Using Insights to Inform Product Strategy with John Cutler & Ibrahim Bashir

Read expert tips on how to set your product strategy, build your roadmap, and identify strategic priorities using product insights.

At a time when inflation is rising and the overall health of the economy is being disputed, business leaders are focusing on what they can control: their strategies.

In a recent Strategy Deep Dive webinar, John Cutler, Product Evangelist at Amplitude, interviewed Ibrahim Bashir, VP of Product Management at Amplitude, to uncover how product insights inform business strategies and customer alignment. The pair provide expert advice on using product analytics and your product’s unique leverage to plan a product roadmap that aligns your entire organization.

Here are the five big takeaways Cutler and Ibrahim shared:

- Developing a strategy with a solid foundation in data analysis gives you the confidence to weather market turbulence.

- Understanding your users’ wishes for your product can inform how you approach pricing and packaging.

- Identifying the gap or unique problem your product can solve is essential when looking for what differentiates your product from your competitors.

- While growth is critical, it should not be the sole focus when formulating KPIs.

- A point of view should be well-researched and easy to communicate.

Adjusting strategy in a changing economic environment

While some teams are discussing their historical data and trying to predict what’s next, they must remember what matters—even as things change. Even though there’s a lot of pressure to quickly formulate strategies that are responsive to seasonal, market-based, or macroeconomic changes, product managers and business leaders shouldn’t lose sight of core strengths, points of differentiation, and customer insights.

Don’t assume that a strategy has become less relevant

Bashir suggests teams ask themselves what they’ve learned in the past year that might make them revisit fundamental assumptions about the product’s value, the typical user behavior, and the go-to-market (GTM) channel and motion. “You might actually double down and have more conviction that you’re in a good position,” he said.

Having those baselines and trends for comparison is helpful, but teams shouldn’t panic if their data starts to look different. The question is whether you should react and respond to the changes, as they could indicate a new context or other market drivers and dynamics.

Pressure testing the existing strategy allows you to figure out where you need to de-risk.

Get specific and qualitative

When macro trends shift, you could use a product analytics tool like Amplitude to slice the data into specific groups, or cohorts—by industry, company size, in-product behaviors, or various other dimensions—until you find a pattern.

You also need to consider qualitative analysis, such as anecdotes and quotes about what’s top of mind. Combining qualitative and quantitative insights will sharpen your recommendations and strategies for internal and external audiences.

Let analytics drive pricing strategies

In recent years, user experience has become an increasingly significant consideration in software development. Users have rising expectations for product usability, security, privacy, and data. As some companies prepare for possible economic setbacks, costs have also become a top-level concern, but product analytics can help you understand how to update your pricing strategies.

Consult internally and externally to identify pricing opportunities

Bashir pointed out that if you’re a technical product manager for a horizontal product or an engineering lead, you should understand how your product is priced and packaged. There could be untapped potential, such as adding speed or performance guarantees. For example, at a past company, Bashir’s team realized their developer customers wanted 99.999% availability guaranteed, so they created an additional SKU. The creation process required parallel infrastructure—a team not working on vertical products partnering with the GTM team.

Respond to cost concerns

Bashir elaborated with another example from a SaaS platform. Suppose you leverage pricing insights from the GTM team and understand the perception of your product’s value from the product team. You may realize some portion of your customers don’t require real-time reports and are trying to lower costs. This could inspire an alternative pricing or product model—it’s all about understanding and using your internal levers.

In the current economic climate, people might be more inclined to proceed with inefficient processes than generate budgets for products that solve those pain points. Therefore, GTM and product strategies have to emphasize the potential for cost savings from the perspectives of multiple parties.

Identify your differentiators

Your company and product should have a set of differentiators based on your unique perspective on the market and its trends. As the previous example showed, instead of bundling more value into a product for differentiation, it’s sometimes better to provide a lower-priced or “baseline” version of the product. Then you can allow customers to layer on additional features or tiers as needed. But differentiation doesn’t stop there, and product analytics can clarify what those differentiators are.

Reflecting internally, Bashir noted that one of Amplitude’s differentiators is self-service: instead of constantly “going to your data scientist” to decipher trends, the product is about immediately connecting curiosity to experiments, analytics, and decision-making—accelerating team velocity.

Identify your economic moat—like your community

Your economic moat could include community, brand awareness, or platform ecosystems. Community moats are hard to displace because it’s difficult for competitors to bootstrap a new community. Sometimes, if you have an early product, you can either make it simple and accessible—or, as Bashir puts it, “drag the market towards you” through communities. He explained that “community is a way to mind-hack the market,” because people think, “we’d better go because that’s where the community is.”

