The Next Hottest Products and the Trends That Drive Them

Our first Amplitude Labs report leverages our own aggregated, anonymized data to share the digital product trends we’re seeing across industries and help companies benchmark and optimize their products.

At Amplitude, we know that data is critical to building amazing products. Digital products have become the center of how companies interact with customers. Every company must learn how to build and optimize their products to survive and thrive. IDC estimates that by 2023—just a little over a year away—more than 500 million new cloud-native products will be developed.

Fueling this growth, the pandemic led to an unprecedented rise in demand for digital products. Our Amplitude Labs data shows that customers quickly—and enthusiastically—took notice: daily active users of digital products has increased by 54% since January 2020.

At Amplitude, as the pioneer of Digital Optimization with over 1,200 customers running 6,000+ digital products, we have an unparalleled view into the trends shaping digital product adoption, usage and strategies. That’s why we’re launching our first Amplitude Labs report, The Product Report 2021, to provide meaningful insights into the factors that drive digital product growth and empower our product-led community to make more strategic decisions.

The Next Hottest Products Around the Globe

It’s no surprise that the digital products with the fastest-growing usage rates around the world this year were products that helped us work, learn, exercise and do other aspects of daily life from home. By aggregating monthly active user data in our platform, we’ve predicted which of these popular products could become the next household names.

In the U.S., products with the fastest usage growth rates included B2B solutions to simplify remote recruiting, like the #1 ranked SmartRecruiters, which saw 10,897% growth in monthly active users (MAU) according to data sent to Amplitude. Other U.S. top products included solutions for coding, language learning and classroom browser extensions, online banking and finance applications and more. In EMEA, digital products for language learning, like AI-powered writing companion Wordtune with 8088% MAU growth, and fintech apps also saw exponential growth. And in APAC, it’s all about crypto. Three of the five companies on our APAC list—CoinDCX, Pintu and Dunamu—have emerged as huge players in the fintech industry, facilitating fast and secure exchanges for a customer base that’s eager to invest.

Next Hottest Products in the U.S.

Next Hottest Products in EMEA

Next Hottest Products in APAC

Product Preferences Vary Across the U.S.

While much of our data focused on global trends, we also looked at which products were used more frequently in some states than others. Our findings paint a story of local cultural trends, as the popularity of apps in certain states reflects the interests of its local population.

For example, the GPS hunting application OnXMaps is more prevalent in states in the West and Midwest regions of the U.S., while AllTrails is popular in states with a big hiking culture like Alaska, Colorado, Maine and others. And Slice, an application that supports local pizzerias (as opposed to big chains), surges in popularity in East Coast states like Connecticut, Rhode Island, Pennsylvania and New York.

The Travel Industry Rides the Wave of COVID Concerns

Much like the travel industry itself, usage rates for digital travel-related products still have not rebounded to pre-pandemic levels. Compared to a baseline of January 2020, daily active user numbers on travel apps began to climb again in March 2021 as vaccines became more widely available but tapered off again as the Delta variant spread this summer.

