Sales-led to Product-led Hybrid Transformation with James Colgan

Join James Colgan to learn how to transition from a sales-led growth model to a hybrid product-led growth model to drive sustainable, efficient growth in your organization.

Transitioning from a sales-led growth model to a hybrid product-led growth model is a complex process that requires significant planning and collaboration between departments. As the Chief Product Officer at Spendesk and in my former role running product teams at Slack and Microsoft, I have seen firsthand the benefits of making this transition and the steps companies need to take to make it happen. This topic is only getting bigger. There is a trove of articles and talks looking at the inner workings of product-led companies, dissecting how these companies operate, and the lessons that can be gleaned and emulated. But I want to take a huge step back. I want to talk about what this transition means and how you can help your colleagues and peers transition to PLG if you are at the C-suite level.

Understand your organization’s origins

The first step in transitioning to a product-led growth model is understanding your company’s DNA and its founders’ DNA. It’s the same process you might deploy when picking which sport your kid should play. Say both parents are on the shorter side, they probably wouldn’t choose basketball as a winning strategy to give their offspring the best chance of succeeding in a sport. Instead, you might want to choose a different game so they can reach those top levels of success. I may or may not be borrowing from my experience with this analogy. So examine the backgrounds of your founders, as this can give you insight into the company’s overall approach to problem-solving and product development. Not to stretch the analogy too far, but building a company for scale is a team sport, and as a CPO, you need to understand where the rest of your team is coming from. What is their perspective, how do they look at the world, and how does the company fit in? By looking at the background of the founders, you will have insight into how to communicate and collaborate with your teammates and better lead the company through the transition.

Product-led DNA

In a product-led founded company, the founders are typically product people or engineers; knowing this matters to understand which decisions you will make later. The company’s DNA influences their perspective on ideation and business validation. The starting point will be engineer-led, and problems will be approached from this lens, with the first step being an actual prototype of the product, which can be built in-house by the founding team. The product itself is used to validate the opportunity and immediately get feedback on the importance of the problem to the customer, how it is being solved, and which direction the product should go in. This significant advantage will enable more efficient and faster scale further down the line.

Once the prototype and the business opportunity have been validated, the founding team will have secured their early-stage investments and begin expanding their engineering team. From this starting point, you will be looking to expand engineering. No need to build it from scratch as you have the foundation there. Whether it’s B2C or B2B, unless you’re very high-end on the enterprise, which is very unusual for a startup to begin, the team is going to productize and release their first product for free. This enables further iteration on the value proposition, the solution, the messaging, and how to drive organic growth, all driven by the product as it continues to evolve. That’s exactly what happened with Slack. Slack started with a free model and went on for a while before hiring the first salesperson. In this scenario, you are product-led from the start. And, as with Slack, once efficient organic growth (aka Product Market Fit) has been established with a paid package of the product (and hence, now a full Freemium offering), the team starts to pivot towards higher Average Contract Value (ACV) customers with the establishment of a sales organization. Often focused on the enterprise, building upon the SMB foundation now established. At this point, revenues may be lower than a sales-led organization, but the overall efficiency in generating revenue will be relatively high.

Sales-led DNA

On the other hand, sales-led growth companies may have founders with a background in sales or marketing – perhaps you started with a corporate or business development type leader? They have great insight into the market, very close relationships with the customer base, and a strong track record of building successful businesses. They’ve identified an opportunity through these deep customer relationships, interactions, and broad market experience. They’ve spotted a common problem customers have, and they’ve got a great idea of what the solution could be. Armed with a convincing deck, they canvas their customer base and validate their business hypothesis. And on the back of these findings, they can secure funding to hire a small engineering team to build the MVP (Minimum Viable Product). Crucially, because of the willingness-to-pay exercises this business-oriented team went through, and their strong ability to sell, this sales-led organization starts charging for the product immediately. Again, the DNA upon which the future of the company will be built is set from the start. Rather than focus on how to organically scale the product, the relatively small engineering team is tasked with quickly building the features the rapidly growing sales organization is discovering through their close customer relationships. The Feature Factory has been born. In this case, while the efficiency in generating revenues will be relatively low, as compared to a product-led founded company, absolute revenues will probably be higher.

When funding is cheap, and the mantra is “growth at all costs,” this structure is tolerated. But now more than ever, efficiency is key, and a transition to product-led to create a hybrid model needs to be made.

Understanding this fundamental difference and the economic context is crucial in setting expectations and developing a collaboration and communication strategy for transitioning to a hybrid company, working alongside the rest of the C-Suite.

The economics of transition

As Chief Product Officers, we must shift our economic thinking and focus on building sustainable businesses as well as scalable products – even as we are trained to be laser-focused on customer problems. Working with your CFO, get a breakdown of the distribution of Operational Expenses across R&D, Sales and Marketing, and G&A. For a sales-led organization, you’re probably looking at a relatively underfunded engineering organization struggling with the delivery of features at a pace that meets the commercial organization’s needs. At the same time, a high proportion of investment is dedicated to a commercial organization operating in a direct way to engage customers and close sales in person. For PLG companies under $100M ARR, there is an approximate balance between R&D and S&M OpEx allocation. However, for SLG companies, the OpEx investment in S&M can be nearly twice that of R&D. This difference is even more pronounced in companies with over $100M ARR.

