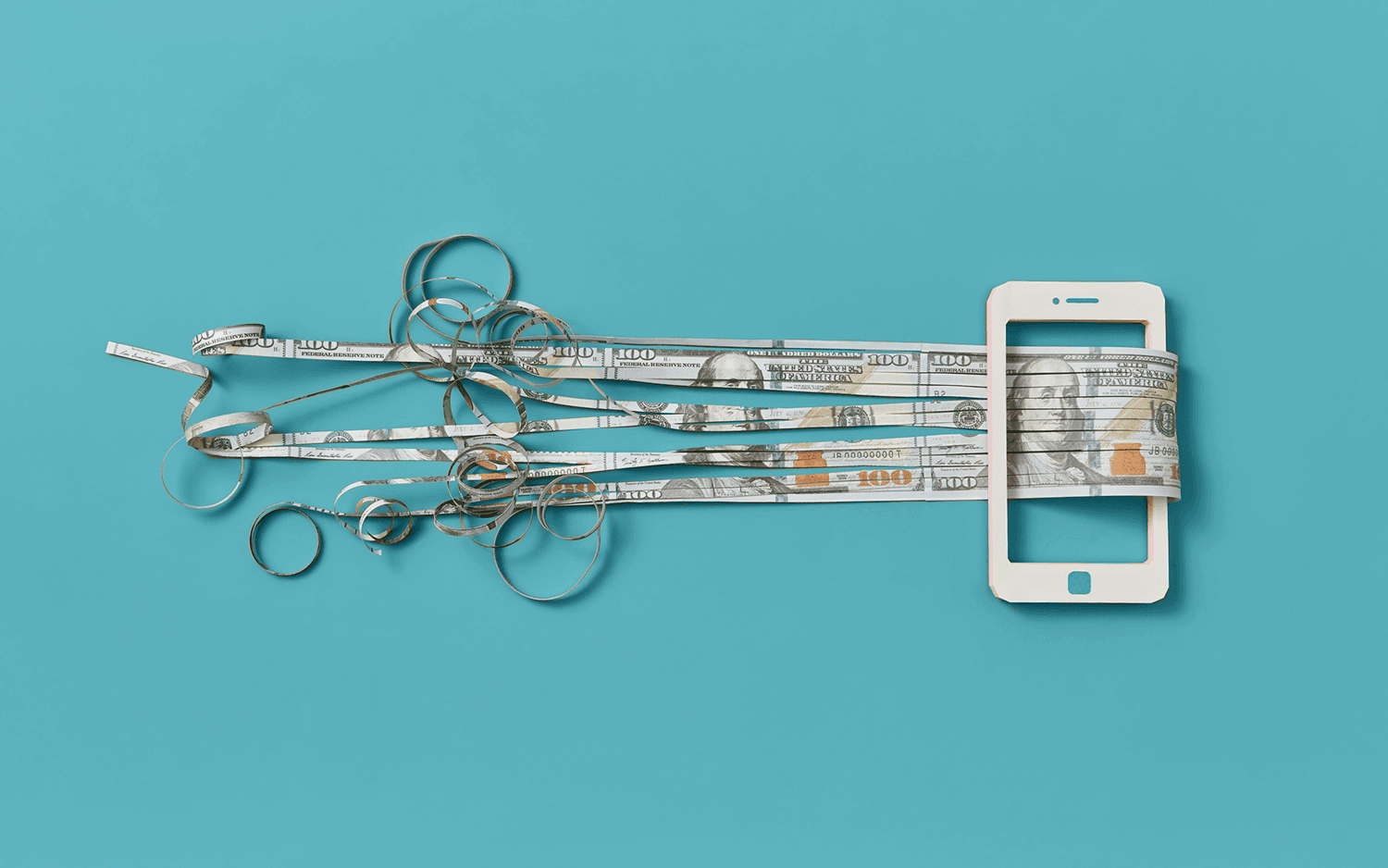

What Can Fintech Learn from Product-led Growth?

Fintech's success often hinges on superior customer experience. PLG principles prioritize the product to drive acquisition, engagement, retention, and monetization. It is vital for fintech to adopt PLG to excel through exceptional products.

The fintech industry is defying market conditions and is expected to be worth $174 billion by the end of 2023. In EMEA, Mckinsey says fintech has moved from the fringes of European finance to its core. So what is it about fintech that makes it so successful? We recently wrote about favorable initiatives in EMEA allowing fintech to flourish despite the challenges of higher interest rates. Diminished trust in established financial institutions may be adding to this trend. But study after study suggests that the overall customer experience and value that fintech can provide its customers leads to its success. And this is where taking the core principles from product-led growth (PLG) comes in.

