Leading vs. Lagging Indicators: How to Identify and Map Your Metrics

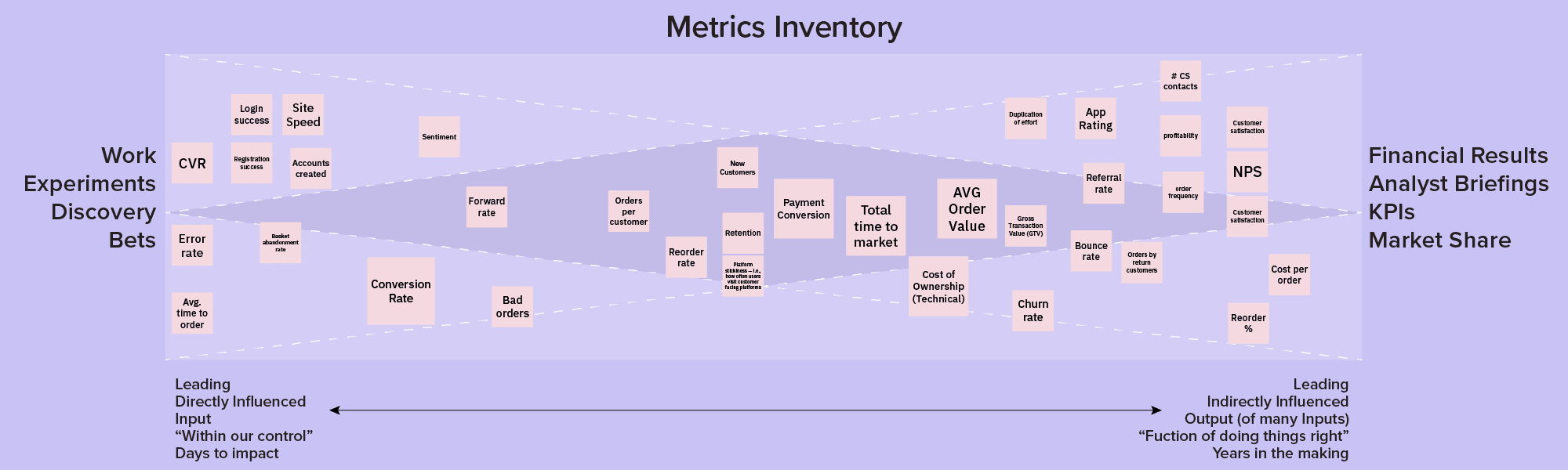

Use this metrics inventory to help your team better understand leading and lagging indicators.

You’re probably familiar with leading and lagging indicators. Leading metrics suggest what will happen in the future; lagging metrics reflect the results you’ve achieved.

The concept of leading and lagging indicators isn’t new. However, few have reflected and worked through the leading and lagging indicators most relevant to their organization.

So, how do you ensure your team understands the two types of indicators and how they interact?

This metrics inventory activity can refresh and refine your team's understanding of leading and lagging indicators and help you plot your product's inputs and outputs on a leading and lagging scale.

The relationship between leading and lagging indicators is a critical component of the North Star Framework, a product management model based on a single North Star Metric, which best captures the value customers derive from your product. The North Star Metric is a leading indicator that defines the relationship between the customer problems your product team is trying to solve and sustainable, long-term business results. So, this activity is an excellent warm-up before diving into defining your North Star Metric. (Check out our full series of North Star resources for more on the topic).

Key takeaways

- Many people understand leading and lagging indicators, but most don’t know how they interact within their organization.

- Leading indicators are easier to impact, and product teams can move these metrics quickly.

- Lagging indicators reflect your achievements, but your product team typically can’t directly impact them.

- The North Star Metric and its inputs aren’t entirely leading or lagging—they fall at different places in the middle of the spectrum.

- Before defining your North Star Metric, expand your team’s understanding of leading and lagging indicators and their nuances with the metrics inventory activity.

Leading vs. lagging indicators defined

Leading indicators predict what will happen in the immediate future. They’re close to your product organization’s day-to-day work, and your team can directly impact them. And while they’re usually relatively easy to influence, they don’t guarantee a specific outcome.

In contrast, lagging indicators tell you what has happened, but they take longer to impact. They’re typically further away from your product team’s daily work—they can affect them indirectly and take longer to move.

Leading and lagging indicators aren’t binary. They sit on a spectrum. At one end are the leading indicators: things within a product team’s control that they can impact within days. They’re the work, experiments, and bets the team makes. Think of things like site speed.

At the other end are most lagging indicators. These items might take years to impact, and they’re usually the result of many different inputs. There’s a chain of work that ladders up to these lagging indicators. Think customer satisfaction and financial outcomes.

