Bringing Product Insights into Marketing

Leverage product insights to improve marketing campaigns.

Almost two years ago, I wrote that product and marketing teams need to increase their collaboration related to digital analytics. Before joining Amplitude, I had seen many cases of organizations working in silos for digital analytics. Product and marketing teams used different metrics for success or even different analytics products. At Amplitude, we had a vision that marketing and product analytics would converge, and two years later, we see evidence that our vision was correct.

Amplitude believed that product and marketing teams should increase collaboration related to analytics because we saw opportunities for both teams to benefit from each other. In this post, I will outline some of the benefits Amplitude customers see through our combination of product and marketing analytics. Specifically, we will outline how marketers can leverage product insights to improve their marketing campaigns through product analytics data.

Understanding downstream conversion

As a marketer, I know how difficult demonstrating the value of marketing can be. Marketers work hard to find new and creative ways to attract new customers to buy products (B2C), view content (Media), or convert into leads (B2B). Many of the metrics marketers use to justify their efforts are short-term. Counts of unique visitors, bounces, orders, and leads often only scratch the surface of what is needed.

For example, suppose you work for a B2B software company, and you have campaigns highlighting which features make your product better than your competitors. Your marketing campaign may include paid search ads, display ads, and video ads to get users to enter a free trial of your software product. You can use marketing analytics functionality to see which portions of your marketing campaign bring the most users to your digital properties. To some extent (due to the flaws in multi-touch attribution), you can also see which campaign elements lead to users completing lead forms. But let’s suppose it takes users a few weeks or months to engage with your software free trial and ultimately purchase.

In this scenario, the marketing analytics data can only base its conclusions on data up until the point a user completes a lead form. After that, the product team captures free trial product usage data using product analytics functionality. If product usage data is siloed from the marketing analytics data in the same or a different analytics product, it is impossible to connect product usage to the marketing campaign. But if the analytics data is connected, ideally in the same analytics product, it is possible to join the free trial usage data to the marketing campaign that drove the free trial.

The first way that product insights can help improve marketing campaigns is by reporting on true downstream success. Suppose product data can show which prospects purchased the product after the free trial. In that case, the product analytics data can show the marketing team which campaigns led to downstream success, often tied to revenue. Instead of basing future marketing campaign decisions on the number of leads or MQLs, decisions can be based on actual conversion. This data can help clarify which marketing campaigns are working and which are not. For example, some paid search keywords may drive a lot of leads but result in very few downstream conversions.

Conversely, there may be some marketing campaigns that don’t look good based on the lead count but convert significantly. Having downstream conversion data removes much of the guesswork and allows marketing teams to shift precious advertising budgets to the campaigns that produce revenue. Of course, this assumes you can accurately connect the marketing campaign to the lead, which is becoming increasingly difficult in today’s cookieless and privacy-centric world! But assuming you can surmount that hurdle, leveraging product analytics data to view downstream conversions is one way product and marketing can benefit from collaboration.

Understanding product/app feature usage

The next way that product insights can help marketing campaigns is through digital product feature usage. Product teams spend a lot of time understanding how users interact with various product features. In a B2B setting, this may mean analyzing which software features are used. In a B2C setting, it might mean analyzing which filters users use to filter products on an eCommerce website. Regardless of the specific features or business model, understanding what is of interest to users from a product perspective can be helpful to the marketing team. Let’s look at this through a few examples.

Continuing our previous B2B software example, the product team has insights into product features used during free trials. It could work with marketing to determine if feature usage in the free trial differs by the marketing campaign that sourced the user. If marketers learn that users from campaign A tend to use features A, B, and C the most in the free trial, they can use this information in future marketing campaigns to highlight those features. For example, let’s suppose that users coming from the paid search term “database management tools” enter the free trial and primarily use the search feature of the product. This scenario may present an opportunity to share more information about the search feature in future advertisements. Perhaps under the paid search ad title, the marketing team adds, “Experience the best search feature of all database management products!” This type of data-informed advertising can help boost conversion rates and return on ad spend (ROAS).

In a B2C context, let’s suppose that an online retailer uses product analytics data to determine that many newer customers coming from marketing campaigns are using the left navigation filter feature to narrow down products. Specifically, users often engage with the sizing and rating filters to find products. This information tells the retailer that those new to the brand want the ability to filter its products by these core attributes quickly. You can then share this insight with the marketing team and add it to future marketing campaigns. For example, new campaigns can use phrases like “Find the best XYZ products by size or customer rating…” Or video ads can highlight how easy it is to find products using the specific filters that many prospects tend to use. These are just a few simple examples of using feature usage insights from product analytics to improve future marketing campaigns.

