The 3 Axes of Mobile Growth

What are the components behind the increasing popularity of mobile?

“I don’t even check e-mail on my computer anymore.” While such a statement might seem typical of today’s high-powered executive, this remark was uttered by my college roommate in 2009. She was sprawled on the couch, intently tapping away on her fancy new iPhone 3G (of which I, still using T9 to send text messages on my dumb-phone, was incredibly jealous).

Back in 2009, this scenario was something relatively new — Internet users were just starting to transition from desktop/laptop computers to tiny 4-inch screens for everyday activities like checking email and Facebook. These days, it’s no surprise. Everyone knows that mobile usage is growing rapidly — that’s not news. The average American already spends at least 20% of their total media consumption time on mobile (based on data from Mary Meeker’s 2014 Internet Trends talk).

But what are the components behind the increasing popularity of mobile? How much growth can we expect, and how quickly? Is the personal computer soon to be relegated to the dustbin of history? It might sound a bit far-fetched right now, especially for computer programmers and other technical professions who won’t be ditching their desktops anytime soon, but personal computers may fall out of general use sooner than we think.

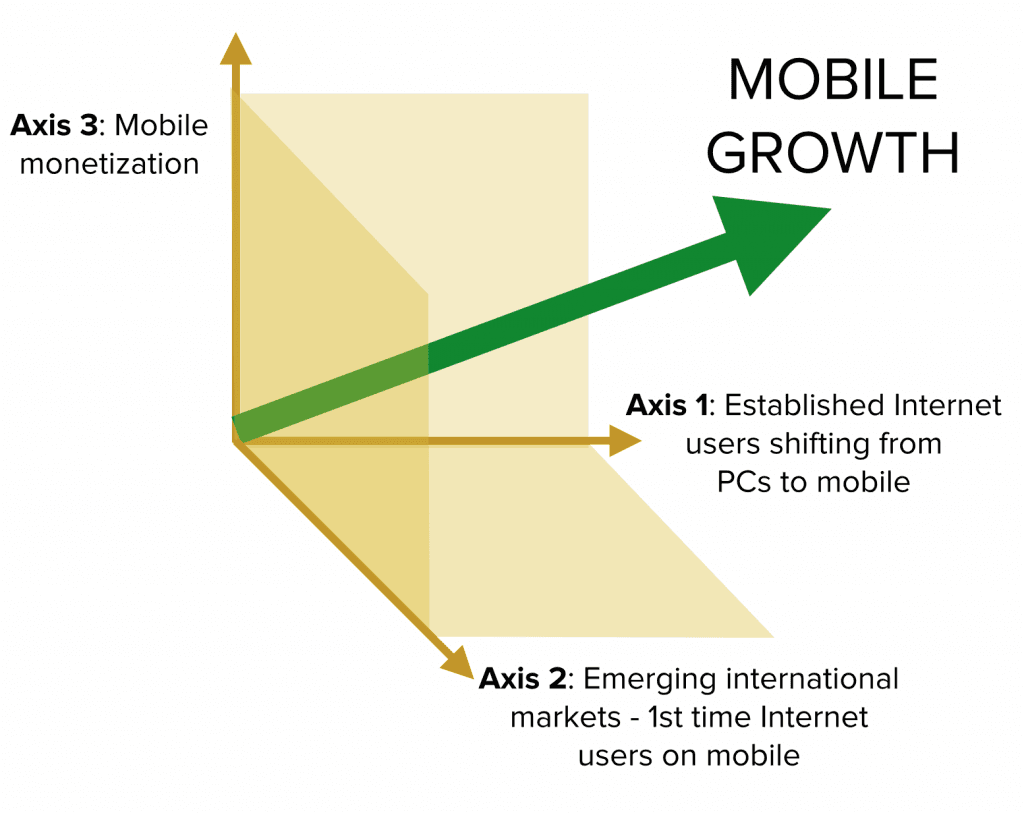

To find some answers, I dug into the data on mobile Internet usage globally over the past few years and discovered three major components, or axes, of the rapid mobile growth that we’re seeing today.

Axis 1: Internet users shifting from desktop/laptop to mobile

Customers in the United States are adopting smartphones and tablets at breakneck speeds. As these mobile devices become more ubiquitous, Internet users are spending increasing amounts of time on mobile instead of desktop.

