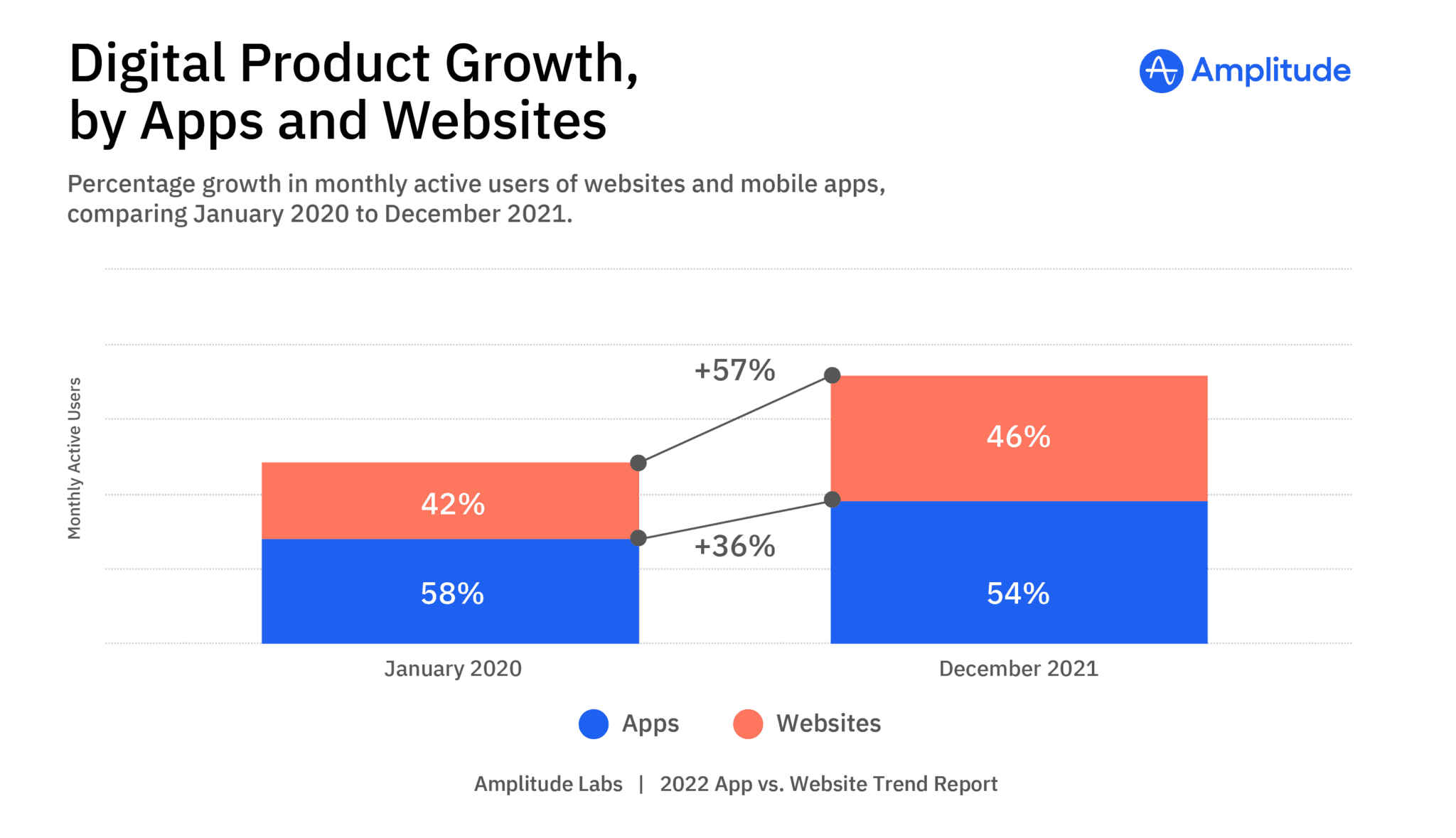

To be clear, mobile apps still engage more users overall, but website usage is growing faster, and quickly closing that gap. In addition, mobile app growth tends to be more steady and reliable, while website usage is more impacted by seasonality and trends. Still, from January 2020 to December 2021, website usage experienced 57% growth in monthly active users, compared to 36% growth for apps in that same time period.

