Personalization Preferences: What Do Customers Want?

Learn how to leverage customer data and product analytics to build a personalized customer experience.

The consumer landscape has undergone a significant transition since 2020. The adoption of real-time payments grew by 41% last year as customers were compelled to shop online more than ever. As online adoption increases, the role of customer engagement becomes key in driving repeat purchases and improving revenue.

Amplitude is the Digital Analytics Platform that enables organizations to deeply understand which digital experiences and customer behaviors lead to long-term value. These critical insights are accessible and actionable across every team, allowing for data-driven decisions that deliver business outcomes.

MoEngage is an intelligent Customer Engagement platform that allows consumer brands to leverage their customer data and robust product analytics, provided by Amplitude, to build relevant experiences and drive systematic business growth via this bidirectional integration. Campaign intelligence from MoEngage can also be fed back to Amplitude to gauge customer interests and predict their behavior.

In this article, we look at the latest personalization preferences from MoEngage’s Personalization Pulse Check Report 2021. We will highlight the changing needs of customers in North America and Europe, and show how Amplitude and MoEngage can help revamp your marketing efforts to customize individual experiences.

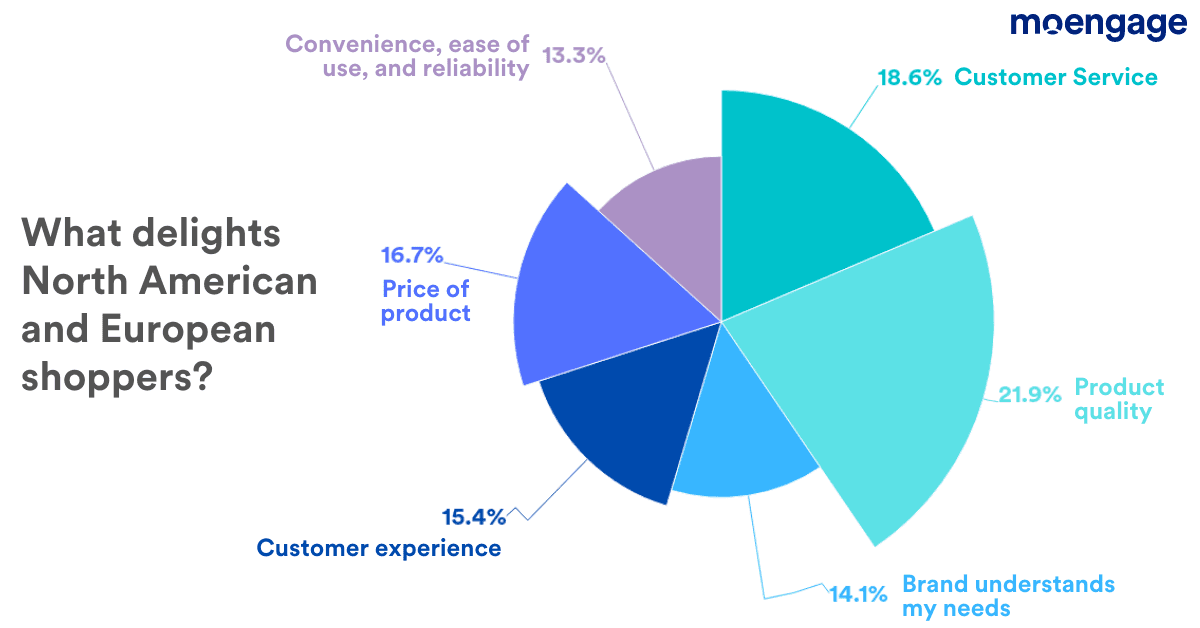

What delights North American and European shoppers?

Quality of product and great customer service are the two most important aspects of a positive experience.

Customer service and communication play a key role for male and female shoppers above the age of 35. They are more open to offers and announcements and prefer a manual intervention to resolve their concerns.

Female shoppers across all age groups prioritize the quality of the product over its price, implying they don’t mind spending more on a product that meets or even exceeds their expectations.

‘Company understands my needs’ is the lowest priority for shoppers across all age groups. This can be because most shopping brands use this phrase as a buzzword instead of practicing customer-centricity.

