Amplitude + Slalom: 3 Ways Leaders Can Leverage Digital Product Analytics to Drive Outcomes

Learn how Amplitude and Slalom work together to empower organizations with the data needed to innovate and improve customer experience.

Business leaders often know that they need to look closely at the entire customer journey and deeply understand different segments of users. They may even have the necessary data to examine the relationships between customer experience and overall retention. But there’s a gap: the data is there, but the teams don’t know how to put the data to work.

Amplitude and technology-led modern consulting firm Slalom helps teams connect the dots. Through in-depth assessments, Slalom identifies where its clients need better data. Often, clients want to understand what customers are doing within their products and how this can lead to insights about the customer experience. Amplitude tracks and analyzes user behavior within a digital platform. Armed with insights from both companies, teams can collaborate to innovate faster and improve the customer experience.

Today’s companies have to think beyond customer acquisition and focus on the complete customer journey. Amplitude and Slalom teamed up to explain how companies can understand the end-to-end digital journey with product analytics in their Growth Webinar Series, and we wanted to share some of the key takeaways.

1. Identify the Metrics That Connect to Your North Star

Product-centric companies have figured out how to build the best experience for their customers that also achieves tangible business outcomes. There is an explosion of choice for consumers due to the ease of putting together an app or a website; in this landscape winning companies do three things differently than the rest of the pack. First, they are aware that every feature, touchpoint, and experience of their product directly shapes their brand. Second, their product development and management teams don’t start by asking, “how can we make this feature valuable?”. Instead of starting from what they already know or can do, they ask “what customer pain points or desires can we uniquely help resolve?” and design experiences and features around them. Third, they align core enterprise capabilities (e.g., people, process, technology, data, and org structure) to the delivery of products that meet those customer needs and desires through a seamless customer experience. This is how they achieve a competitive advantage.

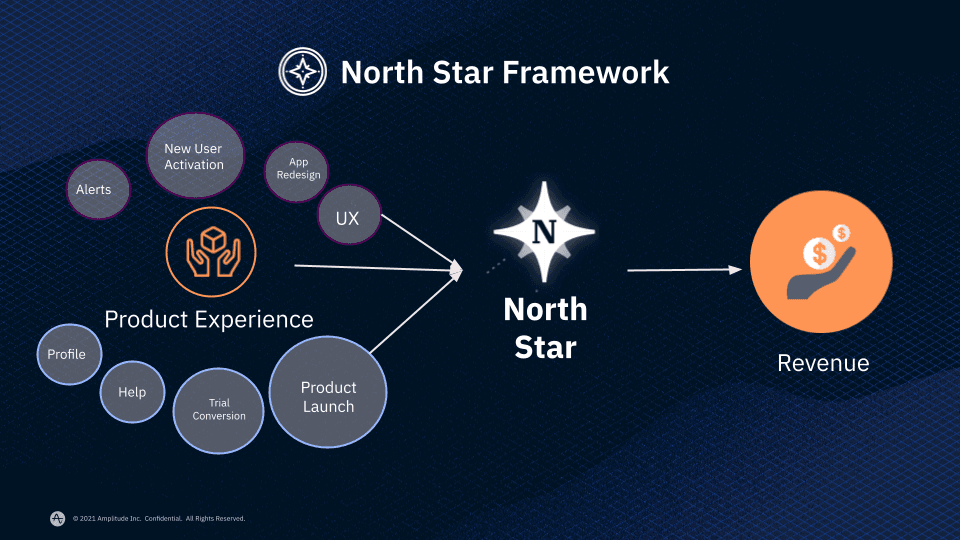

A Product North Star guides your product’s strategy, delivery, and product management, and should consist of two parts—a vision statement and a metric that serves as a key measure of that strategy.

Depending on the industry, the vision of the Product North Star looks different.

- Some companies measure success by the attention received from users or time spent engaging with content. Their North Star Metric could be the number of stories viewed or the number of hours subscribers are streaming per month.

- Companies may also have a transaction North Star where the vision is a customer completing a checkout. Their North Star Metric might be the total number of purchases completed or the average number of purchases per customer.

- Some companies may have a North Star around productivity, where the vision is users engaging with the product to complete tasks. Their metric might be the number of messages sent or the total number of records created within the product.

The North Star Metric is a leading indicator of sustainable growth. It acts as the connective tissue between the product and the broader business and customer value. It communicates the product’s impact and progress to the rest of the company, so the metric should be easily understood, quantifiable, and actionable. And, most importantly, it holds the product accountable for an outcome.