Understanding abandonment

As a marketer, it is often difficult to track the activity of those you acquire beyond their initial interactions. For example, a marketer may know that they drove a new customer to a retail website, but what if that visitor purchases a product in that session but then purchase many more products thirty days later? Depending upon the sophistication of the marketing analytics tracking, proving that the marketing campaign generated downstream purchases may be challenging. In a B2B example, a marketer may know that they drove a new user into a free trial but may not know that the same user abandoned the free trial after a few days.

Both of these examples involve understanding digital product abandonment. Many product analytics implementations encourage or force users to create a unique identifier (via authentication) to address the concept of abandonment. In B2C, this may involve creating an account on a retail website. In B2B, this may involve logging in to use a product. You can then stitch user behavior across different devices and sessions when you have authenticated accounts. User stitching allows product teams and product analytics data to view how often each user returns to the website or app over time.

In the preceding B2C example, the product team can see purchases beyond the initial purchase. All purchases from the same user are associated with the original marketing campaign that sourced the user. This association allows the product team to see the user’s lifetime value and work with marketing to assign these to marketing campaigns. Lifetime value, in turn, helps marketing identify a more accurate view of return on ad spend. The product team can also work with marketing to identify which known customers have not returned to the website over the past x weeks. Marketing can use this information to trigger remarketing campaigns to re-engage customers who have gone dormant.

In the preceding B2B example, the product team can identify which free trial users have stopped engaging with the free trial. You can use cohorts of dormant free trial users to remind users that they have a limited time to explore the product before it is too late. Or marketing can work with the product team to cohort free trial users into cohorts based on which free trial steps they have and have not taken. This type of cohort can provide marketing with a way to target specific use cases to free trailers. For example, suppose fifty free trial users have run a report but not sent it to anyone. In that case, the product team can work with marketing to send a personalized email to those users with training on how to take the next step and share reports with colleagues.

