Why Product Leaders Should Read the Dropbox S1 Filing

A product-led approach creates what I call the R&D spiral, which is the best place to be in SaaS today.

I am always a little disappointed by S1 filings. As a VC investor, ex-engineer and product leader, I am trained to look for the secret sauce in every business – the leading indicators of future outcomes that forecast what success could look like. However, most S1 filings just present the standard wall street analyst metrics like year-over-year growth, gross margin and cost of revenue.

These metrics are a good starting benchmark for business potential and might have been enough for the business models of yesterday. But they no longer illuminate the core drivers of what makes modern technology businesses grow faster than expectations.

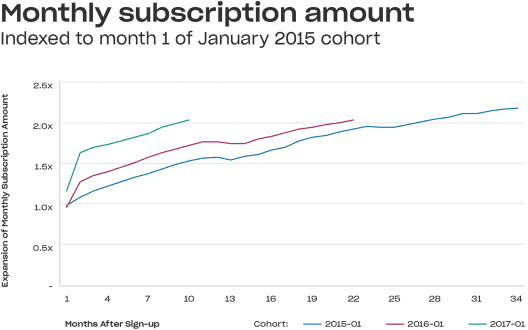

The Dropbox S1 filing gives me some hope, though. Buried deep on page 63 of 219, is a chart of their revenue growth broken down by cohorts of the year the users were acquired. This chart is the Dropbox secret sauce.

The Dropbox secret sauce. Source: Dropbox S1 Filing.

If you are not familiar with cohort analysis, here’s how you interpret this chart:

- The total monthly recurring revenue (MRR) of all Dropbox customers from Jan 2015 grew 2x in 28 months.

- The MRR for the Jan 2016 cohort reached 2x in just 22 months.

- The MRR for their Jan 2017 cohort started 20% higher to begin with and doubled within a year.

- Dropbox has negative churn (at least in their January cohorts). There is no decay in the ARR they acquire.

Interpreting this chart gives you some answer to the question, how sticky is a Dropbox customer? Now, we are still left with a lot of open questions on their specific metrics, like how many users are in each cohort? and how is price per user trending? but this is a great starting point.

There are plenty of other impressive things reported in the Dropbox S1 filing. For instance, Dropbox has doubled revenues over 2015-2017 while decreasing their COGS.

The most important chart in the Dropbox S1

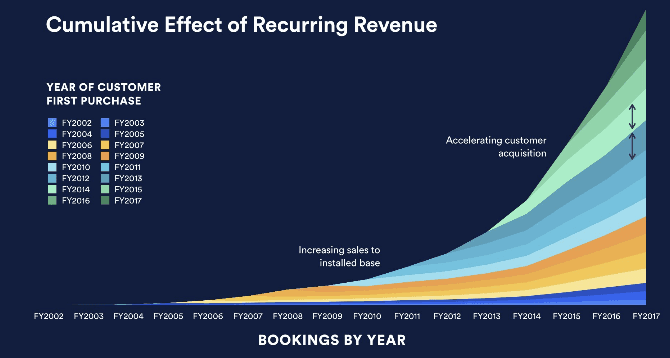

However, the most compelling analysis that should make you long Dropbox stock is this cohorted retention analysis. It is so compelling that it might become the new standard in good financial analysis for a SaaS business. Here’s why:

- Revenue matters a lot more if it is recurring and growing.

- Adoption is a moat only when it’s growing.

- Each customer lifetime value accelerates the longer they pay.

This retention analysis tells the story of a massive revolution happening today in the world of B2B software – product-led companies are winning. They’re winning because they’re investing heavily in R&D. They’re focusing on long term growth via engineering investments rather than buying short term growth with marketing and sales. The product team, not the sales team is starting to control the destiny of the business.

This revolution is in response to changing trends in consumer preferences towards usability and seamless digital experiences.

There are four key SaaS Go-To-Market strategies that are shifting as a result of these trends…

Shift from contract value to annual recurring revenue

The writing’s on the wall. Many historically successful B2B companies focused on large contracts and buyer relationships for success. Today, that model has flipped to the land and expand strategy across the board. The land and expand model is about demonstrating real value to the customer as a path to becoming a layer of invisible infrastructure for your client.

The acquisition interest for companies that have successfully deployed a land and expand strategy is growing. Acquisitions like that of Mulesoft by Salesforce and that of Appdynamics by Cisco are great examples of how larger companies are trying to buy into a new game they haven’t played before.

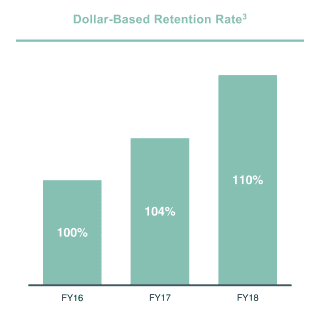

The growth of companies like Zuora, which just filed its own S1 to go public is yet another indicator. Zuora enables companies to implement subscription-based pricing to move to ARR models. They shared a similar retention analysis to that of Dropbox, although not cohorted in their filing.

Source: Zuora S1 Filing

Shift from buyer relationships to adoption

It used to be the case that customers bought software with complex year-long implementations. Vendors considered used the complexity of the install as a way to get their customers “locked in” to their platform. Times have changed. Today, the most sticky software companies like Hubspot, Dropbox, Box and Slack focus on adoption, not complexity, to lock their customers in. This adoption can come in three different forms:

- Getting more users and business units on their platform so that the switching cost of permissioning new users and rolling out a new product/process grows higher

- Getting more “data” onto their platform, thus rendering trials of competing products harder because you can’t compare them directly

- Integrating with an increasing number of products in their customers’ stack

They measure the strength of their relationship based on how widely their platform is used inside a company. The goal is to become a layer of infrastructure embedded so widely and deeply that you cannot be undone). This is highly correlated to long term retention and a leading indicator of negative churn.

Shift from conversion to lifetime value

Early stage VC investors made this shift a long time ago. Comparing the customer lifetime value of two businesses gives you a better perspective on whose acquisition spend is truly effective.

This is called the CAC:LTV ratio, where CAC stands for Cost of Customer Acquisition and LTV stands for Life Time Value. It tells you more about where the business is going than the percent of marketing spend based on current revenue.

As companies grow and build more evidence around LTV, they can predict the ROI of marketing spend with higher confidence. The mistake most companies make is talking about investing in marketing for immediate “conversions” without backing it up with impact on long term LTV.

Shift from sales led to product led

One of the standout comparables for companies like Dropbox and Atlassian is their sales efficiency. These companies spend a lot more on research and product development than on sales & marketing.

- Dropbox spent 34% of their 2017 revenue on R&D

- Atlassian spent 37% of their 2017 revenue on R&D

It’s no surprise that these companies have some of the very best sales efficiency in B2B software. See this example from Atlassian below.

Source: Slide 80 of Atlassian investor presentation

This product-led approach creates what I call the R&D spiral.

Because they are spending more on building the better product, product-led companies have better sales efficiency. Because they have better sales efficiency, they can afford to invest more in R&D and launch improvements and new products that increases adoption and customer LTV even further.

Inside the R&D spiral is the best place to be in SaaS today. That’s why every product leader should read the Dropbox S1.

Sandhya Hegde

Former VP of Marketing, Amplitude

Sandhya Hegde is a former VP of Marketing at Amplitude, driving our strategy to help companies around the world build better products and win. A graduate from IIT Bombay and Stanford GSB, she is passionate about all things technology and business. Having been a startup founder, VC investor at Sequoia Capital, Khosla Ventures, as well as a product leader—she is an expert on how companies can craft product-led strategies for innovative disruption.

More from Sandhya