Ask how quickly you can get to a differentiator that is not easily replicable

UX innovations, such as streamlining existing processes, are not usually considered differentiators. Easy wins in this area can give you a temporary edge or help you gain entry into the market, but your competitors will quickly copy them. In some cases, third parties only realize their true differentiators after they’ve already won the market.

In a market with legacy and new players, product managers and business leaders sometimes have to do a “mix shift,” where they understand what their business looks like today and where it needs to go in three to five years. They might choose to slowly introduce new features to account for these changing market dynamics. This way, they can take steps to ensure future differentiation without abandoning their current business.

Get the company aligned

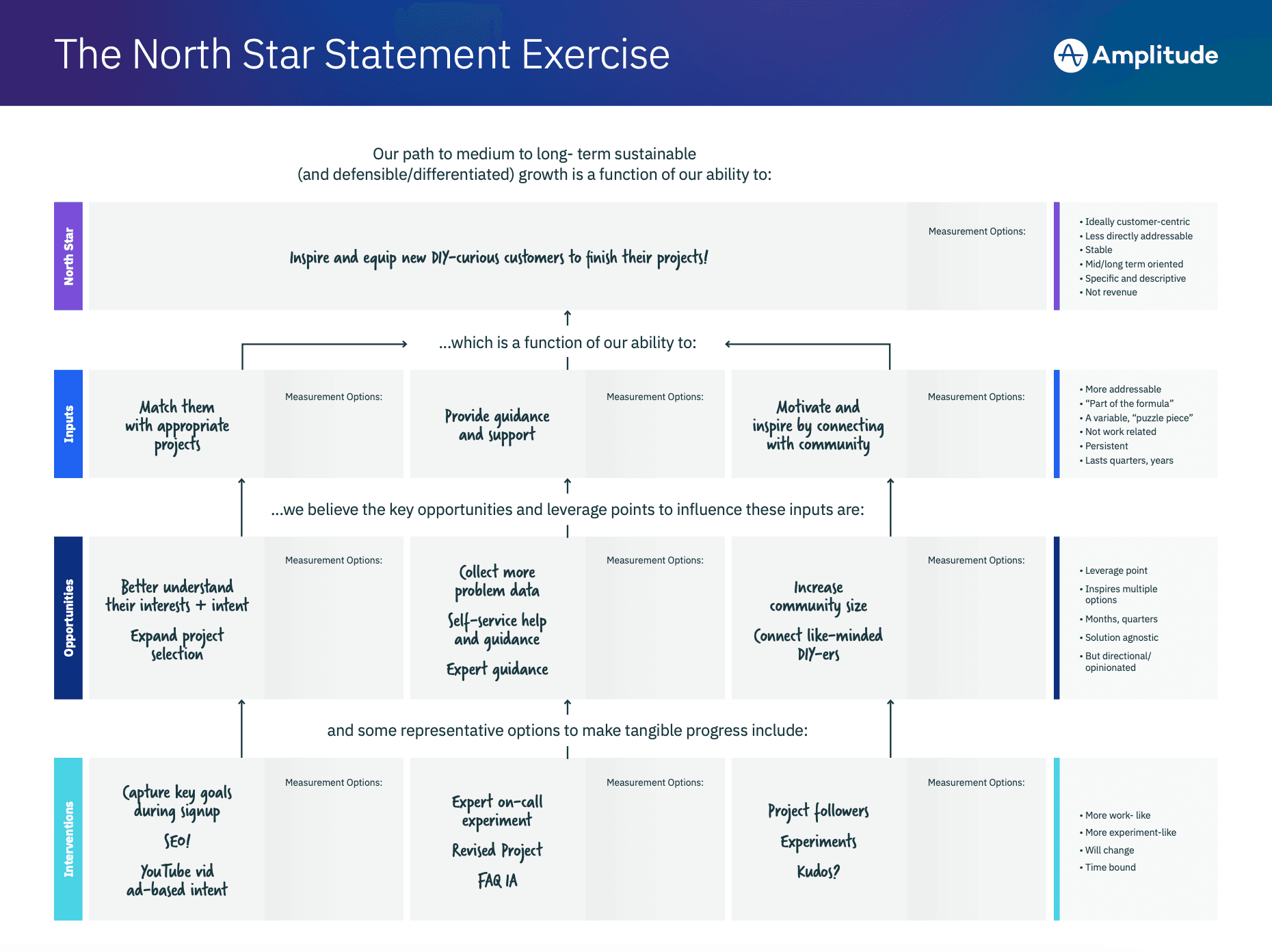

Cutler suggests that as you pursue any strategy changes, you should explicitly identify and frame your North Star Metric to align the company and its levers.