Understand How Customer Engagement Impacts Your Product North Star

Your Product North Star should be tied to how customers define and perceive value and how they engage with your product to yield that value from your product. After all, a product needs to help users in some way to be worthwhile. Yoshi Suzuki-Lambrecht, senior principal of customer and product strategy at Slalom, agrees.

Suzuki-Lambrecht recalls working with a client whose product was an order management system and through consultation, prototyping, and validation sessions, determined that the product North Star was different than expected. He recalled, “The lesson there for the client — and for us — was the importance of really talking to these people… and observing their everyday pain points, to figure out how they would define value and the why behind their interaction with a given product.”

You can understand the value your product brings to your customers with a few simple steps. First, reflect back on your product strategy, and its key value proposition and product vision; these together help you understand (1) why should your customers care about your product, and (2) how your product could change the world for your customers and your business when you successfully deliver on the value proposition. Second, identify the most important customer goals, tasks, and pain points embedded in your customer’s journey. Third, understand which features and interactions or behaviors your customers take to achieve key tasks and goals while engaging with your product. Assessing engagement data of those features will help you determine whether your customers are finding your features valuable or not. The actions users frequently take are a solid indicator of why people come back to your product. Once you identify which behaviors are tied to your product’s core value, you’ve found potential North Star Metrics.

An example of engagement might be that you expect users to spend a certain amount of time with your product. For a streaming app, this might be 30 minutes per day. Then identify the number of users who fall above or below that threshold.

When choosing your North Star Metric, be careful not to pick a vanity metric. Vanity metrics are metrics that seemingly look impressive when they go up, but are (1) easily manipulated by advertising, and (2) do not answer the “so what?” question in light of higher-level strategic objectives. For example, “Likes” on social media are great examples of vanity metrics; it can be easily lifted by investing more money on a paid media campaign, and unless the goal is to get more Likes, it alone does not provide much additional valuable insight for whether you’re on track to achieving a broader business objective.

Identify the KPIs That Are Leading Indicators

Your North Star Metric helps teams gauge whether users are receiving your product’s core value. But if you focus only on the North Star Metric—a lagging indicator—you may miss opportunities to pivot your product strategy.

Instead of waiting to find out whether or not users are benefitting from your product’s core value, identify the key performance indicators (KPIs) that contribute to your North Star Metric. You can track these on a day-to-day basis to make sure you’re making progress on your Product North Star.

Product North Star can be broken down into different parts. You can think of these parts as a formula for your North Star and tie KPIs to each of them. These KPIs become the leading indicators or input metrics that ladder up to your North Star Metric.

- Breadth: How many active/returning users are taking this action? For example, the number of new installs who place an order.

- Depth: What is the depth of their engagement? For example, the percentage of customers who reorder.

- Frequency: How often does each user engage? For example, the number of times a user opens the app.

- Efficiency: How fast do they succeed? For example, the time between when an order is placed and delivery.

For your organization to track its North Star metric—and its leading indicators—it needs a culture of data democracy, where teams have easy access to product data. Continuous alignment means that teams should have access to these insights at any time. After all, reviewing data—such as how often users engage—may influence product decisions.

Slalom and Amplitude can both help with building that culture. Slalom’s consulting work often revolves around company alignment on data: understanding what to measure and providing guidance to product teams. And in Amplitude’s digital analytics platform, any team member can measure product performance and easily pull data insights.

2. Increase Product-Led Growth Through Personalization

In a product-led growth mindset, the product itself is the primary driver of acquisition, conversion, and expansion. Once you build a product that customers love and can’t live without, revenue and retention will follow.

For product-led companies, leveraging the context of users to tailor their experiences has become table stakes. More than ever, end-users expect the product to meet their needs and use cases, whether it is the onboarding tour or recommendations within an e-commerce platform. In order to let the product be the driver, companies have to rely on personalization to provide the fuel.