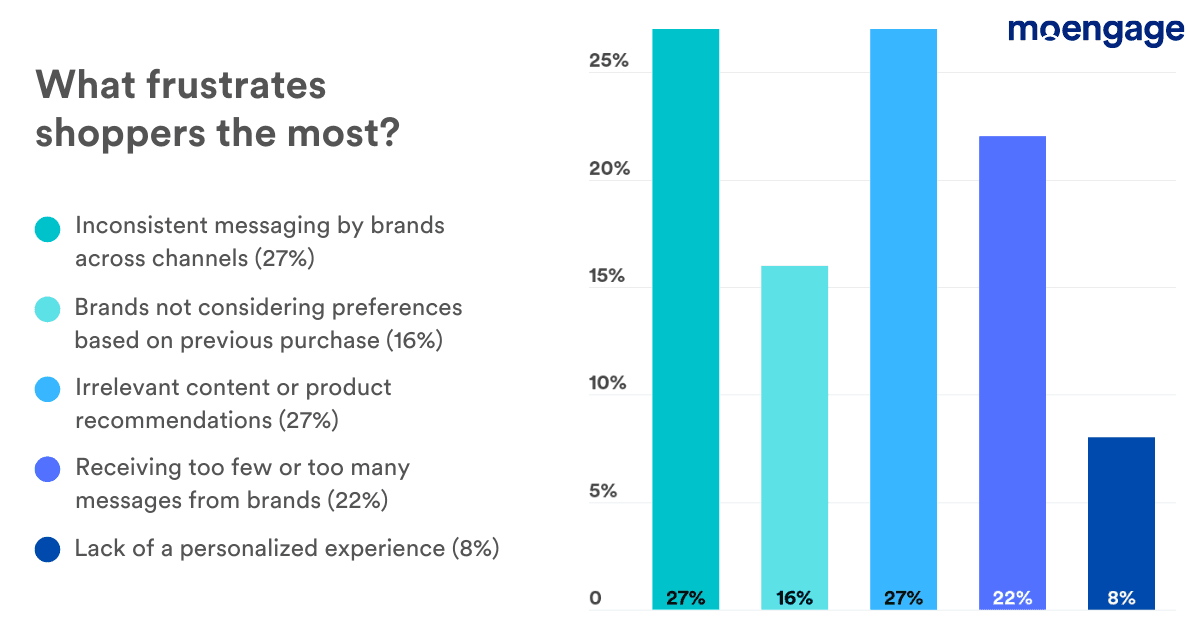

What frustrates shoppers the most about an experience with a brand?

Irrelevant product recommendations and inconsistent messaging across channels are the top frustrations for consumers in North America and Europe.

While women of all ages feel inconsistent messaging frustrated them, the reasons vary in different age groups.

Female shoppers aged 35-44 get overwhelmed when brands send them too many or too few messages. At the same time, those aged 25 to 34 and those above 44 feel irrelevant content and product recommendations frustrate them the most.

Inconsistent messaging across channels bothers male shoppers below the age of 45, while men above 45 find irrelevant content and product recommendations frustrating.

What can consumer brands do to address this?

You can ensure your communication is relevant and consistent across channels by creating Behavioral Cohorts in Amplitude and sending that intelligence to MoEngage.

Step 1: Uncover and validate high-impact audiences with a 360° view of the customer journey using Amplitude’s behavioral analytics and real-time cohorts.

Step 2: Dynamically sync audiences that you create in Amplitude with MoEngage to deliver personalized campaigns at scale across communication channels like emails, text messages, push notifications, or in-app interstitials.

