The Convergence of Analytics Products

Are you confused about the different types of digital analytics products?

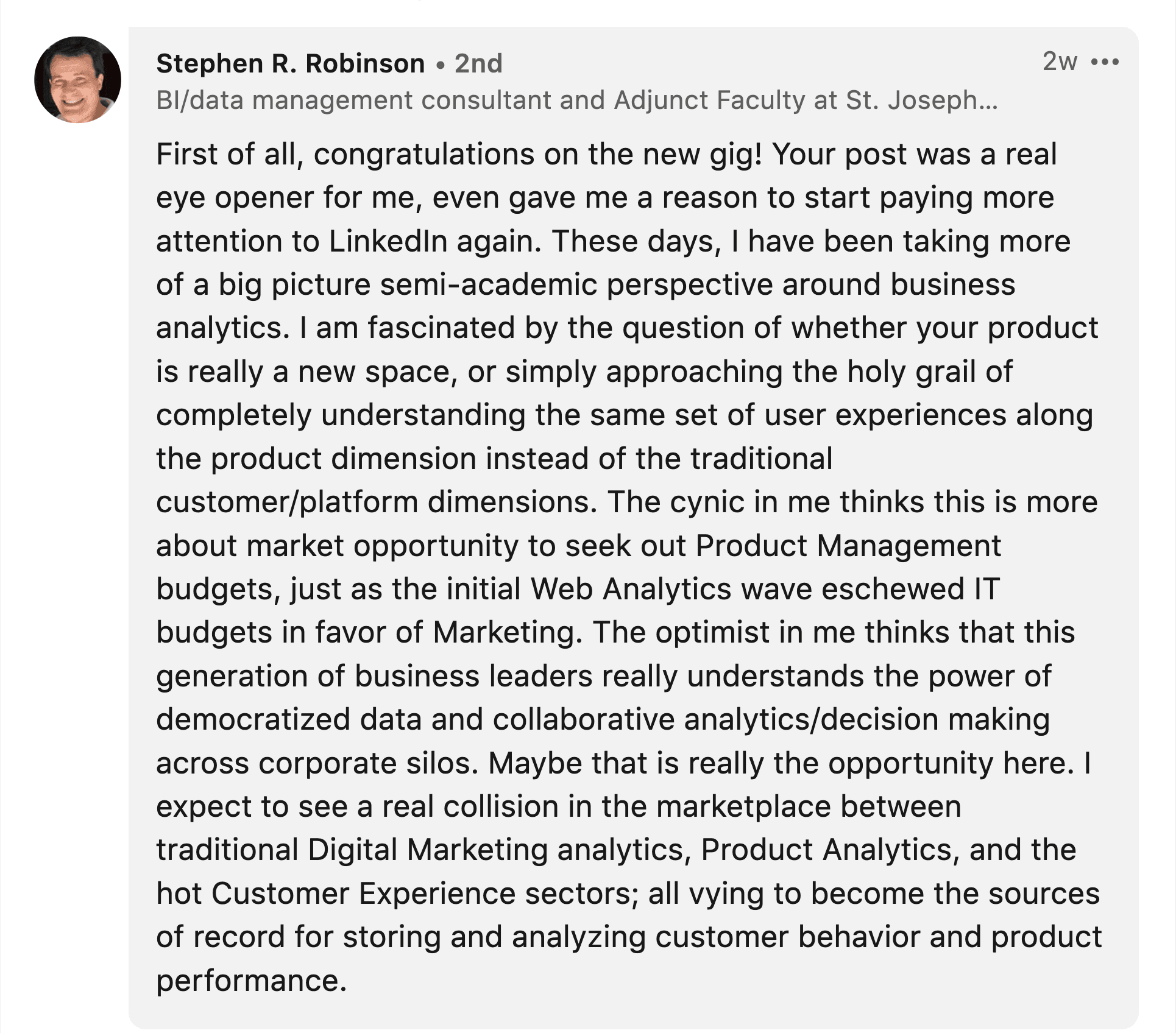

A few weeks ago, when I announced that I had joined Amplitude, it got quite a reaction, including about 30,000 views on LinkedIn and over 100 comments.

One of the comments, in particular, caught my eye:

The latter portion of Stephen’s comment echoes a conversation I have been having with many peers in the industry over the past year related to the convergence of digital marketing analytics, product analytics and experience analytics. Therefore, I wanted to share some of my thoughts on this in case others have the same questions.