Download our North Star Statement Exercise for step-by-step prompts to help you identify your North Star and its inputs.

Bashir added that attempting to minimize internal disruption by “slow rolling” the shift, or allowing a handful of pet projects that no longer make strategic sense to endure, can adversely affect business strategy. As Bashir says, “That’s what hinders strategy—that lack of focus with that distraction because it’s not just, ‘Well, I let this one engineer do this one thing on the side’—that has a ripple effect. And then, before you realize it, you’re working on seven different things.”

Identify the right KPIs for teams and the organization overall

Although you’ll always have a push and pull between structure and strategy, the right product KPIs can help you make those tradeoffs.

Alignment should be year-round

Cutler suggests, “If you find OKR setting to be an incredibly hectic, draining end-of-quarter activity, it’s usually a sign you’re not focused enough on what remains constant across the quarters.” Implementing tactics and methods early on ensures that teams are aligned and helps make the OKR process a continuation of this work rather than a separate consideration.

Choose metrics carefully

Over his career, Bashir has witnessed how the growth-at-all-costs mindset can neglect two crucial dimensions: retention (user or revenue) and healthy margins (such as customer acquisition cost vs. customer lifetime value). Some product managers mistakenly assume the purpose of their product is only user revenue growth, whereas add-on products and platform-based business models are more likely to focus on retention and margins.

For example, while working at a company with a platform model, he saw how tying product development teams to ARR is misleading because it might be more reflective of sales, deals falling through, or unrelated factors on the GTM side. They then realized that customers using their developer APIs were substantially stickier because they were “building hooks into the rest of their enterprise deployment,” Bashir notes. With this insight, the company shifted its focus from ARR to encouraging API usage.

Learn more about the top 15 product metrics you should track in The Amplitude Guide to Product Metrics.

On platform teams, technical and product investments should be the leverage that increases the velocity of product development. While platform teams might not always see how they fit into the larger strategy, they’re often generating higher value and modular capabilities, allowing for pricing and packaging flexibility. Having these multiple product dimensions can positively affect your top and bottom lines.

Identify the internal risks

People tend to laser in on market and competition risks because, as Bashir says, it’s “an easy thing to focus your risk appetite on.” However, this external focus can be distracting when the real question is whether or not you have the right team for execution. Without effectively deploying your team, you’ve already lost.

Many PMs also fall into the trap of thinking that “the pixels are my product.” But the entire customer experience—including the ability for customers to easily use features or demo the product—falls under their purview. It’s vital to have an internal team that takes each step of the customer journey (e.g., the GTM strategy and implementation plan) into consideration rather than having a narrow view of what “the product” constitutes.

Developing the strategic muscle

Bashir and Cutler discussed how becoming more strategic involves developing a point of view, practicing communication, and being honest about limitations.

Develop a point of view

Some business leaders may appear to have their product strategy all figured out. However, what may seem like natural “instincts” are often perspectives carefully distilled from many conversations, experiences, and inputs over time. Therefore, you could equate product strategy to having a point of view on the market, the user, and how the product helps the user.

