5 Ways to Increase LTV of a Customer

Learn the basics of lifetime value, how to calculate it, where to measure it in Amplitude, and strategies to improve LTV over time.

Many businesses look at their sales, revenue, and customer satisfaction metrics to determine how successful their business is at the moment. However, these three metrics only look at short-term success.

If you want to see the complete picture of your company’s success now and in the future, you need to measure customer lifetime value (CLV). This product metric is often overlooked by many businesses but it can be crucial in predicting how much your customers are worth to your business.

Let’s take a look at what the lifetime value (LTV) of a customer is, how you can measure it, and most importantly—interesting ways you can improve it.

Key Takeaways

- There are several ways to measure CLV.

- With a digital analytics platform, you can even measure revenue generated over time by groups who engaged versus did not with a feature.

- CLV is sometimes used interchangeably with “LTV” (lifetime value), especially when referred to as “customer LTV.”

- There are many ways to improve the lifetime value of a customer. Some are simple to do, while others are more complex and require more resources.

- The biggest mistakes with customer LTV include not being careful when calculating it, setting an unrealistic timeframe, and not calculating it frequently.

What is customer lifetime value & why is it important?

Customer lifetime value (“CLV” or “customer LTV”) is the monetary worth of a customer to your business for the length of their engagement with your company. It is an important figure for businesses, as it helps you optimize customer acquisition and retention costs.

Customer lifetime value can be calculated in several ways. Some of the most common formulas include:

- CLV = Average Customer Lifespan × Customer Value

- CLV = (Total Customer Revenue × Customer Margin) ÷ Churn Rate

- CLV = Average Value of Sale × Retention Period × Number of Transactions × Profit Margin

In addition to helping you optimize customer acquisition and retention costs, CLV can help influence your marketing tactics and improve the overall business efficiency by improving how you allocate marketing resources and by helping you predict your revenue.

Customer lifetime value can also help you measure the effectiveness of your customer retention programs, improve your marketing segmentation efforts, and recognize poor marketing decisions.

Measure ARPU in Amplitude with the Revenue LTV Chart

The following visuals show how you can use Amplitude to track customer lifetime value. This helps you graduate from simply building buttons and features to connecting features to business outcomes.

