Employee Equity is Broken, Here’s Our Fix

We feel strongly about changing the status quo at Amplitude.

Equity compensation for startup employees is broken. Ownership of a company is supposed to be one of the biggest upsides of joining an early stage startup, but it’s riddled with traps. Employers don’t share as much information as they should and employees don’t know the right questions to ask to make sure they get treated fairly. I have only seen prospective hires ask questions about equity compensation when they have been screwed over by a previous startup. It took being screwed over to even know where to look!

Founders are in the lucky position that they have a seat at the table during any decisions that impact their equity and can advocate for what’s important to them. I’ve never seen employees be afforded that even though they’re the biggest contributors to a company’s success (much more so than the founders or investors).

We feel strongly about changing the status quo at Amplitude. Today we’re announcing two big improvements to the standard way startups grant equity:

- We’ve extended the post-termination option exercise window from the standard 90 days to ten years for all employees, regardless of how long they’ve been at the company.

- We provide every hire with detailed information about what the equity that we’re granting them means.

Changing the Exercise Window to 10 Years

The 90 day exercise window is one of the biggest “gotchas” of equity compensation, especially for employees who are new to startups.

A quick primer: employees are not given shares in a company for tax reasons.1 Instead, equity compensation comes in the form of stock options, the right to buy shares. In order for an employee to own shares, they must exercise their options and spend money to buy the shares. Almost all startups have a 90 day period once an employee leaves or is terminated to exercise their vested options, otherwise they lose the options. To exercise options, the employee needs to pay the exercise price as well as the tax liability on the new shares.

Under the current system, employees only get to have ownership if they can come up with enough cash within 90 days of leaving. Employees often run into this as a surprise and need to come up with a substantial amount of money in the middle of a job change. To make it all worse, there’s a good chance the shares will be worthless in the future. I know of one instance where an employee ended up spending all of their savings to exercise their options right after leaving and the company ended up going through bankruptcy, leaving the former employee with no cash and a bunch of worthless paper.

We’re changing the option exercise window from 90 days to ten years for employee options.2 (We’ve actually removed any restriction on exercising post-termination and simply left in the options default exercise timeline of 10 years which applies from the start date of the grant.) This is for everyone at Amplitude—regardless of how long they’ve been at the company. I feel very strongly that once you’ve vested options they’re yours without conditions on employment. The 90 day window is an artifact of IRS tax treatments and is unfair to employees. This also allows the company to get far enough along towards liquidity so the employee knows more about whether it’s worth it to exercise in addition to not forcing them to come up with a lot of cash on short notice. Not only is this the right thing to do for employees—more startups should seriously consider it as a way to attract more talent.

There were a few legal hurdles to get here. The first legal team we talked to told us they had never seen anything like it and recommended against it.3. Luckily we’ve been able to work with the exceptional Craig Schmitz at Goodwin Procter and get it done. We’re also open sourcing 4 our documents so other startups can use them. (Please consult your lawyer before doing so!)

Explaining What Equity Means

Too many startups consider even really basic things like the number of shares outstanding or the valuation of a company to be a trade secret. They don’t share this information to potential hires even though these basic metrics are critical to understanding the value of equity. Knowing only the number of shares in a grant is useless without knowing the denominator.

In one particularly egregious example, employees of a startup were not told how many shares there were in the company—only what percentage of the employee pool they had. The company told them that typical employee option pools range between 5% and 20%, starting on the higher end of that range and coming down after future financing rounds. It later emerged that the pool was slightly above 5% before taking into account any dilution, including an already raised seed round through convertible debt.

We’re changing that by sharing detailed information with potential hires about what their equity could be worth under different scenarios and making it concrete by including a spreadsheet that outlines all the details. Both our lawyers and our board were apprehensive about sharing this data with prospective hires as it could set the wrong expectation, but I felt very strongly about sharing as much as we could, even if there’s a lot of uncertainty around it. Before sharing it with any hires I make it clear that both the valuation of the company and the percentage that a particular number of shares represents are best guesses and have a massive variation on them. The most likely outcome is that the equity will be worth zero. (As those on Hacker News like to remind us, there’s no intrinsic value to these options.)

