How to Lose a Fintech Customer in 10 days & 3 Tips to Retain Them

Achieve growth by retaining customers through a churn prevention strategy, improved customer journey, and continued experimentation.

The ‘tech winter’ has brought a slowdown in investment and growth that has reached every corner of the industry. Despite these challenges, Europe’s fintech scene is still thriving. Analysis from KPMG shows that UK fintech investment reached $37.3bn in 2021—up sevenfold from 2020. There is also huge growth in Sweden and Switzerland, as well as exciting initiatives such as the piloting of a supportive regulatory framework in Lithuania. In this current market, we may see products that provide essential services doing better, such as insurance. Lower prices are already the most common reason for European customers to switch to fintech. With the current emphasis on household cost saving, the downturn may make such offerings even more appealing.

The opportunity for fintech is still available. It will be the companies that can harness growth that will survive the freeze. As acquiring a new customer can be up to 25 times more expensive than holding on to an existing one, paying attention to keeping the ones you already have is an excellent place to start. With fintech experiencing churn as high as 73% within the first week, getting your customers past the 10-day mark is the first step. Then, you need to figure out how to compel customers to keep returning to use your product or service over time.

How to lose a customer

- Even if you think your onboarding process is simple, your customers might be experiencing friction in surprising places. It’s essential to understand their customer behavior instead of relying on your intuition. To successfully drive them away, make your onboarding process confusing and cumbersome. Achieve this by adding as many twists and turns as possible and leaving your customers to navigate it alone without support.

- Neglect your customers, especially if they start to show signs of cooling off. Pay no attention to low usage or lack of engagement, and don’t try to reignite the spark. Provide a customer interface that leaves your customers scratching their heads. Don’t look for customer journeys that are successful for other customers to try.

- Stop growing and evolving.

A 3-step plan for retaining them

It isn’t easy to create a smooth onboarding process, be attentive to customers, provide clear paths, and keep your product up to date to meet shifting priorities. However, if solved, each area offers an excellent opportunity to stand out from your competitors and create a product that your customers genuinely want and need.

Step 1: Starting with a churn prevention strategy will set you up for success. This will allow you to identify where customers feel frustration and friction. With cohort analysis, you can study and compare different groups, known as cohorts, to understand how they behave in your product and exactly who is getting stuck and where. As part of this exercise, you will want to look at three distinct groups:

- Acquisition cohorts: when they discovered your product

- Behavioral cohorts: how they interact with your product

- Predictive cohorts: what they’re expected to do in the future

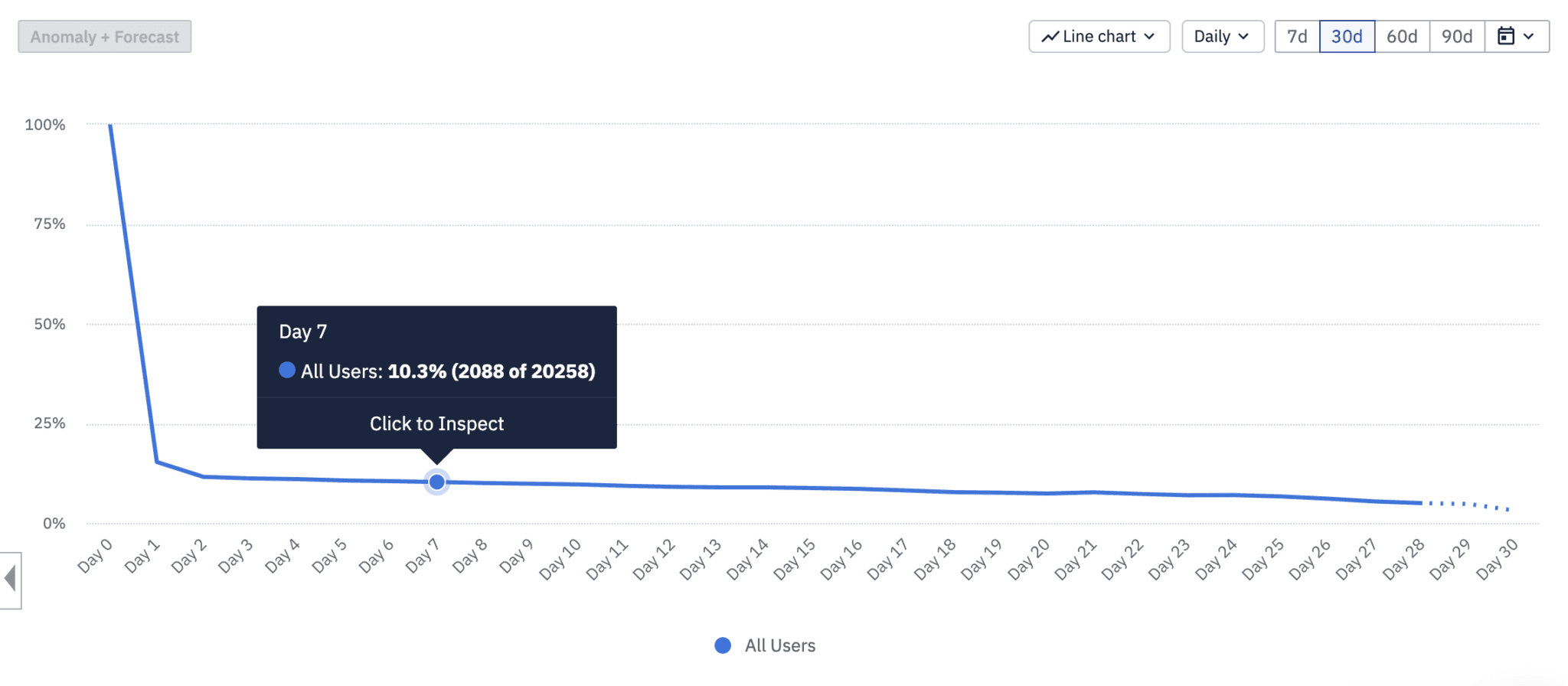

From these cohorts, you can run a retention analysis. This analysis can show the typical, atypical, positive, or negative details of product usage following a sign-up or subscription. You can use these insights to gauge the likelihood of churn and, in turn, the most appropriate messaging or optimizations for different cohorts. Retention is critical for every product, whether you’re at a Fortune 500 company or a 5-person startup. Learn proven methods for building a data-informed retention strategy.

Example retention line chart in Amplitude

Step 2: Use these insights to create a hypothesis of where you can improve the customer journey within your product.

Dave, a personal finance app, leveraged the insights from the customer behavior data they gathered to find product-market fit and their key retention drivers. Dave realized the users who added recurring expenses during the onboarding process showed a higher retention curve than the ones who didn’t. They used this insight to revamp the onboarding process and focus on adding recurring expenses. Three months later, they had 5.7X higher retention rates.

Step 3: You’ve understood which cohorts have higher retention, used your insights to predict churn, and made the appropriate updates to your app. You’ve successfully retained your customers for now, but this does not mean the process is over. You need an ever-improving customer experience. Your product needs to keep growing with your customers changing needs and requirements. To do that, experimentation is critical.

We recently worked with an EMEA-based credit score and financial product marketplace. With access to data in Amplitude, their product and engineering teams could quickly launch experiments, learn daily, and recalibrate models. Experimentation helped them figure out the correct data to work with, and they then turned their attention to shortening their insight-to-action time across roughly 1,000 releases per month. Using Templates, they standardized their testing methodology so their teams could easily set up and run their own experiments and evaluate a broad range of primary and secondary metrics. Thanks to Templates, the organization was able to run over 100 experiments in 2020, up from 20 experiments in 2019 — representing a 400% increase.

Final thoughts

In Europe, fintech is still thriving, but market caution, pressure on customer finances, and unattractive inflation rates are hitting investment opportunities and causing customers to be even more discerning about where they are willing to spend. Digging deep into your growth levers and providing value to customers and investors is essential—a product that is simply new and flashy will no longer cut it.

It is prudent to look at how to retain your customers and how to maintain that loyalty long-term. Using a data analytics platform such as Amplitude will ensure that the points of friction you find and solve will help you develop your product in a way that aligns with what your customers want. Being able to continue experimenting will keep you relevant. These three steps will get your customer through the first ten days—and keep them loyal well beyond.

Click below to watch our CPO, Justin Bauer, talk to 11:FS about how data can serve the fintech industry.

Lucy Harwood

Former EMEA Content Marketing Manager, Amplitude

Lucy Harwood is formerly a Content Marketing Manager at Amplitude, focusing on topics that speak to the EMEA region. Lucy graduated from the University of Amsterdam with an MA in Communication & Information, focusing on argumentation in science, health, and politics.

More from Lucy