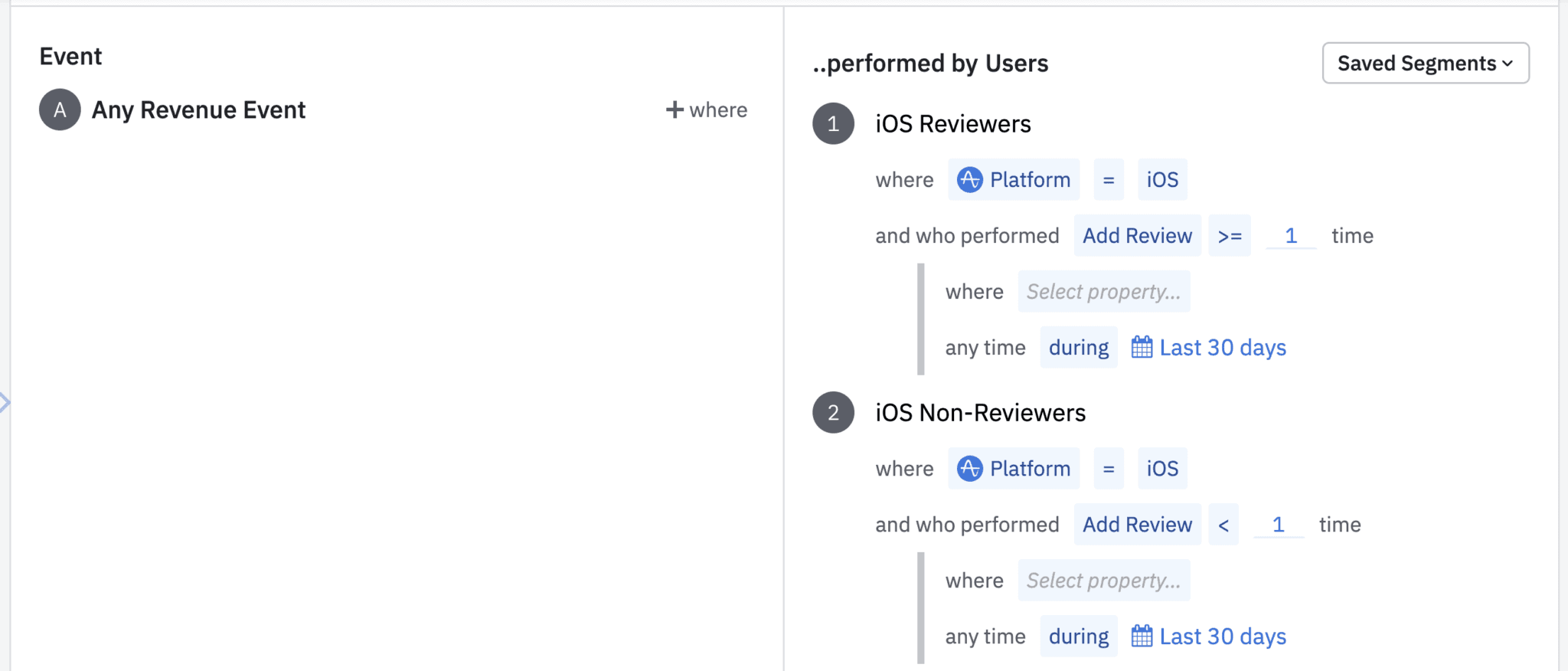

Let’s say you have an ecommerce product. You launched a feature that allowed users to add reviews. The question is: How do you connect this to company revenue? Does usage of this feature drive higher CLV?

Amplitude enables quick segmentation and cohort comparisons that you can use to identify users who have engaged versus not engaged with a feature. In this example, you can segment users by whether they performed the action “Add Review” at least once or not at all. These cohorts can be further filtered down to those users who performed this on a particular platform, such as iOS devices.