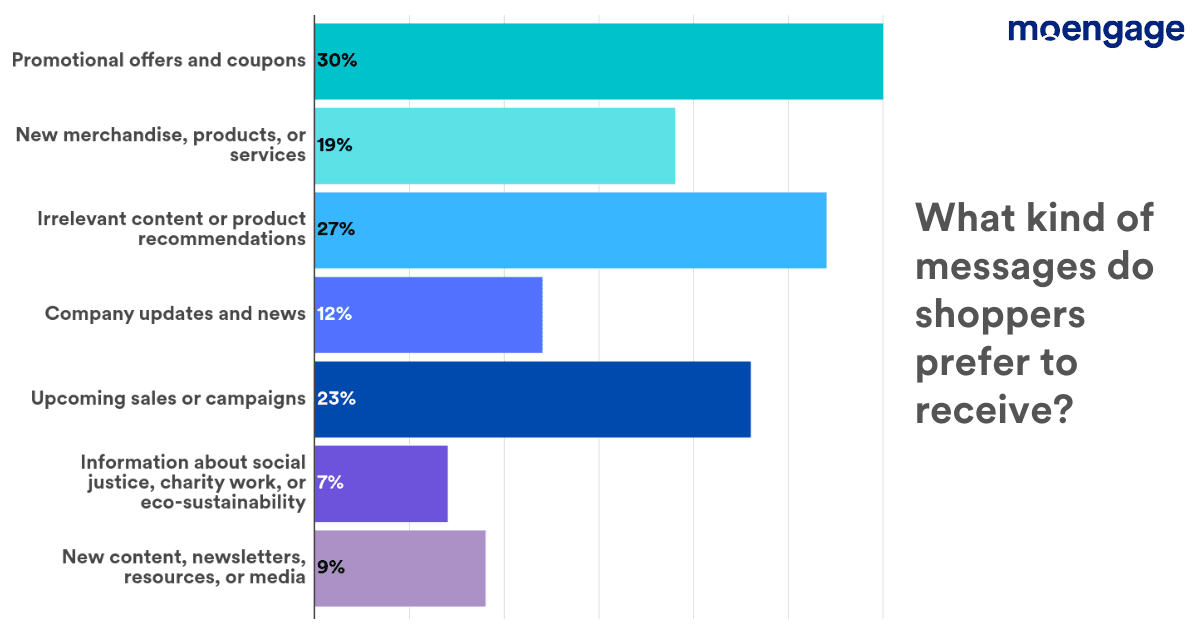

What kind of messages do shoppers prefer to receive?

30% of shoppers in North America and Europe like to receive promotional offers and upcoming sales.

Most shoppers are not interested in receiving new product announcements, newsletters, resources, and information about social justice, charity work, and eco-sustainability.

So, if you are planning to run campaigns informing your customers about the addition of new merchandise, products, or services, combine it with other ongoing promotional offers or with the announcement of an upcoming sale.

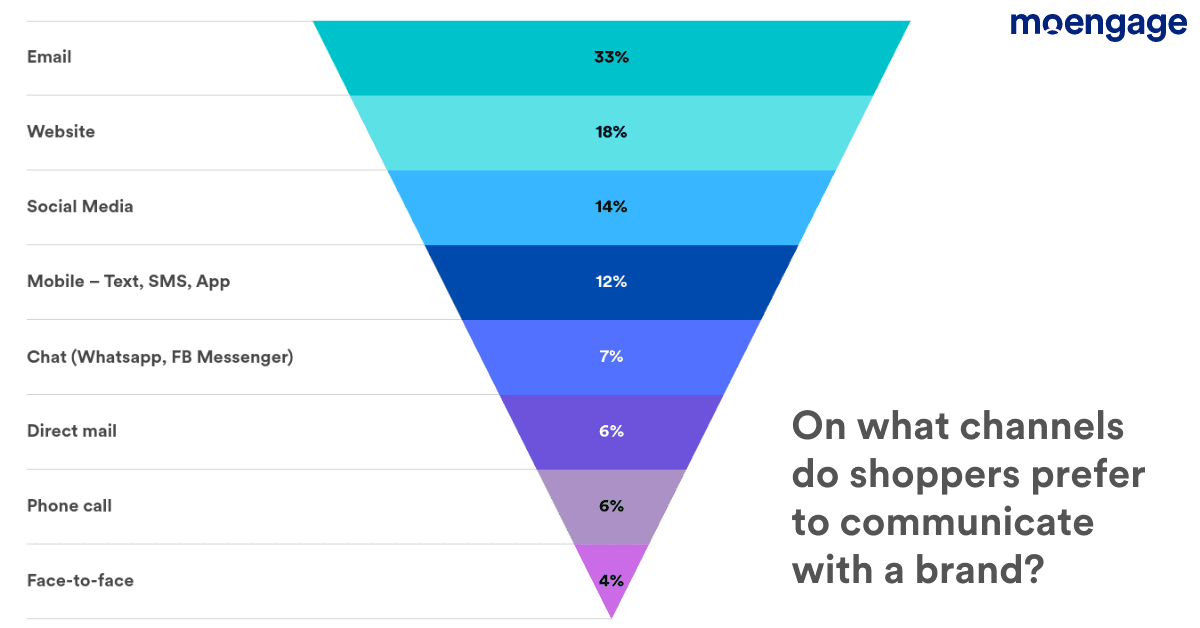

On what channels do North American and European shoppers prefer to communicate with a brand?