B2C fintech and the principles of PLG

By creating a product that delivers a superior experience to their target audience, B2C fintech companies can attract and retain more customers, reduce customer acquisition costs, and increase revenue over time. PLG is borrowed from B2C strategy in the first place, so in that sense, the need for customer centrality for B2C fintech is nothing new. However, many learnings from PLG and its related theories, such as product-led marketing, provide a useful roadmap for supercharged growth.

Product-led growth refers to a business strategy that prioritizes the product as the primary driver of customer acquisition, engagement, retention, and monetization. In other words, the product is the primary marketing and sales tool, rather than traditional marketing and advertising tactics. This approach involves creating a product that delivers value to the target audience, leading to organic growth through customer referrals and word-of-mouth marketing.

Acquisition

With PLG, the product itself is the primary acquisition driver, and users can discover and try the product independently, without needing a sales team or other marketing efforts. This approach typically involves offering a free or low-cost product version, which users can try before committing to a paid subscription or upgrade. The goal of the acquisition phase is to drive as many users as possible to try the product and experience its value, hoping they will become paying customers and advocates.

To achieve successful acquisition with PLG, companies need to design a product that delivers value and solves a real problem for users. They also need to ensure that the onboarding process is seamless and user-friendly, so users can quickly reach the “aha” moment when using your product. This part of the customer cycle is the optimal time to run experiments on user segments. The higher volume of users at this stage allows you to run tests quickly to attain actionable insights on improving the product and reducing the drop-off rate. As fintech products often have some verification steps to complete during onboarding, ensuring the processes are as user friendly as possible is very important. This can be honed and tested through experimentation. Additionally, companies can use tactics such as referral programs, social sharing, and incentives to encourage users to invite others to try the product.

Engagement and retention

Engagement and retention refer to keeping users coming back the product over time, and encouraging them to continue using and paying for the product. PLG focuses on using the product to drive user engagement and retention, rather than relying on traditional marketing and sales tactics.

To achieve successful engagement and retention with PLG, companies need to design a product that delivers ongoing value to users and meets their evolving needs. This often involves regular updates and improvements to the product, based on user feedback and data-driven insights. Companies can also use gamification, personalized experiences, and social sharing tactics to keep users engaged and motivated to use the product.

Retention with PLG is typically achieved through product quality, customer experience, push notifications, and in-app messages. Companies need to be proactive in identifying and addressing issues or concerns that users may have and providing ongoing value and help to keep them engaged with the product over time

How Lydia increased clickthrough rate by 14%

One example of a fintech company successfully implementing aspects of PLG to retain its customers is Lydia, an EMEA-based consumer-led fintech company. They used monitoring tools like Metabase to track operational activities such as how many card payments were made every day. However, these tools weren’t as useful for the product design team to understand in-app user behavior. Amplitude provided the granularity designers needed to dive into a product’s events and determine what they needed to change to achieve their desired outcome. With Lydia’s loan calculator, they discovered that 20% of users left before seeing an offer. The team then redesigned the app to improve the UX. The result was a 14 percentage point increase in clickthrough rate.

Monetization

Monetization refers to converting engaged and retained users into paying customers and generating revenue from the product. With PLG, the focus is on using the product as the primary driver of customer acquisition and revenue rather than relying on traditional sales and marketing tactics.

To achieve successful monetization with PLG, companies need to design a product that delivers ongoing value and meets users’ specific needs and goals. This often involves offering multiple pricing tiers or plans, each with different features and capabilities to cater to a range of user needs and budgets.

In addition, companies can use tactics such as in-app purchasing, upselling, cross-selling, and reverse trials to encourage users to upgrade to higher-priced plans or add-on services. Companies can also use data-driven insights and personalized recommendations to help users discover new features and services that may interest them and are relevant to their needs.

Get started with PLG

The fintech industry is rapidly growing, and the key to success lies in creating a product that delivers a superior experience to the target audience. By adopting PLG, fintech companies can attract and retain more customers, reduce customer acquisition costs, and increase revenue over time. By understanding the value of a product-led approach and using behavioral analytics to measure and grow the product, fintech companies can stay ahead of the curve, and deliver the customer centric experience that is so foundational to this industry’s success.

Start mapping your product-led customer journey and identifying opportunities for growth with Amplitude’s free plan.

Lucy Harwood

Former EMEA Content Marketing Manager, Amplitude

Lucy Harwood is formerly a Content Marketing Manager at Amplitude, focusing on topics that speak to the EMEA region. Lucy graduated from the University of Amsterdam with an MA in Communication & Information, focusing on argumentation in science, health, and politics.

More from Lucy