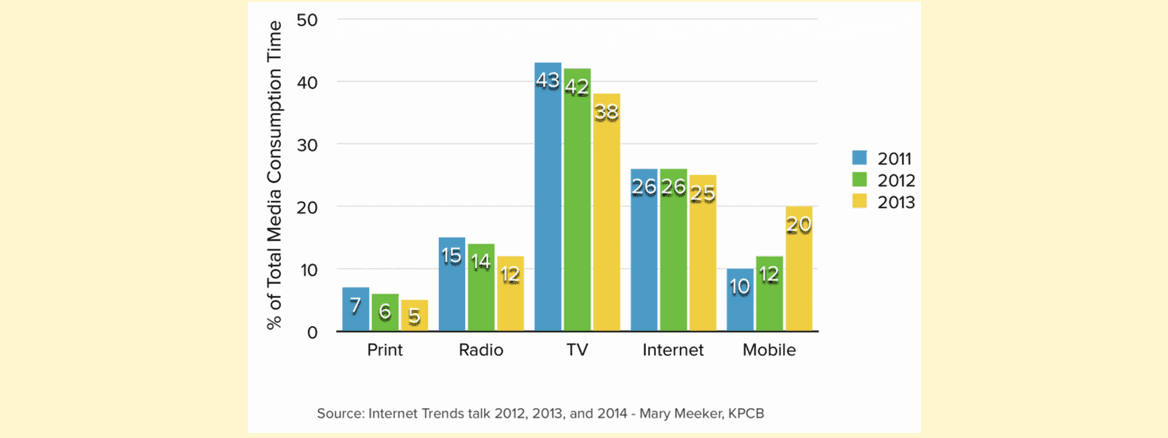

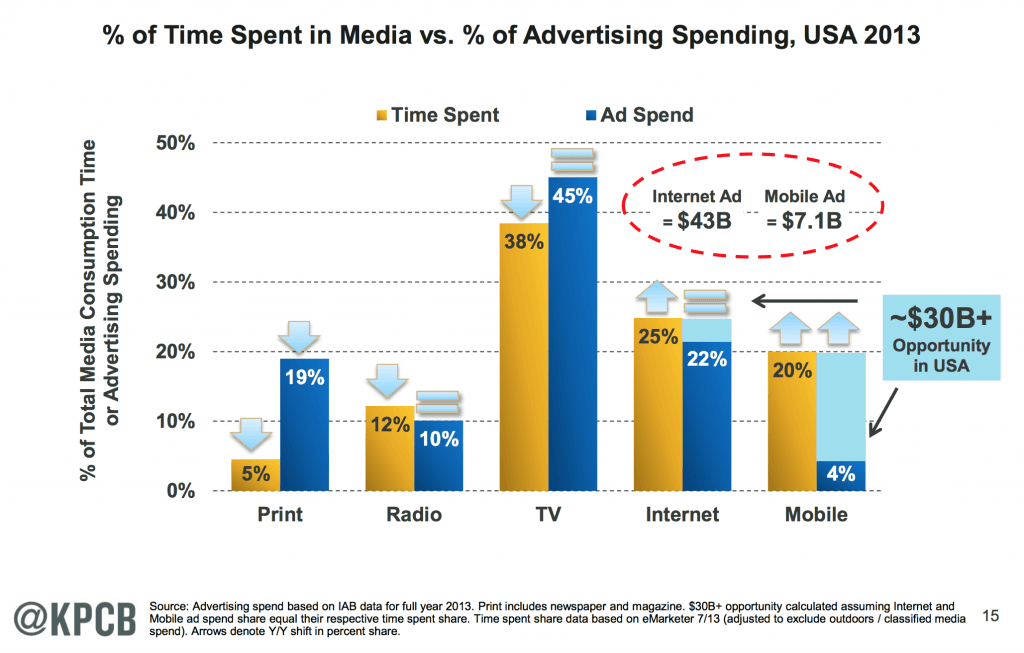

The graph below shows how the relative time-share that Americans spend on different media channels has changed just over the past few years. The portion of time that the U.S. population is spending on established media channels like print, radio, and even TV are declining, while the percent of time spent on mobile has doubled between 2011 and 2013.