Ecommerce Is Just Commerce Now

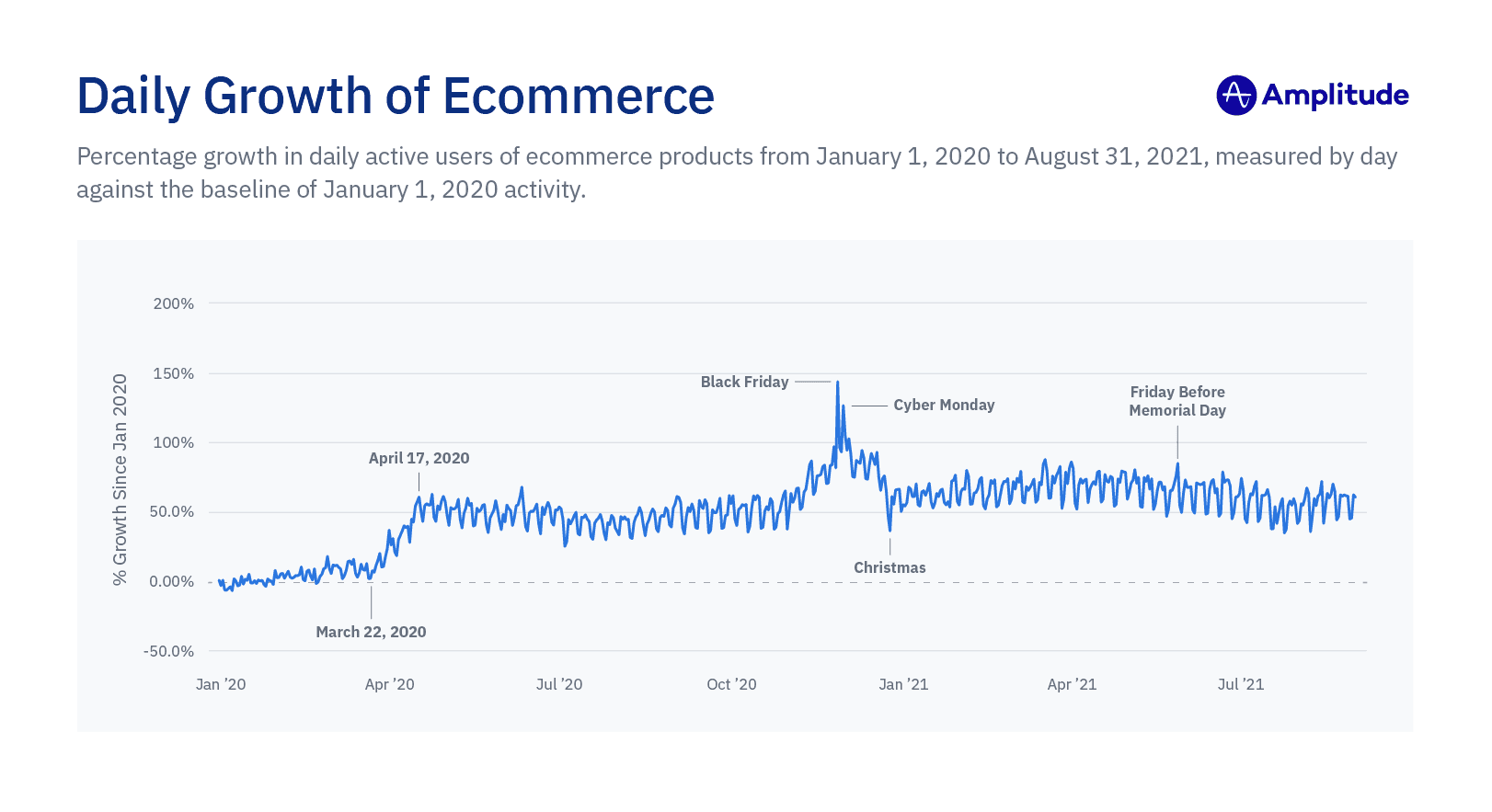

Not surprisingly, as people worldwide began staying home during the pandemic, they also started buying more and more of the things they needed online. In April 2020, ecommerce activity rose more than 50% compared to January 2020 and continued to rise, with record-level growth rates on Black Friday (143%) and Cyber Monday (126%).

Data Belongs to Everyone

We’ve always believed that all teams within an organization—from product to marketing to sales and biz ops—need access to the right data in order to best support customers and grow their business. The good news? More organizations are beginning to recognize this, too. In 2021, for the first time since Amplitude’s founding, the count of customer success roles using Amplitude surpassed the count of data scientists. Marketing teams are increasingly using Amplitude as well. This pattern indicates that organizations are learning an important lesson: data is not just for product people. Teams across many functions benefit from easy access to data to make impactful decisions for the business.

To 2022 and Beyond

The pandemic has changed a lot about how we work, forcing companies to shift to digital rapidly, and the data shows us that much of that change is here to stay. Our predictions for the next hottest products, for example, are unified by more than just exponential user growth. Each of these companies has won over enormous customer bases in a short amount of time by prioritizing the digital experience.

In 2022 and beyond, the most successful businesses will be ones that leverage data to understand digital product usage and adopt a product-led strategy. This means scaling data literacy within your organization so everyone has a deep understanding of digital customer behavior and then putting digital optimization into practice. We invite you to read the full report to learn more about these products, gain insight into the power of data democracy, and benchmark and optimize your own products.

JJ Johnson

Former Chief Marketing & Strategy Officer, Amplitude

Jennifer Johnson (JJ) formerly led the global marketing, partnerships and customer experience organizations. Prior to Amplitude, JJ was CMO at Tenable and was instrumental in its 2018 IPO. JJ was also CMO at Tanium and Coverity (now Synopsys), and a Partner at Andreessen Horowitz.

More from JJ