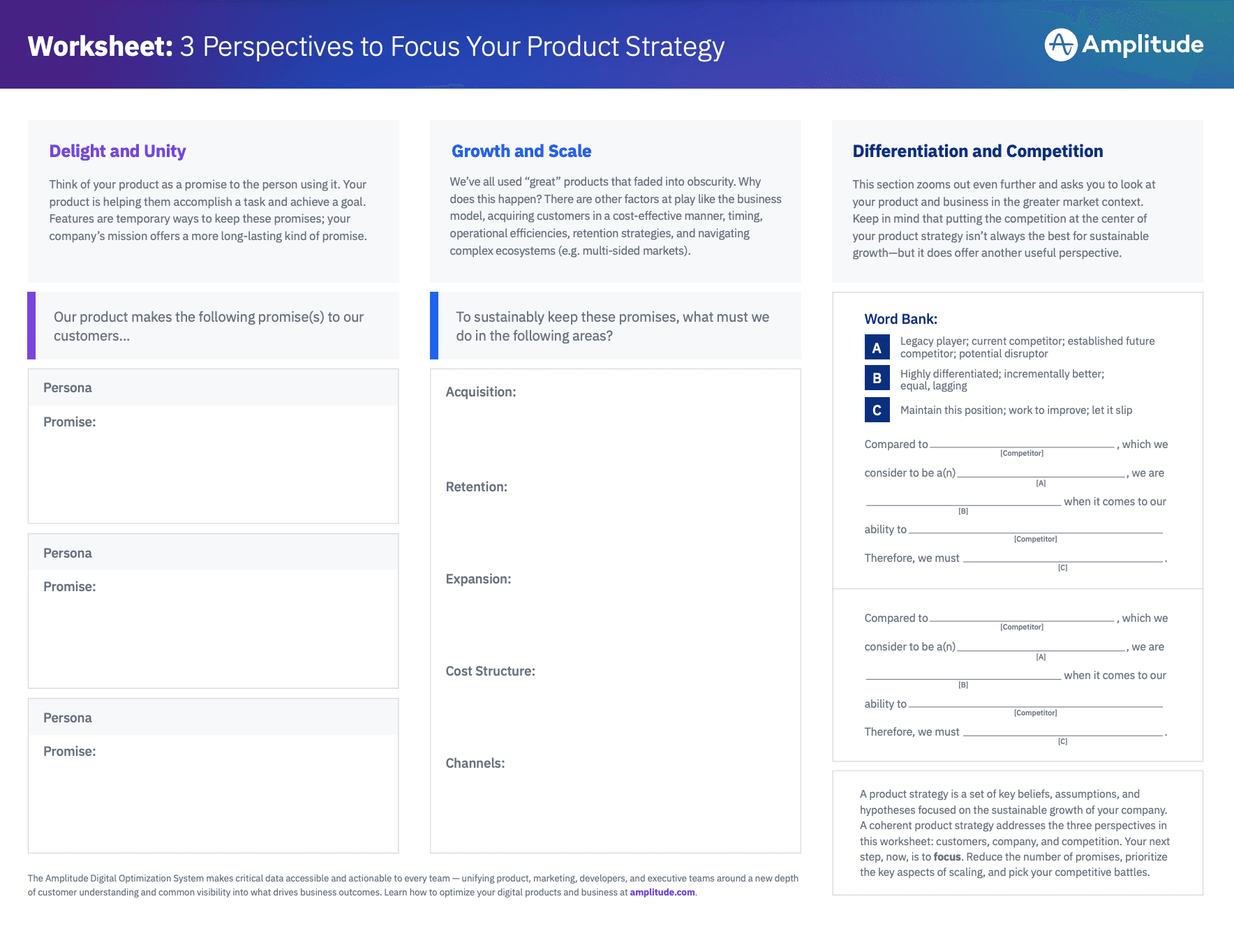

Fill out our Product Strategy Template to build your strategy based on your customers, company, and competitive landscape.

You can develop a strategy or a point of view by engaging with customers, analyzing behavioral customer data, disentangling muddled signals, actioning your insights, and running experiments.

Practice communication

Developing the strategic muscle involves deep research and model building—but is useless if you can’t communicate your findings, observed Cutler. Highly strategic people often have a lot of experience articulating their thoughts, which adds to their confidence. A leader trying to develop their strategizing capabilities could practice clear, concise communication with an internal strategy group.

Bashir added that as team leaders strategize, they should write their thoughts down in a document, bullet points, or presentation deck. They should be able to break it down from different angles and integrate it into other formats. The process can be illuminating because if you encounter challenges articulating the strategy, you likely need to revisit it.

Be realistic

It’s easy to identify an endpoint but to strategize well, team leaders must think through constraints instead of assuming they have unlimited resources. You can be right about the market, the customer, and what’s required, but you need to be honest about your resources, the existing load on your team, and the limitations of your product. Then you can use this information to strategize accordingly.

Be unique

Ideally, your product strategy should be unique to your organization. Otherwise, if you’re mimicking a strategy used by multiple competitors in the market, it’s just “a coin flip as to who might win,” Bashir notes.

Strategy is how you interpret and act on common sense about the market. The common sense observation needs to be followed with a “why?” Companies that succeed can identify the reasons behind observable trends and adjust their strategies in response.

Set your strategy with analytics

Product analytics tools like Amplitude are critical when plotting a course through an uncertain world. They can help you cut through the noise and decide what to pay attention to and what to disregard. By analyzing and activating data, you can determine how to price your products and services, identify and market competitive differentiation, organize teams, and measure results.

Whether teams identify their unique forms of leverage, manage trade-offs, or model outcomes, analytics should always have a seat at the table.

If you enjoyed this recap, watch the full webinar or get started with data-driven strategizing by signing up for a free Amplitude account.

Noorisingh Saini

Global Content Marketing Manager, Amplitude

Noorisingh Saini is a data-driven marketer managing global content marketing at Amplitude. Previously, she managed all customer identity content at Okta. Noorisingh graduated from Yale University with a degree in Cognitive Science.

More from Noorisingh