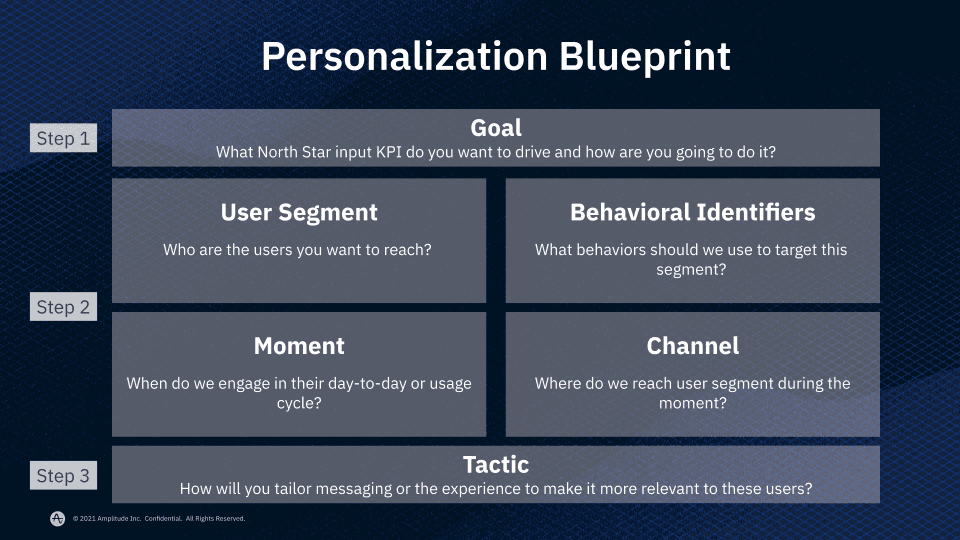

Introduce Personalization with a Clear Strategy

While personalization is a critical aspect of the product-led growth model, companies need to introduce personalization with a strategy in mind. Gartner has found that “80% of marketers who have invested in personalization will abandon their efforts by 2025” due to lack of ROI, poor customer data management, or both.

“What we end up seeing is that companies are jumping into technology investments because they want to create this 360 view of the customer and deliver more personalized experiences… but they jump into a technology solution without a strategic wrapper,” says Heather Roth, Director of Digital and Customer Strategy at Slalom.

To build your personalization strategy, start with your North Star Metric. From there, identify your target users—the people who are most likely to interact with your product as defined by your North Star Metric—and how you’ll engage this audience. Behavioral data can be used to tailor your outreach, giving information on what channel to engage users on or what time to engage users.

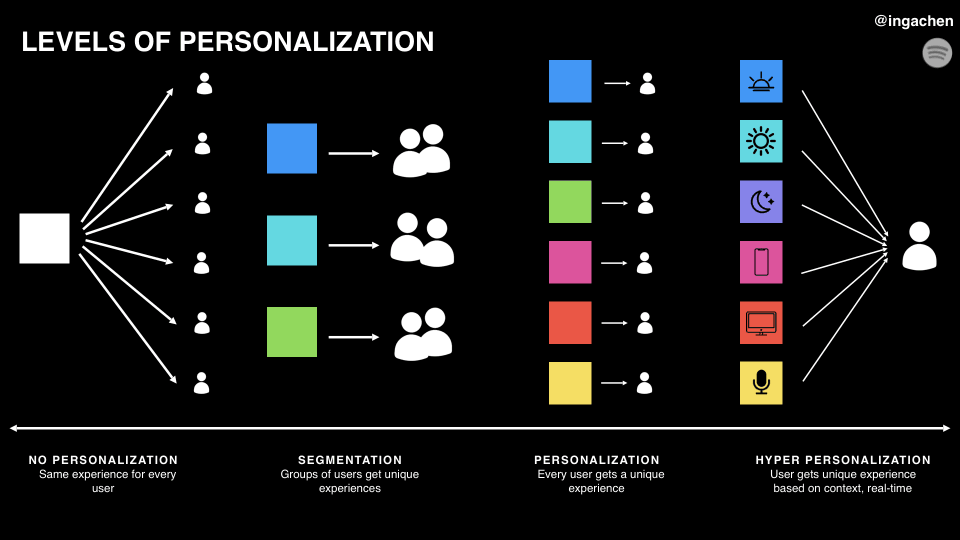

Work Your Way Up to Hyper-Personalization

If your company currently doesn’t have a robust personalization strategy, it’s best to start small. At Amplitude’s Product Roadmap Summit, Inga Chen, senior product manager at Spotify, outlined what personalization looks like for companies that are starting from ground zero and providing the same experience to every user.

- Segmentation: The first step is to group users to get unique experiences and ask what behaviors these users have in common. Personalized experiences are provided to these segments of users.

- 1:1 Personalization: As the team gets more sophisticated, personalization can happen in a 1:1 manner. Each user has a unique experience based on their attributes.