For 33% of shoppers in North America and Europe, email remains the most preferred medium of communication with mobile (text, SMS, app) and social media emerging as new favored channels.

Female shoppers aged 18-24 years prefer interacting with brands through email, mobile (text, SMS, app), and social, while female shoppers over 45 prefer interacting with brands via their website.

Male shoppers in the age group of 18-24 years prefer interacting with brands through email, website, and mobile (text, SMS, app) over social media. They prefer phone calls over direct mails and face-to-face interactions with brands.

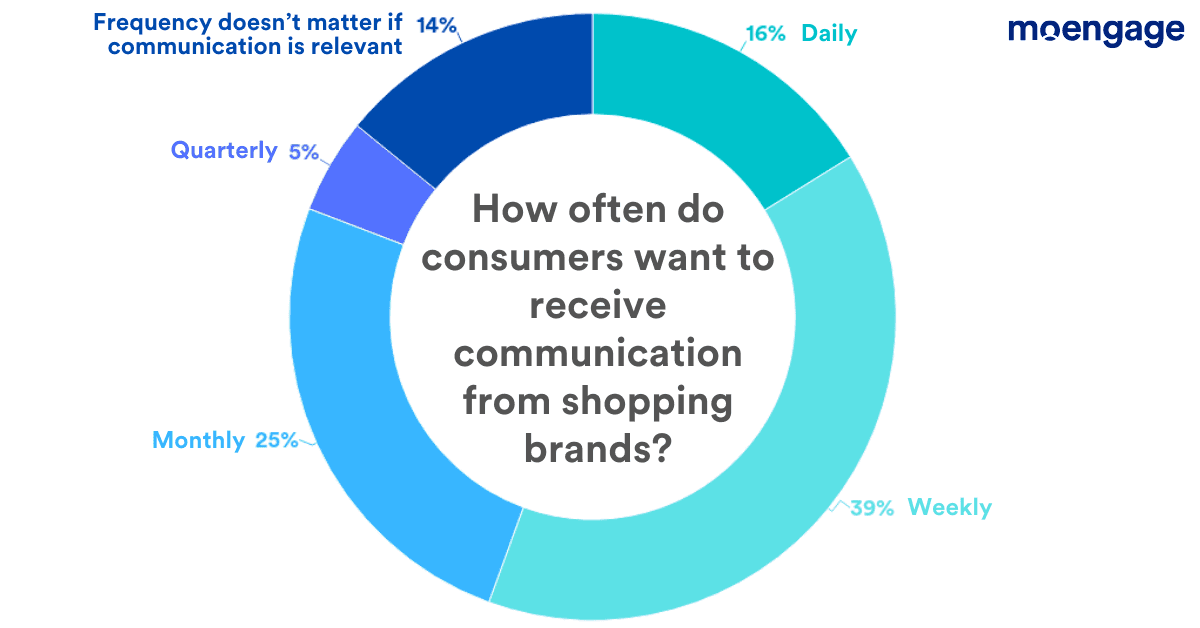

How often do shoppers prefer to receive messages and communications from brands?

While 39% of shoppers in North America and Europe want brands to communicate with them weekly, 14% of them do not mind frequent communication as long as it is relevant.

Male shoppers in all age brackets and female shoppers up to the age of 45 strongly favor weekly communication over monthly communication. However, women above the age of 45 prefer brands to communicate with them only once a month.

Female shoppers do not mind the frequency of the communication as long as it is relevant, however, only male shoppers in the age bracket of 18 to 24 agree with this sentiment.

How can consumer brands figure out the right communication frequency?

Using the Amplitude and MoEngage integration, you can measure the long-term impact of your engagement campaigns on change in customer behavior and frequency of interaction with your communication.