Before we talk about the convergence of these disciplines and technologies, let’s begin with some history on how these different analytics genres emerged.

Digital Marketing Analytics

When I think of digital marketing analytics, I think of products like Google and Adobe Analytics which have traditionally been used for “web analytics.” Digital marketing analytics has been around for about 20 years and began as a way to identify how many visitors were coming to your website, which digital advertisements were working best, which website content was the most popular and where visitors were dropping off in website paths. Over the years, it has evolved quite a bit to include funnel analysis, visitor segmentation and integrations with other marketing tools.

At a high level, digital marketing analytics products are used today by marketing teams to improve websites through data. The owner and main users of digital marketing analytics product is the marketing team who would either answer common questions for the organization or train users to answer questions.

Experience Analytics

Shortly after the “web analytics” revolution, organizations began investing in experience analytics products. Back then, these were called Voice of Customer (VOC) products and included vendors like Foresee Results or OpinionLab, which allowed you to survey your website users and ask them about their experience. Instead of rummaging through terabytes of data looking for a needle in a haystack, you could simply ask them what they liked and didn’t like. Fixing the things they didn’t like could drive enormous ROI. However, Voice of Customer products ultimately weren’t enough.

As the years went on, VOC tools had limitations on usefulness, and soon a new crop of experience analytics vendors emerged that offered “session replay,” which allowed organizations to record visitors’ sessions and watch them after the fact. This technology empowered organizations to empathize with their visitors and actually see their individual experiences. Oftentimes it was easier to see a problem with your own eyes than it was to guess what the issue was via tables of data. These technologies were often coupled with marketing analytics vendors to create synergistic effects. Marketing analytics vendors identified a potential conversion issue and experience analytics vendors isolated visitors having the issue and let you see what was happening.

In some cases experience analytics products were owned by the marketing department, but in other organizations it was owned by customer support or the design team.

Product Analytics

As mobile applications exploded, product analytics vendors like Amplitude surfaced. Mobile applications didn’t place as much importance on browsing or consuming content. They had to optimize more complex experiences and interactions and, thus, required a new type of analytics product. Mobile app developers were using different tools, technologies and SDKs than their website counterparts. Product teams needed to iterate much more quickly than website teams and since new app releases had to be downloaded, they had to be much more deliberate about their updates. Their needs often focused around user retention and engagement and they were more preoccupied with what users were doing within the app than how they got there.

At organizations large and small, I witnessed situations where the web team and the mobile app team were completely siloed and had completely different analytics requirements and implementations. In most cases, product analytics was owned and used by the product development team. In some cases, product analytics was owned by data and analytics teams who implemented and managed the solution, but enabled teams across the organization to self-serve a majority of their analysis needs.

Digital Analytics Convergence

As stated previously, over the past few years, the desire to improve the overall user experience has prompted a convergence of the aforementioned analytics products. Many organizations are using more than one type of analytics product and I have even seen some that use all three. For example, it is pretty common for an organization to use a marketing analytics product on its corporate/marketing website and a product analytics product on its mobile app, authenticated web app, and connected device.

But as Stephen points out above, the current path may be unsustainable and convergence may be inevitable. In fact, there are many things happening right now that indicate that the convergence is well underway. The following are some of the things that I have been thinking about lately related to this convergence.

Event-Based Paradigm Shift

For a while now, marketing analytics products like Google and Adobe Analytics have realized that the future is mobile/digital apps and that their products were designed for a website and advertisement paradigm. To address this they have begun to change their products. Google purchased Firebase Analytics (a product analytics vendor) and recently refactored its entire analytics product to follow an event-based model. Adobe has begun the process of transitioning its analytics product to Customer Journey Analytics and its Experience Platform. With these moves, Google and Adobe have recognized that their paradigm centered around websites, content and page views were not well-equipped for the future and that they had to evolve. Their new offerings follow the more popular “event-based” model that was made popular by product analytics vendors (like Amplitude). The recent adoption of this event-based model by all analytics vendors has accelerated the convergence of these analytics disciplines. However, marketing analytics users are just now learning about these changes and will have to re-instrument data from their digital products into these new event-based systems. Also, these evolved solutions from the marketing analytics vendors are still a “work in progress.”