- Hyper-Personalization: Ultimately, teams may want to deliver a highly contextual user experience based on real-time data. The goal would be improved personalization (with machine learning technology, for example) as more user data is collected.

For companies that have reached the level of hyper-personalization, manually identifying customer segments and improving experiences aren’t scalable. Teams need technology that can automatically deliver relevant messaging that is based on real-time data.

Amplitude Recommend allows companies to use hyper-personalization strategies without a team of data scientists and engineers. Recommend builds lists of users to target based on behavior and uses machine learning to anticipate future behavior. Predictive personalization determines the content that maximizes conversion and the right channel and timing for delivery. These tactics move companies into the digital elite by providing a truly unique experience for each customer.

3. Uncover Patterns of Retention Through Customer Behavior

A common misconception about retention is that active users are equivalent to user retention. Companies focus on acquiring new users to increase their active user counts. But focusing only on acquisition is like adding water to a leaky bucket. You may be adding more to the top, but there isn’t sufficient activation to maintain a strong user base.

Research shows that relying on acquisition alone isn’t a sustainable retention strategy.

- Over 77% of new users stop using most apps just three days after downloading it.

- Over the last five years, overall customer acquisition costs have risen almost 50%.

- It’s 5-25 times more expensive to get a new customer than to keep one you already have.

You can keep your business healthy by keeping existing users happy, so they’re more likely to remain loyal or return to your product.

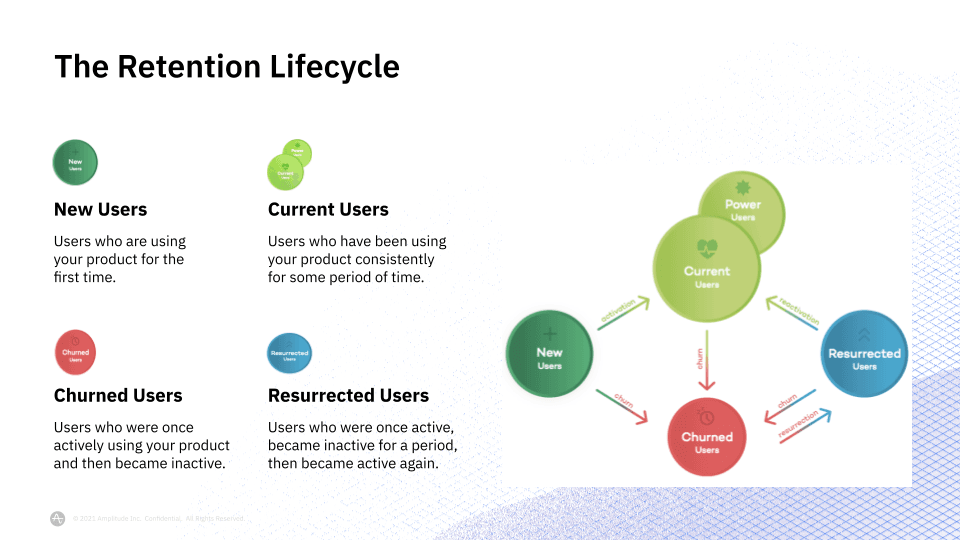

Tailor Retention Efforts Around the Customer Lifecycle

Retention looks different for customers in various stages of the customer lifecycle. You have:

- New users trying out your product for the first time

- Current users with consistent product usage

- Churned users who have become inactive

- Resurrected users who were once active, became inactive for a period and became active again

Use behavioral data to discover what will drive retention in each stage of the lifecycle. Amplitude allows teams to group customers into behavioral cohorts—groups of users that take similar actions in your product. From there, teams can identify what drives retention, act on that information, and measure the outcomes.

Patreon, a creator-founded membership platform, discovered that it could deliver more value to its users by optimizing the creator page through behavioral data from Amplitude. This helped creators earn more money from their fans, which improved the overall value provided. Patreon now has a deeper understanding of their subscribers and has been able to use those insights to adjust everything from UX elements to how to structure their checkout flow.

Companies that may not have access to the data needed to understand customer behavior have to find another way to understand user experience and what is driving value.

“If no data is available, you go out and collect… You might have to interview customers to understand what are the different product personas and how they differ,” says Jimmy Shanfield, Senior Principal of Customer and MarTech Strategy at Slalom. “You confirm that with a survey [to see if] that makes sense.”