You can track conversion events at a user level, identify which of those behavioral events lead to inactivity, and proactively reduce the risk of churn with timely intervention.

Additionally, you can also forward communication data (such as notification clicks, email opens, or in-app interactions) from MoEngage to Amplitude to enrich your cohorts. This way you can create a real-time analytics loop that will help you gauge your users’ interests and improve your messaging across the customer lifecycle.

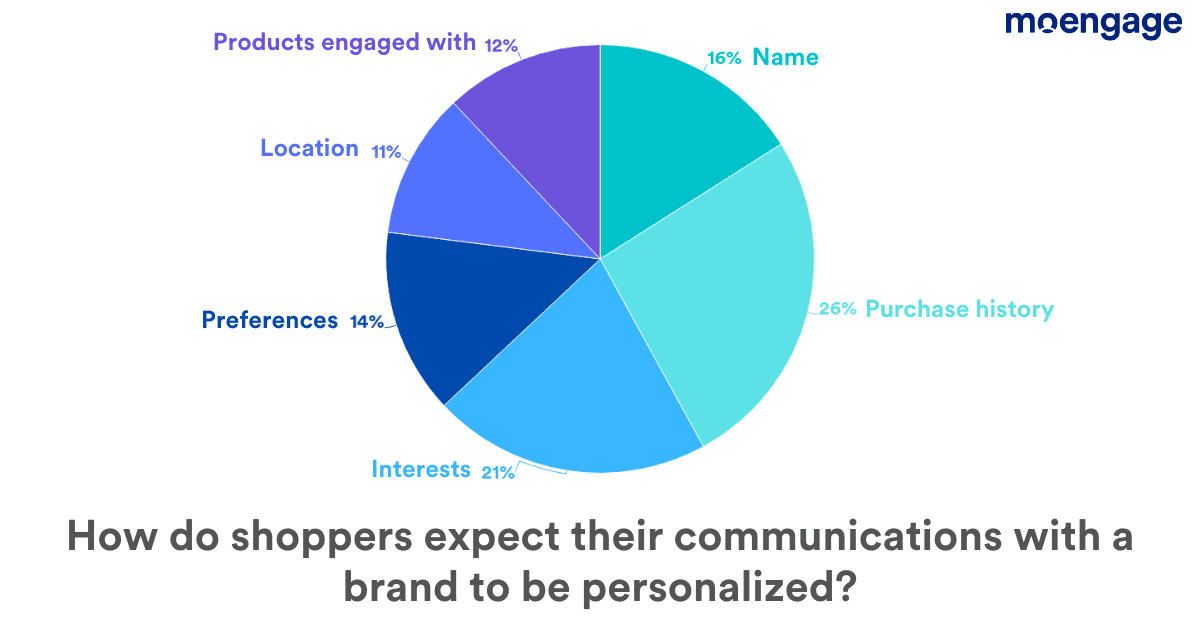

How do shoppers in North America and Europe expect communications from a brand to be personalized?

In North America and Europe, shoppers want brands to personalize their experiences based on their previous purchase history (26%) and interests (21%).

Female shoppers across all age groups want brands to personalize their experience based on their previous purchase history and interests, and those above the age of 45 preferring name personalization over location, interests, and browsing history.

Conclusion

Online shopping has witnessed an all-time surge leading to increased expectations of virtual experiences. While consumers want to hear from shopping brands regularly, irrelevant product recommendations and inconsistent communication frustrate them.

Brands must offer an impeccable customer experience across multiple touchpoints in the shopping journey to meet these ever-changing demands. With a rapid increase in online shopping, having consistent and integrated messaging to meet expectations will help build a loyal customer base.

The Amplitude and MoEngage bidirectional integration empowers brands to better understand customer behavior and deliver personalization that boosts customer retention and increases conversion.

This integration also lets you measure campaign results in real-time, allowing teams to quickly understand the impact of initiatives on customer engagement, as well as make quick adjustments if there are churn issues.

Learn more about how Amplitude and MoEngage work together.

Pulkit Jain

Sr. Content Marketing Manager, MoEngage

Pulkit drives growth through content at MoEngage. His experience as a B2B marketer comes fueled with a passion for user-centricity, affinity for data, and a love for technology, movies, comics, and gaming.

More from Pulkit