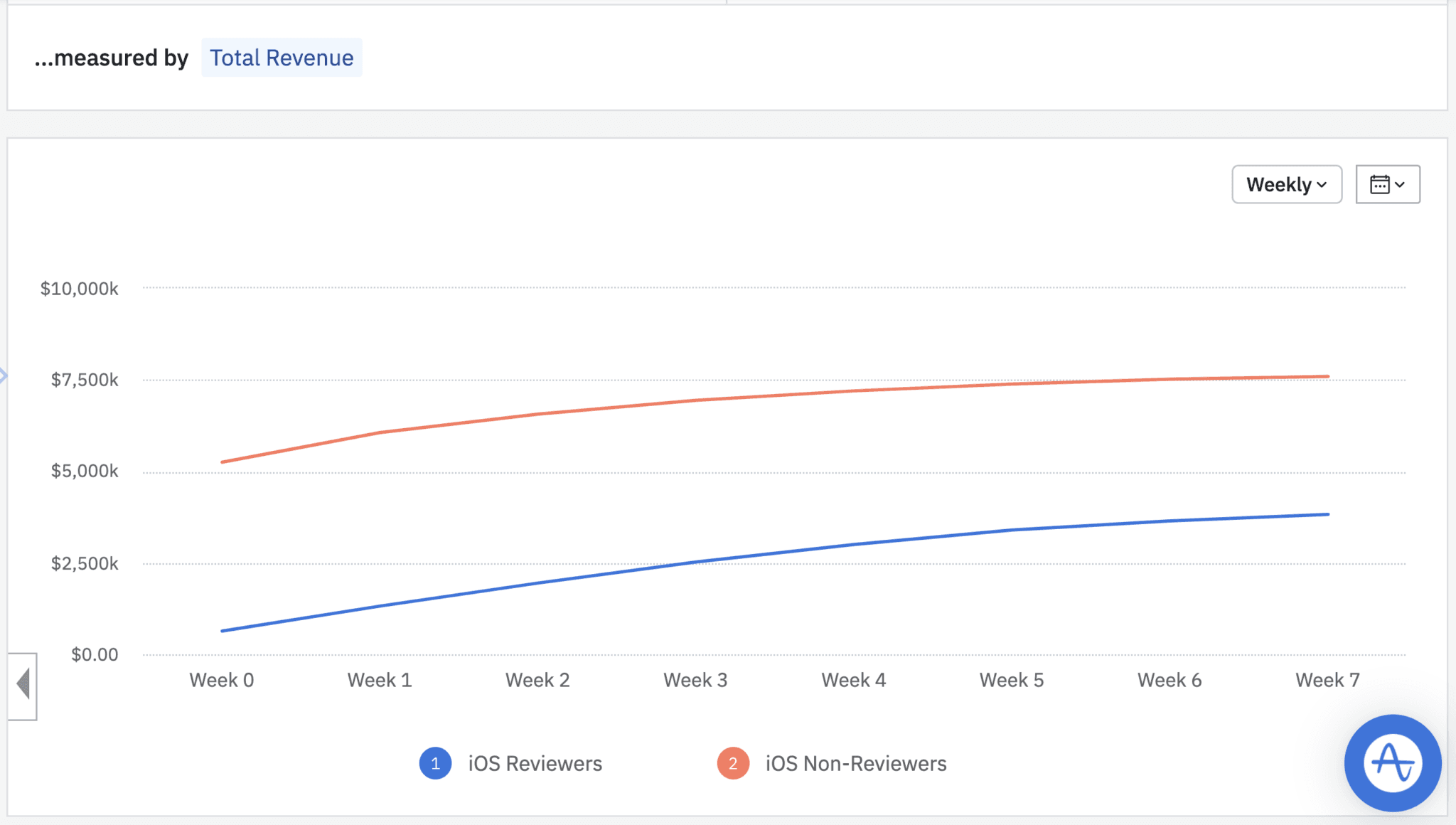

Then, using the Revenue LTV chart in Amplitude, you’ll see the total revenue indicated for these groups of customers over time. In this chart, you see that the total revenue for the group that did not leave a review is higher than the group that did leave a review. This may seem to indicate that customers who leave reviews are less valuable. However, keep in mind that these two lines represent large groups of users. It could just be that the group of non-reviewers is far larger than the group of reviewers, and thus contributes more revenue overall.