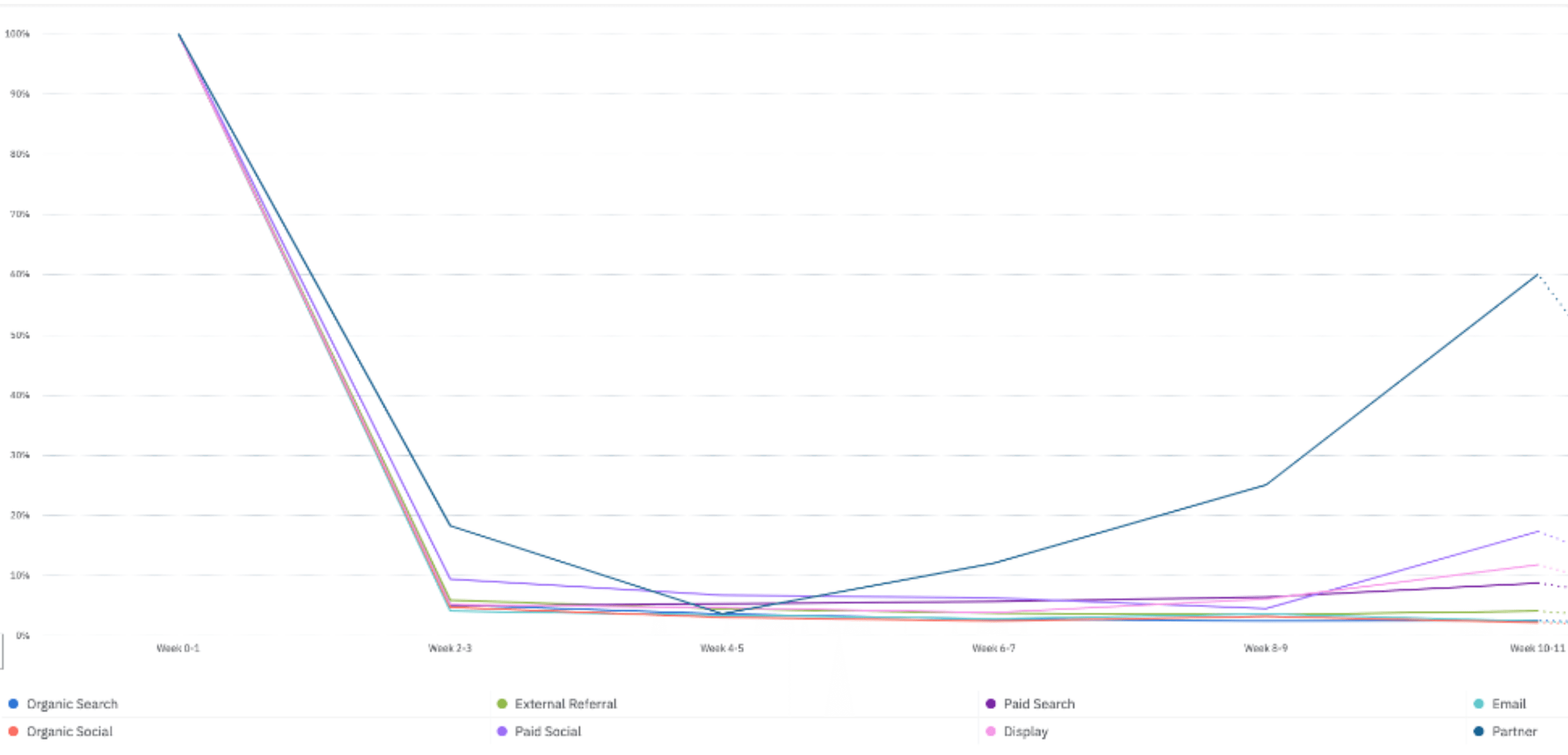

Another benefit of combining marketing and product teams and data is viewing long-term product usage by marketing campaign or channel. Marketers are good at seeing when users bounce from their campaigns immediately or if they return over the next 30 or 90 days. But after 90 days, most organizations rely on product analytics data to analyze user retention. The need for long-term retention analysis is why product analytics tools offer many different user retention reports and visualizations while marketing analytics products offer very few.

Once marketing and product analytics data are combined, you can use standard product analytics retention reports to view user retention by marketing channel or campaign:

Regardless of the context, having the product team share its insights related to usage and abandonment with marketing provides a way for both teams to benefit.

Understanding which campaigns drive the right/wrong users

While marketers would like to think they can target specific audiences of users through their marketing campaigns, this is difficult to do in reality. You may advertise on a popular website with a younger demographic to target younger people. You can use social networks like Facebook and Instagram to target ads at a high level of granularity. But no matter how good you are at focusing your marketing campaigns on the right audience, you will have people who click on your campaigns that are right for your product/service and those that are not. The proof of targeting accuracy is when users perform the actions you want them to perform after you acquire them.

While marketers are great at building cohorts of potential customers, product teams are great at building cohorts of actual customers. Product teams use product analytics functionality to identify which users are performing the desired tasks or journeys. These cohorts can be simple or complex, depending on the situation. For example, a product team may determine that its ideal customer profile (ICP) for a music streaming service is a user who listens to at least five songs per week and builds at least one playlist every three months.