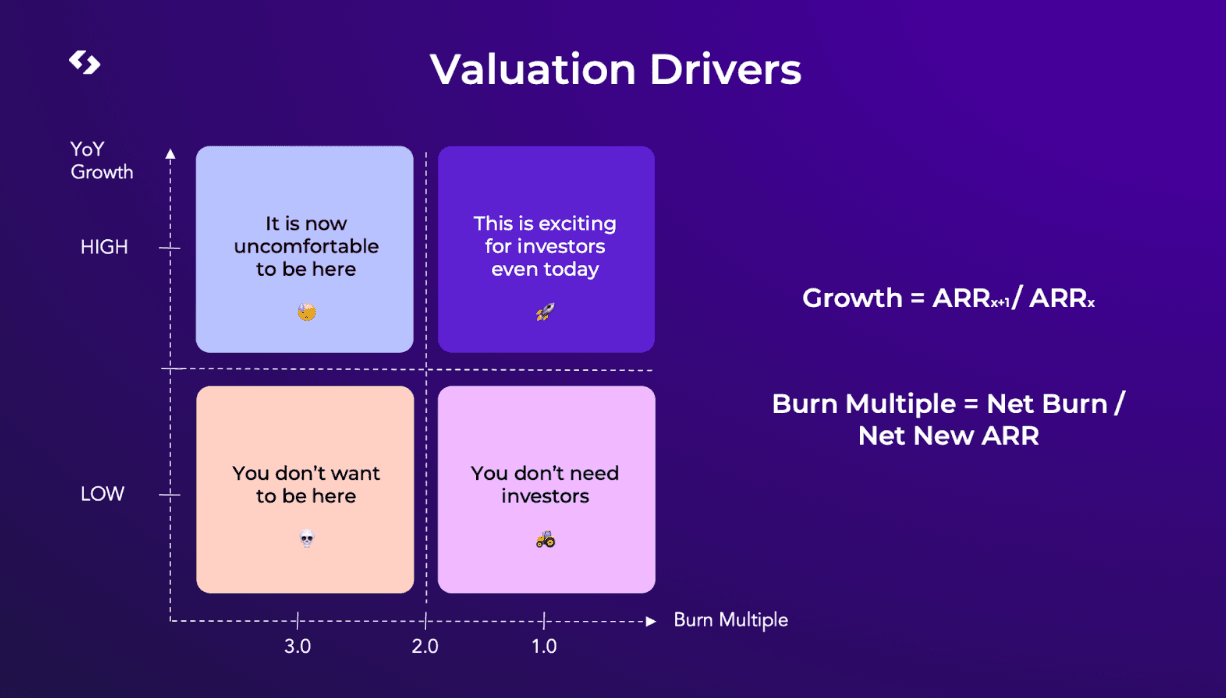

From an investor’s perspective, both SLG and PLG models can have high Year-on-Year ARR Growth. However, it is the cost of that growth that becomes the issue. The graph below represents the company’s Burn Multiple – how it costs to generate every net new dollar ARR.

Which quadrant your business sits in drives your business valuation:

The top left-hand corner of the growth chart represents high growth but expensive growth – your typical SLG model. The bottom left-hand corner represents high spending with low returns, which is unsustainable. The bottom right-hand corner represents a lifestyle kind of business that generates revenues efficiently but is not growing. The top right-hand corner is the ideal position and where investors want us to be – high ARR growth generated at a relatively low cost.

For a scale-up, here we are in PLG territory, as this model is necessary for this kind of sustainable growth and success in the long term.

Collaborate & Align

Transitioning from the top left-hand corner and the SLG model to the top right-hand quadrant with efficient ARR growth requires us, as CPOs, to collaborate closely with the rest of the C-Suite. Understand what each of them needs to be successful through the transition and work with them to deliver the product and the value to meet that need.

The CFO plays a key role in understanding the economics of the business, especially the Customer Acquisition Costs (CAC) Payback. This leading indicator metric is key to understanding how efficiently the business is growing and is what they’re probably discussing with your board regularly. It is also where PLG can have a material impact by enabling a self-serve onboarding flow, increasing organic product-driven growth, and increasing ACV by increasing product value. All these will contribute to lowering CAC Payback – what investors want to see.

Work with your Chief Revenue Officer to transition the sales organization and Customer Success from low-value selling and customer support to high-value package sales, upgrades and expansion.

Your CMO is probably looking to broaden their marketing mix away from an over-dependence on paid search to an integrated iterative go-to-market motion that can support the product-led growth model and effectively tell the product’s story. Marketing can also help bridge the gap between product and the commercial organization, accelerating the customer journey through clarity in messaging that resonates with a compelling product truth. Work closely with your CMO to build a narrative that spans the product roadmap. That provides evergreen narratives to drive engagement and market pull while giving space for product innovation and agility.