Why the surge in website activity? One insight is that websites are becoming more valuable business tools. Digitally optimized companies aren’t relegating websites to function like brochures that merely showcase their products and services. Instead, they’re treating websites like apps—as dynamic products capable of driving growth, engagement, and revenue with customers.

For any business with a digital footprint, optimizing customer journeys is mission-critical. Pressure to support the two major digital touchpoints—apps and websites—can sometimes lead to competition for an organization’s limited time and resources.

But as the new 2022 App vs. Website Trend Report from Amplitude Labs shows, it would be a mistake to neglect one product for another. Customers use apps and websites across the digital journey. If you don’t invest in both experiences, you’re leaving dollars—and opportunities to win with product-led growth—on the table.

Download the full report to see where apps and websites are growing across six industries and five countries. Read on for a hint at what you’ll learn in the report.

App Growth by Industry: 2020-2021

The overall web-versus-app numbers are just the tip of the insights iceberg. Informed by Amplitude’s vast Behavioral Graph dataset of more than 900 billion data points, our report assesses two years of customer digital behavior and even maps the changes brought about by the pandemic.

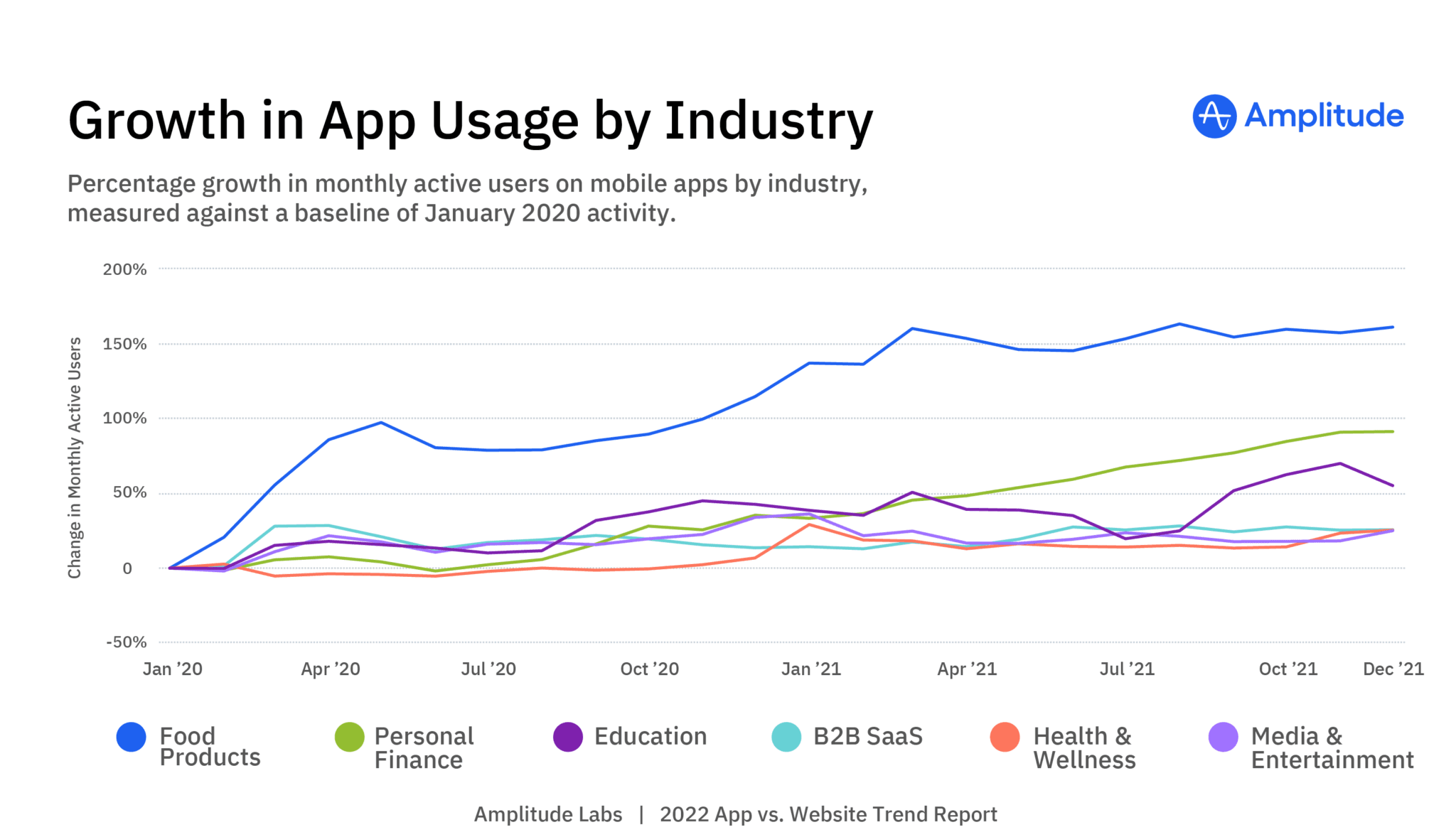

Take a look at the following chart, showcasing the growth rate of monthly active users on mobile apps by industry:

When we separate our data by industry and compare the growth trends of monthly average users (MAUs) on apps, we see a few interesting takeaways. Anecdotally we know that when the pandemic started shutting public spaces down, people turned increasingly to digital solutions for needs they’d formerly taken care of in person, like food shopping. But what happened after the “pandemic bump” in the spring of 2020?

It turns out that after a cool-down period in the summer of 2020, most sectors continued to experience substantial growth in MAUs on apps throughout 2021. Food-related shopping demonstrates this trend line clearly: The rate of growth nearly doubled between January 2020 and May 2020, then continued to climb throughout 2021, ultimately reaching 162% growth in December 2021 relative to the baseline of January 2020.

The personal finance sector yielded a remarkably steady month-over-month growth rate throughout 2021, ending the year with 92% MAU growth on apps against January 2020. B2B SaaS showed peak MAU growth on apps in April 2020 while media and entertainment and health and wellness categories peaked in January 2021.

That’s a broad overview of the app story; with more details about each industry available in the report. But what about websites? Specifically, what does the data show us about MAU growth for websites in different industries? Let’s take a look.