Over the past 3 years, the proportion of time spent on print, radio, and even TV has steadily declined, while the percentage of time spent on mobile doubled from 2011-2013.There are no signs that this growth will slow down anytime soon — if anything, we’ll see mobile usage grow even faster.

Axis 2: Developing international markets

As the Internet becomes more accessible in developing markets in Asia and Africa, first time internet users are entering the market — and starting out on mobile.

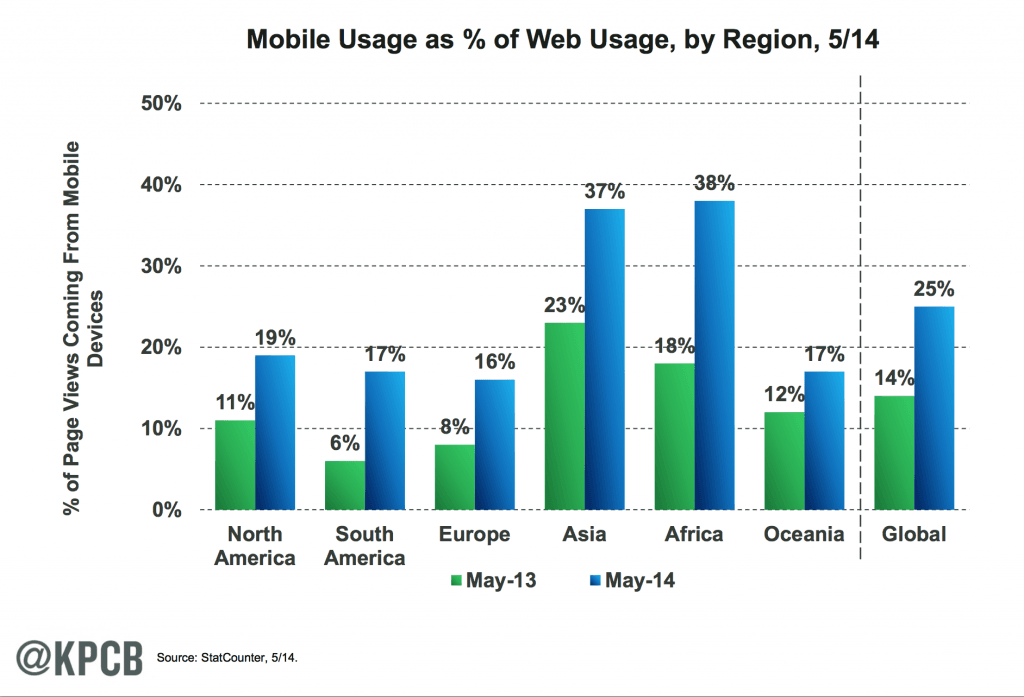

Globally, mobile Internet traffic is accounting for an increasing percentage of total Internet traffic. Between May 2013 and May 2014, mobile Internet traffic jumped from 14% to 25% of total Internet use. The share of mobile web traffic is particularly high in developing markets in Asia and Africa, accounting for almost 40% of Internet traffic.

Across the board, mobile usage is making up a larger percentage of overall web usage. This is particularly true in developing markets in Asia and Africa, in which some of these users are coming online for the first time — strictly on mobile. Globally, mobile web usage now makes up 25% of all web traffic. Source: Internet Trends 2014, Mary Meeker, KPCB