Finally, your CTO partner is most in need of the move away from a feature factory model to one of scalable growth. The transition from SLG to a hybrid SLG/PLG model facilitates this by clarifying how squads can be structured to align with value delivery and user personas or roles, for example. This transition will likely coincide with the re-architecting of key components of your platform and a migration away from what is likely to be a very monolithic codebase. These are necessary to increase engineering velocity and overall performance and quality improvements to the user experience.

As an SLG GTM motion gains traction and market penetration progresses from early adopters to the early majority, CAC increases. Especially as competitors enter a now-validated market and sales cycles lengthen. As a CPO, we need to do two things simultaneously. Reduce CAC through PLG motions and a self-serve onboarding process while increasing the value/differentiation of the product itself. This will increase the efficiency of the customer adoption funnel and provide the sales organization with the differentiators they need to fend off competition and, ideally, increase ACV.

Both of these programs require deep collaboration with marketing. From an onboarding perspective, we need to integrate the product onboarding flow into the company website, ideally within an immersive experience that removes the distance between the product messaging and the realization of that value. We also need deep collaboration in developing and experimenting with the messaging as part of this exercise.

Once the self-serve onboarding flow into a free product has been created, we introduce a new funnel metric – Product Qualified Lead (PQL). Built out of how customers use your free product, this composite metric flags deeply qualified prospects to your sales organization.

As well as generating PQLs for sales teams to follow up on, the goal of a free offering is to enable users to experience the product and gain value before charging them. This will lead to a more passionate and invested user base. This creates word-of-mouth market opportunities, PLG growth motions, and a more straightforward monetization process through sales.

Another way to think about it is while SLG-centered GTM motions are focused on a “Land and Expand” strategy, PLG GTM motions emphasize an “Expand and then Land” motion. Get customers and users onto the platform and monetize and upsell them. Very much as was done at Slack.

Product teams need to work closely with the CRO to make this transition and introduce a PLG motion into the funnel. The metrics by which they manage their funnel evolves, and how they’re deploying resources at what part of the funnel will also change. Ideally, this will involve rebalancing resources away from the front end of the funnel and more emphasis on upgrades, upsells, and the closing of higher-end SKUs. All of which should result in a much more efficient funnel and an increase in ACV.

This work is underpinned by a transition of the PDE (Product, Design/Data, and Engineering) organization, requiring deep collaboration between the CPO and CTO. As the engineering organization scales, there will be a need to strengthen the alignment of squads with the value they deliver for different personas or roles. Typically, smaller engineering organizations that have been rotating around different aspects of the code base will be glad to stabilize and grow expertise, practices, and team identity in what is commonly referred to as a “reverse Conway maneuver” to re-organize and mature engineering. With clarity brought to the definition of customers, personas, and the problems you’re collectively solving, you can help your CTO partner think through how they can structure their teams and give them the time to do it.

As the CPO, you collaborate across the C-Suite to achieve strategic objectives. You work with the CFO to align product strategy with financial objectives; with the CRO to drive efficient revenue growth; with the CMO to optimize go-to-market efforts, and with the CTO to build a high-velocity value delivery engine. By fostering cross-functional collaboration, the CPO ensures the product’s success in the market while achieving the organization’s overall goals.

Metrics and Tactics

From a metrics perspective, there is a set of key business performance indicators and associated investments a CPO can prioritize to meet the goals of each partner member of the executive suite and, by extension, the business overall.

To reduce CAC payback, increase the value of the product to drive ACV/MRR up, and implement self-serve onboarding with a free product to drive CAC down. Increase the value of the product and ensure it is deeply embedded in your customers’ lives to drive up NRR and Net Dollar Retention. All of which will help the creation of a compelling pricing and packaging strategy and a strong value proposition and messaging architecture.

The combination of all of these strategies will drive up the overall efficiency of the company, ARR/FTE.

Final Thoughts

While transitioning to a product-led/sales-led hybrid growth model can be challenging, the benefits are significant. Product-led growth models built upon a strong Sales-led GTM motion are more sustainable and cost-effective than sales-led growth models alone.

An SLG + PLG approach to building products and companies leads to greater alignment across organizations, more efficient product development, and GTM processes that enable companies to iterate quickly and deliver value to customers more effectively.

Before embarking on this transition, it’s essential to understand your company’s DNA, collaborate between departments, and track metrics closely. By doing so, you can achieve high growth at a low cost and stay competitive in an increasingly crowded market.

Get started with PLG

Take a closer look at how your organization can get started with product-led growth by downloading Product-Led Growth Guide Volume 1: What Is PLG?

In this guide, you’ll learn:

- What you need to adopt PLG

- Whether PLG is right for your business

- How to pinpoint your PLG maturity

- How to get started on your PLG journey

James Colgan

Former Chief Product Officer, Spendesk

James is an experienced product executive renowned for his ability to transform businesses across multi-billion-dollar enterprises like Microsoft, hyper-growth challengers such as Slack, and scale-up unicorns like Spendesk. Expert in building and rearchitecting teams, processes, and organizations for massive business impact, James brings the customer and the user into the heart of everything, to build solutions to problems and deliver experiences that users love.

More from James