Customer Journeys

Another factor contributing to the convergence of analytics disciplines is the realization that organizations have to focus on the entire customer experience/journey. In the past, it was common for organizations to have one team focused on acquiring new customers and another focused on converting and retaining them. For example, when I worked at Salesforce, I managed digital marketing analytics and was mainly responsible for generating leads and pipeline. Once someone started a free trial, that was the product team’s responsibility to get them to buy and remain a customer.

But in today’s hyper-competitive world, that type of thinking isn’t possible. Today, organizations like Salesforce need to connect the acquisition data with the product data so they can measure the entire experience and find ways to optimize it. For example, it may be the case that someone reading a particular white paper on the website prior to the trial leads to a 5% increase in trial conversion. Conversely, Salesforce could leverage data found within the trial to help determine which marketing campaigns they should invest in to produce the best free trial candidates.

Viewing the entire experience and dynamically displaying personalized content and running experiments is one of the ways that digital-first organizations win. But doing this requires unifying user data from all user touch points across all platform experiences.

User Identity

In order to build a complete customer journey, organizations need to combine anonymous and known users together with a unique identifier. Without this, the customer journeys are meaningless. Marketing analytics vendors have traditionally relied on cookies to identify users. But recent privacy laws and browser changes are making cookies less reliable. So now marketing analytics vendors are scrambling to find ways to stitch anonymous and known visitors together (though doing so often requires paying for more advanced tools or add-ons).

Product analytics vendors, on the other hand, have typically had a unique user identifier since users typically log into the product or app. But as product analytics vendors start capturing anonymous marketing data, they too will need a way to unify user identity. And all vendors have to be sure to adhere to new privacy laws when it comes to users and user identity.

Marketing & Product Teams

When it comes to building comprehensive customer journeys and unified user identity, it will be imperative for the marketing and product teams to start collaborating. Today, these groups don’t often work together and often have completely different goals. We have seen this when we run our North Star workshops and are able to, for the first time, get these different teams to work together and create shared goals.

In many respects, I think that getting these two teams to collaborate will be the difference between organizations that win and lose in the era of digital transformation. For many organizations, marketing has held the purse strings and budgets and has been able to dictate analytics processes, tools and KPIs. But as products and apps become more important, there may likely be a shift towards the product team and smart marketers will start building relationships now before they get left behind.

Experience Analytics Consolidation

You may have noticed that I haven’t mentioned the experience analytics vendors in a while. While the above changes have been taking place, there has been a recent uptick in consolidation of experience analytics vendors themselves. Contentsquare raised a large round of funding and subsequently went on a bit of a shopping spree, acquiring ClickTale and Hotjar. Medallia purchased Decibel Insight. Quantum Metric and FullStory raised large rounds of funding.

The influx could be linked to a number of factors – the race to determine a leader, major investments needed to evolve product offering beyond session replay, or the recent opportunity to win ecommerce companies that experienced large increases in traffic due to COVID.

As someone who has advised these types of experience analytics product vendors in the past, I am definitely a fan of the technology. However, I have always felt that experience analytics is not a standalone offering, but rather an important component of an analytics stack. I haven’t seen too many organizations that only use an experience analytics product and don’t use another marketing or product analytics product. While there may be situations I don’t know about where this happens, I haven’t heard of it being the norm.

For this reason, I believe that experience analytics vendors will continue to integrate with other analytics products or other analytics products will add this type of functionality.