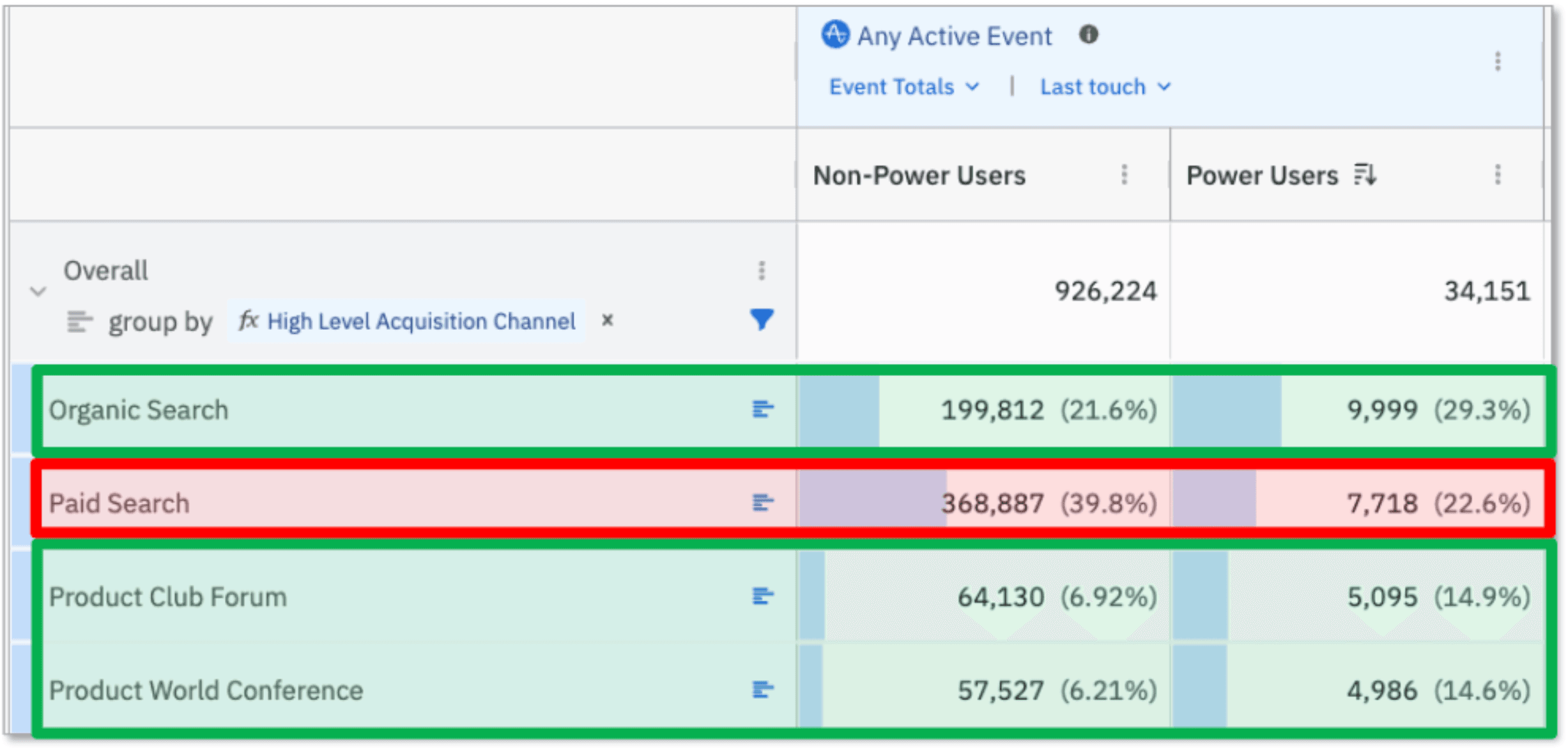

Regardless of the criteria, product teams can use product analytics tools to create cohorts of their ideal users and, the inverse, those that are not ideal. You can use these cohorts to determine which marketing campaigns or channels are attracting the right and wrong people. Some marketing campaigns may bring in many new customers, but not the right types of customers. Let’s look at an example. Suppose a marketing team spends money on paid search, SEO resources, and a few smaller communities/events. When visitors enter the acquisition funnel, you capture their source in a digital analytics product like Amplitude. After the acquisition, the product team builds cohorts that identify their “power” users and those who are not “power” users. The marketing and product team then views the marketing acquisition channels by each of these inverse cohorts:

When viewed through this lens, some marketing sources (SEO, Product Club Forum, and Product World Conference) may attract more power users than non-power users. Some of the marketing sources with the least amount of activity, like the Product Club Forum and Product World Conference, are more than double their percentage of power users. Even though these two sources are dwarfed in volume compared to Paid Search, they produce more power users on a relative basis. What might happen if these sources received more focus than Paid Search? Investing more in these campaigns might be a worthwhile experiment to see if marketing misallocates its budgets.

As you can see, the benefit of connecting product usage data and cohorts to marketing activity is that it can illuminate opportunities for improvement. The combination of marketing and product data is a way that product teams can help inform and improve marketing campaigns. But these benefits depend upon both teams using the same digital analytics platform or another way of joining user data.

Summary

Traditionally, marketing and product teams have worked in silos. Marketing was responsible for acquiring customers, and the product team engaged and retained them. But there are many ways in which product teams can collaborate with marketing teams and help them achieve their goals through product analytics and data. Product teams often have insights into longer-term user behavior that marketing teams do not. Some examples of this include:

- Understanding downstream conversion

- Understanding product/app feature usage

- Understanding abandonment

- Understanding which campaigns drive the right/wrong users

These are just a few examples of how product insights can help improve marketing campaigns and why marketing and product teams should increase collaboration related to digital analytics.

Adam Greco

Former Product Evangelist, Amplitude

Adam Greco is one of the leading voices in the digital analytics industry. Over the past 20 years, Adam has advised hundreds of organizations on analytics best practices and has authored over 300 blogs and one book related to analytics. Adam is a frequent speaker at analytics conferences and has served on the board of the Digital Analytics Association.

More from Adam