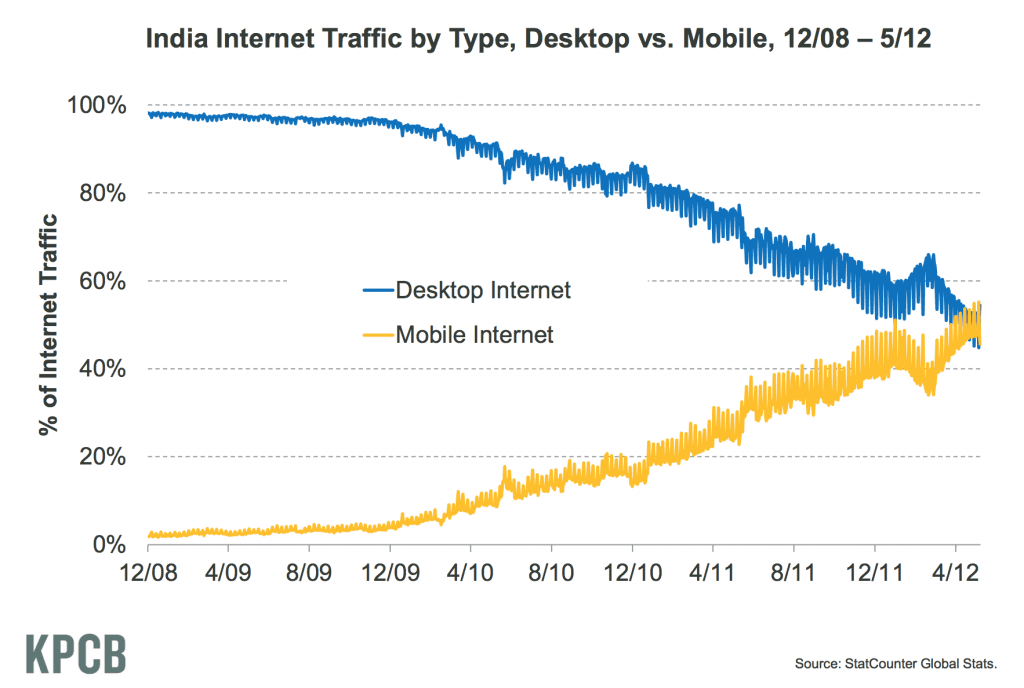

In fact, mobile internet traffic surpassed desktop internet usage in India in May 2012, according to Meeker’s 2012 report. In China, more users access the Internet from a mobile device than from a PC.

In May of 2012, mobile Internet traffic in India surpassed desktop Internet usage. Source: Internet Trends 2012, Mary Meeker, KPCB

Axis 3: Mobile monetization

While the first 2 axes we discussed had to do with increasing usage of mobile platforms, the third axis is about the opportunity for monetization on mobile platforms.

As we discussed in the first 2 axes, users in the U.S., as well as around the world, are spending increasing amounts of time on mobile devices.

Interestingly, the money has yet to follow. The percentage of advertising spending on print far outstrips the amount of time people are spending reading print media. Meanwhile, in 2013 only 4% of all ad spending in the United States went to mobile — just a paltry $7.1B compared to the $43B spent on Internet advertising. According to Meeker’s report, this leaves an opportunity of roughly $30B in mobile ad spending.

Ad spending has yet to catch up to the media channels that customers are flocking to. Spending on print ads grossly outstrips the amount of time people spend consuming print media, while there is an open opportunity of about $30B in ad spending in the United States alone. Source: Internet Trends 2014, Mary Meeker, KPCB

One more interesting data point:** revenue directly from mobile apps (ie paid apps and in-app purchases) still outweighs mobile ad revenue**, and has been rapidly growing over the past 5 years. As of 2013, direct mobile app revenue accounts for 68% of total mobile revenue (direct mobile app revenue + mobile ad revenue). Many users and developers find ads disruptive on a phone or tablet’s already limited real estate. To get around that, companies will need to come up with more innovative ways to monetize their mobile user base.

3 orthogonal axes

You may be wondering why I decided to call each component an ‘axis’ (or maybe you already guessed). After parsing out each component, it became clear that they could be thought of as 3 orthogonal axes, each contributing to the overall trend of mobile growth. With exponential growth along each of these 3 axes, mobile is poised for truly explosive growth — more than I was expecting anyway.

Soon enough, mobile usage will surpass desktop Internet usage globally, as it already has in some parts of the world. For the general population, computers are largely used for activities like checking e-mail, accessing social media, and streaming video — if you can do all of that from your phone or tablet, why bother with the computer at all? Within a few years, the refrain may be: “I don’t even use my computer anymore.”

Alicia Shiu

Former Growth Product Manager, Amplitude

Alicia is a former Growth Product Manager at Amplitude, where she worked on projects and experiments spanning top of funnel, website optimization, and the new user experience. Prior to Amplitude, she worked on biomedical & neuroscience research (running very different experiments) at Stanford.

More from Alicia