The Future

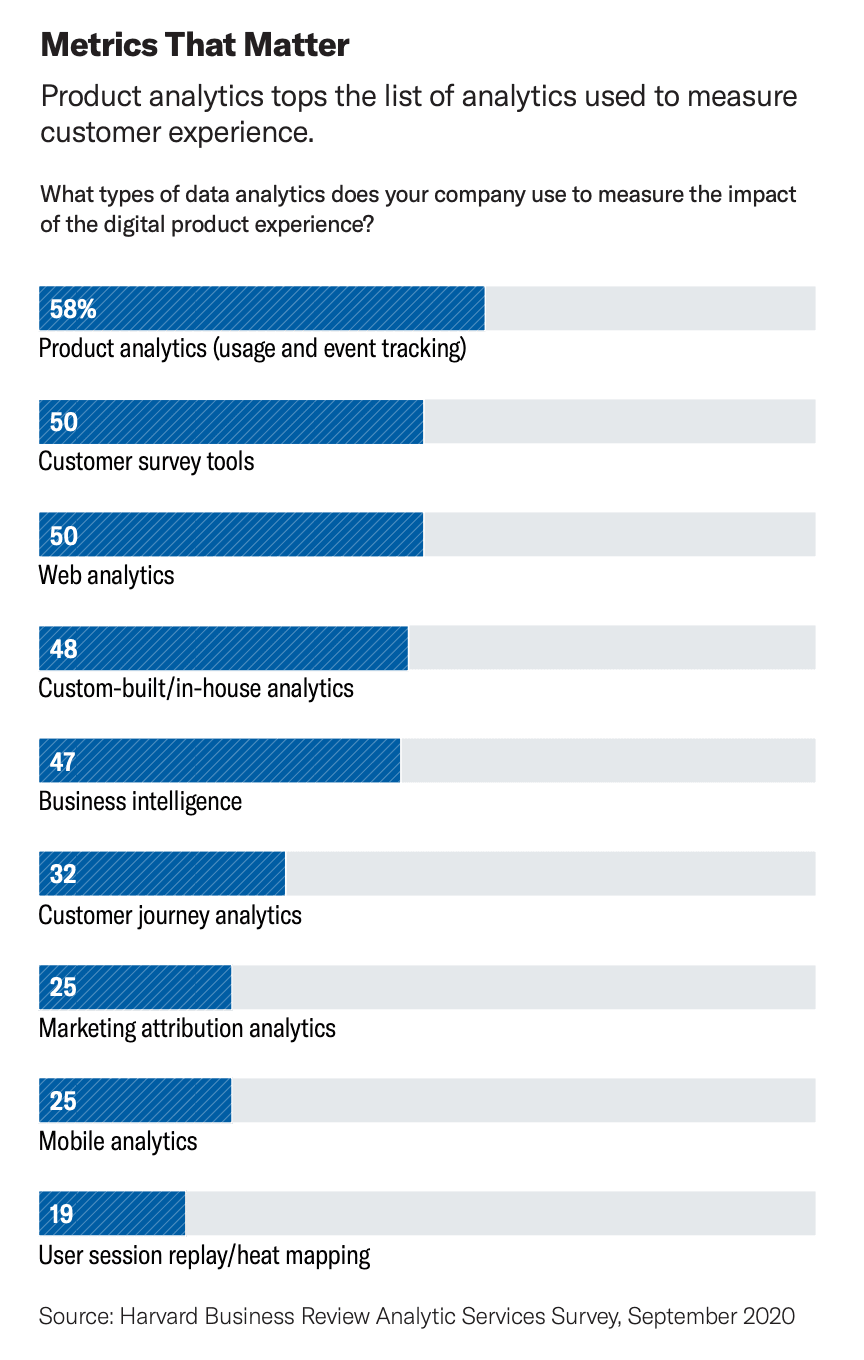

So what does the future look like? It’s my belief that the pace of business will force organizations to break down the silos that exist between marketing and product teams. According to research from Harvard Business Review Analytics Services sponsored by Amplitude, most future investments in analytics will be in product analytics.

Read the full report at https://info.amplitude.com/harvard-business-review-report

From my own experience, I have seen that marketing analytics products have a long way to go to catch-up with the architectures and features of product analytics vendors. Of course, product analytics vendors are similarly lacking some key features of marketing analytics products. But the gap between what product analytics vendors are missing related to marketing is much smaller than what marketing analytics vendors are missing related to product analytics. Primarily because marketing analytics vendors are being forced to re-architect their entire platform while trying to avoid upsetting existing clients or forcing them to migrate to new (and sometimes more expensive) offerings. And since most organizations have shown that they care more about user engagement and retention, this might give product analytics an edge, though marketing analytics vendors currently have a huge footprint in the enterprise space.

It will be interesting to see if enterprises stick with marketing analytics vendors or decide to try a new class of product analytics vendors when their marketing and product teams decide to work together. In the end, it will likely be a heated race between marketing and product analytics vendors with experience analytics vendors helping both to complete the full picture of customer experiences.

Adam Greco

Former Product Evangelist, Amplitude

Adam Greco is one of the leading voices in the digital analytics industry. Over the past 20 years, Adam has advised hundreds of organizations on analytics best practices and has authored over 300 blogs and one book related to analytics. Adam is a frequent speaker at analytics conferences and has served on the board of the Digital Analytics Association.

More from Adam