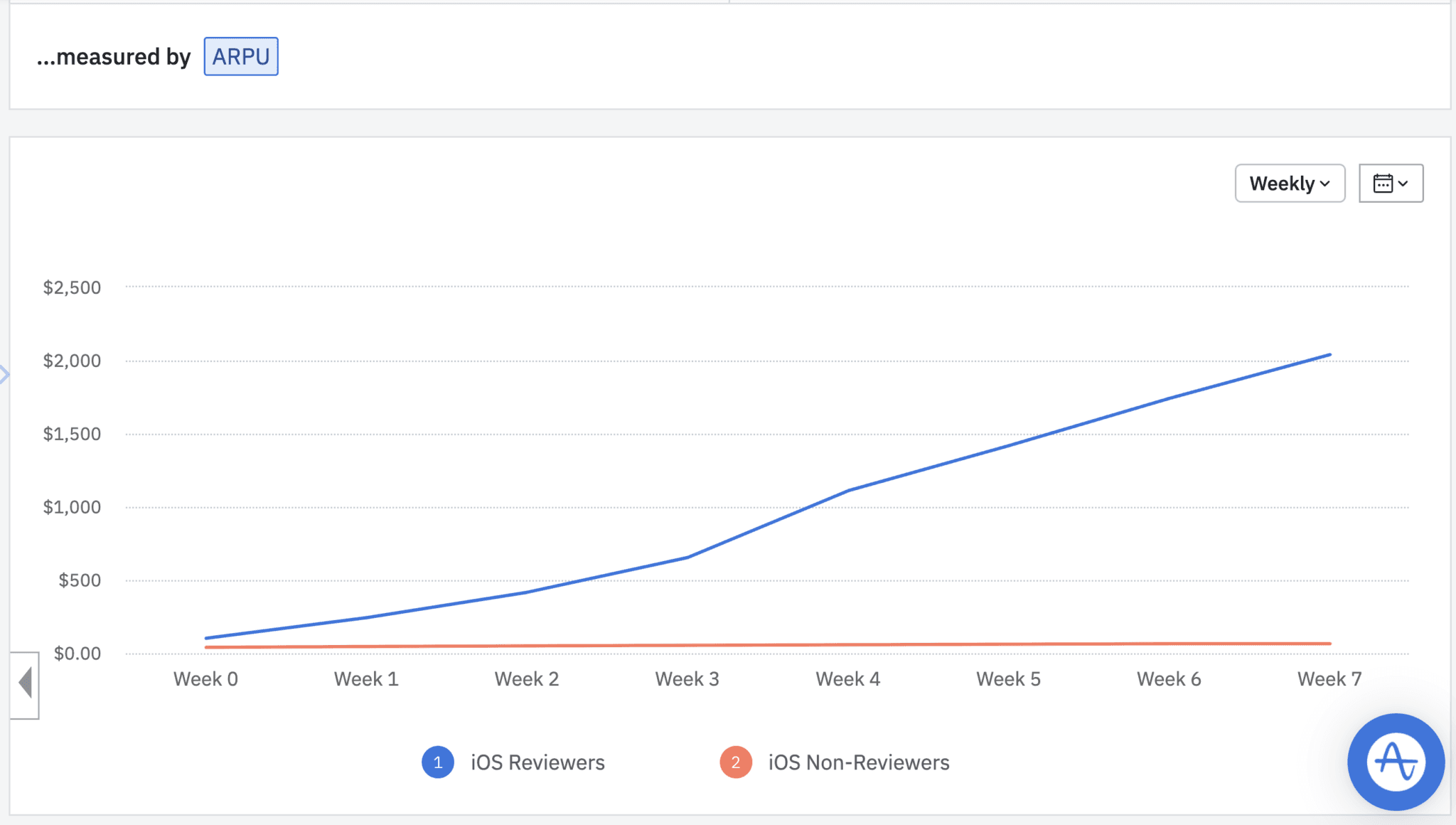

This is why it’s important to dig deeper. You can change the way revenue is measured from “Total Revenue” to “Average Revenue Per User (ARPU).” The ARPU chart shows that users who do adopt this feature and leave reviews tend to have much higher ARPU than users who do not. With this insight, your team can connect this new feature to overall revenue and make the case to invest more into it.

5 strategies to increase customer lifetime value

There are many different ways to improve your customer lifetime value. Some are as simple as making it easier for customers to choose between different billing cycles, while others—such as optimizing your customer service—are more complex. Here are a few ideas to get you started:

1. Help customers better understand your product

Every product requires specific skills and knowledge to be properly used. If your customers don’t know how to use your product and why it is beneficial for them, they won’t be able to recognize its full value, which will likely lead to them using it less, and eventually churning.

To stop that from happening, you need to educate customers and help them understand your product. Start by talking to your customer-facing employees and see what are the most common questions customers ask them. Then, use that to build out training resources that are engaging and easy to follow. The training resources can be in many formats, including webinars, videos, and help docs.

2. Improve your customer support

If the level of customer service in your company is below the average in your industry, customers are likely to move on to your competitors even if your product is better than theirs. Having better customer service improves the overall customer experience. The better the customer experience is, the more likely customers are going to stay longer on the customer journey.

Offering flexible customer support options is a great start. Ensuring that customers can reach out to your support team on multiple channels is another way to improve the experience. Also, building and maintaining a knowledge base will take some pressure off your customer support team, while also ensuring customers’ questions get answered quickly.

3. Collect customer feedback

If you want to grow your product, you need to know what your customers think of you. This will help you prioritize profitable aspects of your business, see which areas should be a part of your digital optimization efforts, and tell what your customers really think about you and your offerings.

Start by collecting all the feedback you receive in one central place. Make sure that all your departments have access to it and that someone from your company monitors the online sentiment about your business.

4. Start a loyalty program

Creating a customer loyalty program is one of the best ways to build a base of loyal long-term customers. Studies show that 93.1% of companies with a loyalty program have a positive ROI.

A loyalty program can have many shapes and forms. Some of the most popular loyalty programs include points redemption, mission-driven, influencer, referral, and community programs.

In a point redemption program, loyal customers earn points that can be redeemed for coupons, discounts, and other special offers. Mission-driven programs make loyal customers feel like their payments make a positive impact on the world. Influencer programs reward customers that refer their followers with unique gifts. This is a twist on the classic referral program, which rewards customers that refer other people to the product or service with discounts. Community programs help connect like-minded customers instead of offering freebies and discounts.