For instance, annual revenue is a lagging indicator. By the time you know what your annual revenue is, it’s too late to do anything to change it. Your lagging indicators give you information you can use to make long-term decisions.

Metrics like “time in app” and “number of free trial signups” are leading indicators. If people spend longer in your app and benefit from it, that’s a positive sign that more people will upgrade to your premium plan. That, in turn, would increase your revenue.

But it doesn’t guarantee a revenue outcome.

Some metrics can also be both leading and lagging. Where different metrics fall on the spectrum depends on your organization and business model. In the North Star Framework, your North Star Metric and its inputs should fall somewhere around the middle of the leading/lagging scale.

The spectrum of leading to lagging indicators

Why leading and lagging metrics matter in the North Star Framework

There’s often a disconnect between a product team’s work and the rest of the organization. They’re aware of seemingly distant lagging metrics and high-level usage metrics—like active users—but lack in-depth knowledge. The result? Your product team focuses on product development without clearly understanding how it impacts your organization's high-level goals.

The North Star Framework can help you fill in that gap. With the framework, your team knows what they're working on and how that work affects higher-level metrics. Additionally, running a Bet Up activity is one way to connect the dots between day-to-day work and big organizational goals.

The North Star Metric shouldn’t be exclusively lagging or leading, so your team needs a nuanced understanding of the entire spectrum to define it. It’s helpful if the North Star Metric is slightly out of reach. Your product team will have to move a set of different metrics—the North Star Metric inputs—to affect it.

However, the North Star Metric needs to be actionable. It’s best if your team feels they can affect the metric through product work. For instance, something like “average revenue per user” is likely too abstract and doesn't offer your product team a basis for taking action.

Without a clear understanding of leading and lagging metrics, your team might struggle to connect their product work to broader goals. And if that happens, you risk tracking and focusing on vanity metrics that are isolated from the rest of the organization.

Case study: Spotify’s North Star

Let’s imagine that Spotify’s entire organization focuses on increasing monthly recurring revenue (MRR). That’s a lagging metric and arguably at the most extreme end of the spectrum, making it abstract to individual team members.

But what about “time spent listening” as a North Star Metric?

While MRR sits on one extreme of the leading and lagging spectrum, the product team's daily work sits on the other. Metrics like “sessions per day” and “time per session” are leading indicators and only one step away from the team's feature-building work. They are the inputs to the North Star Metric.

Let’s say, for instance, they’re working on a new recommendations feature to encourage listeners to return more often and spend more time on the app. If the team can improve the recommendation feature, that should help to increase “sessions per day” and “time per session.” Those drivers, in turn, help to increase “time spent listening”—the North Star Metric.

Using the metrics inventory activity

To inventory your organization’s metrics, get your team to identify and sort the metrics you’re currently tracking and map them on the spectrum. Use a blank version of the metrics inventory template.

Start with a blank metrics inventory.

Ask people to suggest metrics, starting with the most leading and lagging indicators, and add them to the board.

For example, imagine you’re an ecommerce brand.

Question 1: What are some of your lagging indicators?

You might add metrics like net promoter score (NPS), reorder percentage, and revenue to the lagging side.

Question 2: What are some leading indicators?

These should be things your team is directly working to impact, like error rate, load speed, or average time to order.

Once you have your extremes for each on the inventory, get the team to trace the steps from leading to lagging, adding indicators on the way.

Question 3: What do those leading indicators impact?

Let's say we reduce our error rate, load our app faster, and accelerate checkout. That should help increase our conversion rate, number of orders per customer, and number of mobile orders delivered.

As you plot these indicators across the spectrum, encourage team discussion. Discussing the indicators in detail will help them better understand where different indicators fall on the spectrum.

Choose the right combination of metrics

This activity might challenge your team if they aren’t already tracking the right metrics. But that’s OK. We can help—whether you want to improve acquisition, retention, or monetization.

We have a few helpful resources that might guide you on the next steps:

For a general guide on what metrics you should track and how to track them, check out the Amplitude Guide to Product Metrics.

If your company doesn't already have a leading indicator North Star Metric defined—it's one of the most valuable exercises your team can accomplish for your long-term growth results.

Get your copy of our comprehensive North Star Playbook today, which will guide your team through the North Star Framework and help you discover your North Star Metric.

Rachel Torres

Former Group Product Marketing Manager, Amplitude

Rachel Torres is a former product marketing manager at Amplitude, focusing on go-to-market solutions for enterprise customers. Before Amplitude, she served as a strategic marketing consultant to early-stage startups, including DataGrail, ConductorOne, and Elevate Security. In her free time, she enjoys ballet, Beyoncé, and library books.

More from Rachel