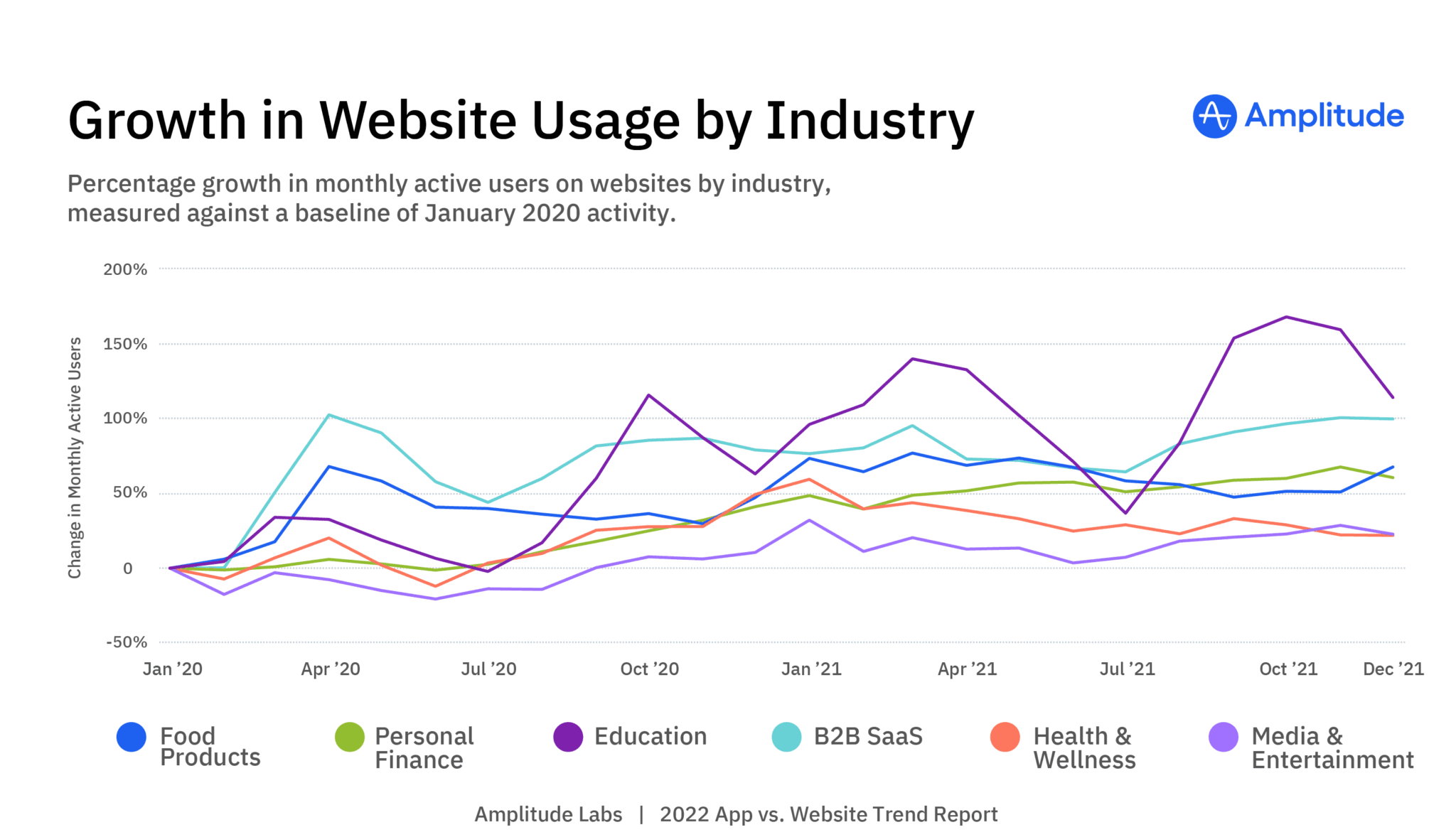

Website Growth by Industry: 2020-2021

At a glance, it’s easy to see that the trend lines for website growth are significantly more erratic. Some of the volatility is tied to seasonality, such as the large summer-vacation dips for educational and B2B SaaS tools. Among website users the “pandemic bump” generally led to a similar cooldown period in the April to July timeframe, with some industries going briefly into retrograde. Growth for personal finance, media and entertainment, and health and wellness all hit negative numbers in June 2020 relative to January 2020 (-1%, -12%, and -21% respectively) while education hit -2% in July 2020 before rising again.

The growth of MAUs shopping for food on websites continued to cool through November 2020, until it hovered just 30% above the January 2020 benchmark before climbing again. The tides of website growth rose and fell, but it was the education sector that emerged victorious, ending the two-year data period at a best-of-show 115% growth against January 2020. B2B SaaS tools followed close behind with 100% growth, and food products ended strong with 68%.

It’s not app or website. You need both for a winning customer experience

It may seem at times like apps have all the momentum and deserve the lion’s share of time and resources relative to your company’s websites. But the data tells a different story. Both apps and websites are growing, with website growth outpacing that of apps.

Rather than choosing one to prioritize, product leaders are well-advised to support both products, and build seamless, unified customer journeys that can drive engagement. Investing in both touchpoints is the way to optimize customer retention, and fully embrace product-led growth.

Whether you’re just looking for a deeper understanding of customer behavior or have a vested interest in applying resources to optimize customer journeys, the 2022 App vs. Website Trend Report provides the foundational data you need to make better-informed decisions. Are you reading this on an app? In a web browser? Either way, download the report today.

Jenna Kozel King

Former Vice President, Corporate Marketing + Communications, Amplitude

Jenna Kozel King is a former Vice President of Corporate Marketing and Communications at Amplitude. Previously, she was Vice President of Corporate Communications and Content Marketing at Okta.

More from Jenna