Run Experiments to Increase Retention

To move the needle with retention, companies need to experiment with changes to the customer experience. You may have a hunch about why customers are leaving but won’t know if the hypothesis is correct until you release changes and measure the downstream impact. To create the right experiments, you need to understand two key inputs: the critical event and the product usage interval.

While retention looks different for every company, all companies have a critical event, depending on both the product and company stage. The critical event is the action users must take to receive your product’s core value. It might be booking a class on an exercise app or completing a purchase on a grocery app. They’re the actions that you want users to repeat every time they use your product.

Next, you need to look at your product usage interval, which is how often you expect people to naturally return to your product. Your usage interval is the ideal time between critical events: productivity apps may expect daily usage while travel booking apps will experience more irregular usage. You can look at your current user base to find those who have performed your critical event and plot the amount of time before they return. Your usage interval will occur at the time point when about 80% of users have completed the critical event a second time.

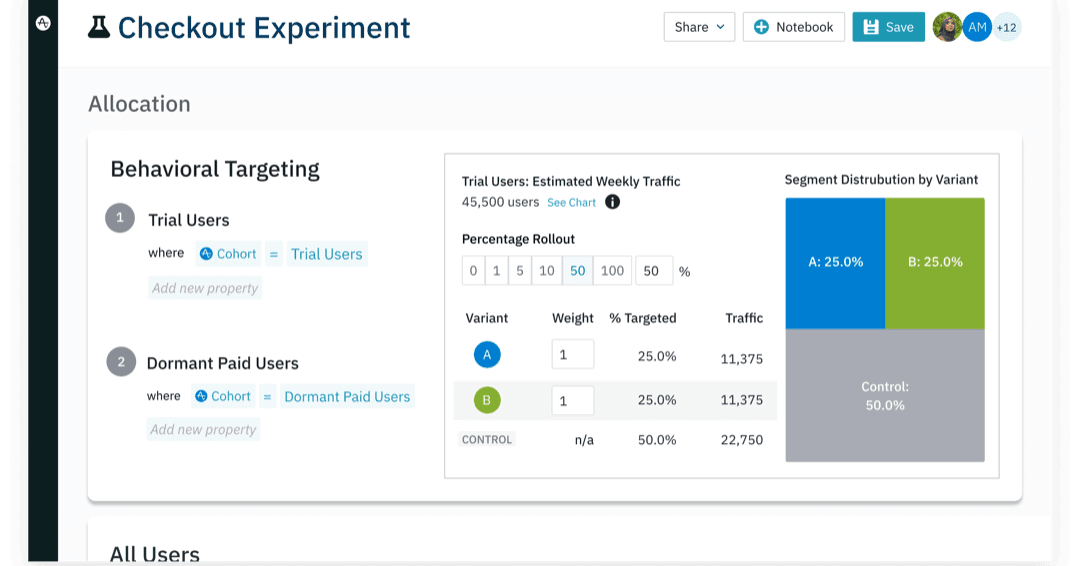

After companies know their critical event and usage interval, Amplitude can measure the impact of product changes on retention. Amplitude Experiment embeds analytics and customer behavior into A/B testing so that teams can iterate quickly and react based on results. You can create tests based on customer behavior, for example, specifically targeting customers who have not repeated your critical event or are not at your ideal usage interval. Teams can see results in real-time and measure the downstream impact on engagement and retention.

Transformational Outcomes with Slalom and Amplitude

As a technology-led consulting company, Slalom helps companies tackle ambitious projects. Clients come to Slalom seeking help evaluating the tools that drive better customer experiences. Slalom and Amplitude work together to serve mutual clients looking for business transformation. Amplitude provides the product analytics and personalized recommendations to achieve business objectives, and Slalom has the expertise to help teams think through their strategy and implement technology for their use case.

Companies that want to build disruptive experiences can turn to Amplitude and Slalom for best-in-class products and consulting. Slalom consultants help teams implement technology that will help them improve customer experiences, while Amplitude provides the analytics, personalization, and experimentation companies need to attract and retain their users.

For a deeper dive watch our on-demand webinars: Defining your North Star, Optimize for Retention, and Building for Product-Led Growth.

Nicole Spivak

Partner Marketing Manager, Amplitude

Nicole Spivak is the Partner Marketing Manager at Amplitude, where she helps partners highlight joint value and tell meaningful customer stories. She has worked in every area of marketing, but particularly enjoys developing content that resonates with clients.

More from Nicole