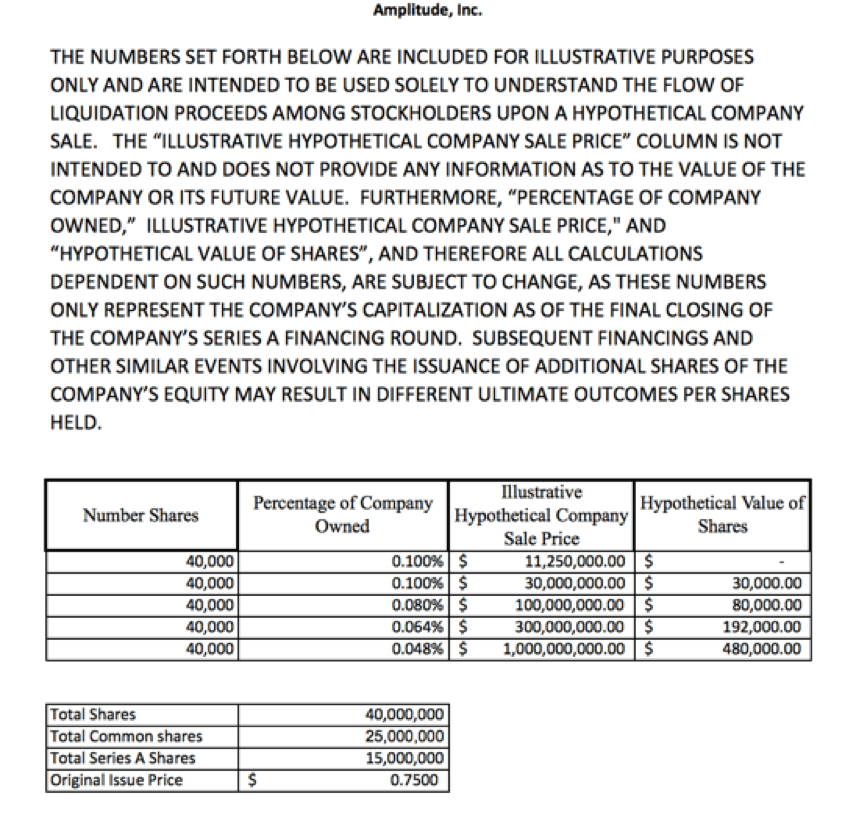

Here’s the spreadsheet that we share with employees. (These numbers are sample numbers, not actuals):

I walk potential hires through this spreadsheet so they have an understanding of different hypothetical scenarios with potential dilution included. It also outlines that if we sell at less than or equal to our liquidation price, then the equity is worth nothing. Even though this is a rough picture with huge variance on it, I’d much prefer to share this than nothing.

Raising the Bar on Employee Equity

Sam Altman 5 has written about ways to improve employee equity before and Coinbase, Quora, Pinterest, and Clef 6 have begun to make moves to fix it. As far as I know, this is the most progressive take on equity compensation that I’ve seen. If there are bolder equity compensation plans out there, please let me know- we’d love to get a chance to match and improve on them! I hope that a lot of what we’re experimenting with here becomes the new standard for employee compensation at startups—it’s a huge problem that needs fixing.

Notes:

- Granting shares to an employee requires the employee to pay taxes on the grant while the way option grants are structured do not. There are also tax implications with options that Adam D’Angelo from Quora covers in more detail.

- We’ve actually removed any restriction on exercising post-termination and simply left in the options default exercise timeline of 10 years which applies from the start date of the grant.

- Here’s the text of the email they sent me: “I’ve worked with thousands of startups for nearly a decade and I’d never even heard of this idea until a few months ago. My spidey sense tells me there are potentially some serious pitfalls. For example, one reason there is a 90 day post-termination exercise window on ISOs is because the IRS requires as much in order for an option to qualify as an ISO (26 U.S. Code § 422). There may be ways to hack around this requirement, such as granting NSOs or converting ISOs to NSOs. However, the hacks themselves are full of their own pitfalls. As innovative as the idea is, my guess is it might make sense to negotiate a special term like this on a case-by-case basis (such as with your employee who requested it), but making it “standard” for all employees might be taking on more complexity than makes sense. I’m pretty sure [company name] did not give this to all their employees – see [link redacted]. And it sounds like [company name 2] also only did this on a limited basis. I’ll reach out to the folks at [company name] to see what I can learn from them. I spoke briefly with the equity compensation expert at [law firm] that we work with, who had the same reaction I did.”

- Employee Stock Summary Chart& Amplitude – Form of ISO Agreement (2014 Plan)

- Sam also talks about granting more equity to early employees and the unfavorable tax treatment. I’m very much for fixing both of them but didn’t want to make it the topic of this post. We’re in line with his suggestions around granting more equity. I agree that the tax issue needs to be fixed but it was too complex for our first iteration of equity compensation.

- I’ve also read about Asana and Palantir having longer exercise windows but they haven’t shared many details.

Spenser Skates

CEO and Co-founder, Amplitude

Spenser is the CEO and Co-founder of Amplitude. He experienced the need for a better product analytics solution firsthand while developing Sonalight, a text-to-voice app. Out of that need, Spenser created Amplitude so that everyone can learn from user behavior to build better products.

More from Spenser