5. Create a personalized experience for your customers

These days, customers want products and services that are tailored to their specific needs. Personalization is key if you want your customers to build longer relationships with your business. It can help you deliver the right messages at the right time through the right channel, helping improve the chances of that customer becoming a repeat buyer.

Personalization can help you provide a better customer experience in your product. It can also increase your odds of converting customers to a higher-paid subscription with the help of personalized in-product messaging and behavioral targeting. Proper personalization requires specialized tools, such as Amplitude.

Common mistakes that can negatively impact customer LTV

There are a lot of mistakes businesses can make when assessing their existing customer lifetime value numbers or implementing one of the strategies for increasing it.

Using the wrong metrics to calculate customer lifetime value

Not doing a good job at calculating your customer revenue, churn rate, customer lifespan, or any other metric used for calculating customer LTV can result in unexpected LTV numbers. To make certain this doesn’t happen, you should focus on the net present value (NPV) of a customer.

To do so, consider the future purchasing behavior of your customers and do an RFM (recency, frequency, monetary) analysis to figure out expected revenues. Then, calculate the cost generated for each customer in each period, their profit contribution, and the chances of future contribution being negative. Finally, use the freshly calculated NPV value to calculate the proper LTV.

Setting unrealistic timeframes when calculating customer LTV

One of the most important factors when calculating customer LTV is the customer lifetime—the duration of a customer’s relationship with your business. Many LTV calculations account for just a few years—two or three max. However, some companies go all out and put in forty years.

While there is nothing wrong with wanting long-term loyalty, it’s hard to predict what will happen in the future. Because of this, basing the LTV calculations on more realistic timeframes is better.

Calculating customer LTV at irregular intervals

The needs of customers change all the time. You can’t be certain that your LTV will be the same in the next week, month, or year. Because of this, you should calculate your LTV frequently, each time you implement big changes to your product, and each time you start implementing a different strategy for increasing your LTV.

Refining the customer lifetime value model at the right times will help you make better business decisions and allow you to stay competitive longer.

Customer LTV benchmarks

To ensure you’re on the right track relative to the rest of your industry, you need to keep up with key industry benchmarks for LTV. The benchmark for customer lifetime value is far more valuable when it’s compared to customer acquisition cost (CAC). Essentially, CAC is the amount spent by a company to acquire a customer. It’s calculated as: CAC = Total Acquisition Costs ÷ Number of Acquisitions.

You need to evaluate the LTV to CAC ratio to estimate the amount you should spend to acquire a single customer. A good benchmark is when LTV is more than 50% higher than the value of CAC.

Check out the below table to understand the LTV to CAC ratio in detail.

| LTV to CAC ratio | Rating | Explanation |

| 1:1.5 | Extremely bad |

|

| 1:1 | Bad |

|

| 2:1 | Fine |

|

| 3:1 | Good |

|

| 4:1 or higher | Great |

|

Increase LTV with a customer-centric mindset

There are many ways to increase the lifetime value of a customer. However, what you should do first is make sure that your business runs with a customer-centric mindset.

Educating customers about how to use your product, providing top-notch customer service, collecting user feedback, starting a loyalty program, and personalizing the product experience are some of the strategies that can help put the customer at the forefront of your business.

These strategies ensure that every decision you make has the customers’ best interest in mind, which should encourage them to stay longer with your company—and improve your customer LTV in the process.

References

- Subscriber Lifecycle Management Demo, Salesforce

- How To Calculate (And Improve) Lifetime Value, YEC for Forbes

- How to Increase Customer Lifetime Value, Joe Moriarty for Raven360

- LTV:CAC Ratio, Geckoboard

- LTV:CAC Ratio, Finmark

Darshil Gandhi

Director, Product Marketing, Amplitude

Darshil Gandhi is a Director of Product Marketing at Amplitude. He leads competitive intelligence, partner product marketing and technical product marketing. Darshil collaborates with product and go-to-market teams on strategy, positioning, messaging, campaigns, and enablement. He was previously a solutions consulting team principal at Amplitude, and has helped dozens of Amplitude customers turn data into actionable insights. Darshil graduated from Dartmouth College with a Masters in Engineering Management.

More from Darshil