Setting Good Product Management KPIs (B2B and B2C)

Learn about product management KPIs that help you track financial performance, user growth, customer engagement, and customer satisfaction.

Originally Published on May 27, 2022

Browse by category

Product management KPIs are metrics that help you track your product’s performance and understand how your users are interacting with your product. They give you a picture of how successful your product is in the marketplace.

Key takeaways

- Choosing the right product KPIs is a step-by-step process that starts with defining your business goals, deciding the indicators of success for those goals, then determining the metrics which help address those goals.

- Avoid vanity metrics and be mindful of how many key performance indicators are tracked and why.

- There are several KPIs you can choose that help you measure product success. Here are some product KPI examples:

| KPIs for measuring financial success | KPIs for measuring user growth | KPIs for measuring user engagement | KPIs for measuring customer satisfaction |

| Monthly recurring revenue (MRR) | Daily/monthly active user ratio (DAU/MAU ratio) | Retention rate | Net promoter score (NPS) |

| Average revenue per user (ARPU) | Session duration | Churn rate | Customer satisfaction score (CSAT) |

| Customer lifetime value (CLV) | Traffic | Number of sessions per user | Customer effort score (CES) |

How to choose the right metrics for your business

It’s important to choose product metrics that are right for your specific product. This means that your choice should depend on where your product is in its lifecycle, the type of product you have, and the size of your company. For instance, an early-stage product that’s trying to find product-market fit might be focused on the number of transactions, while a mature product might be focused on the engagement it’s driving. The metrics you choose need to link back to your organization’s top-level goals and business results, so they fit into the big picture.

Choosing the right product management metrics is a step-by-step process:

- Define your business and product-specific goals.

- Decide what the indicators of success for those goals are.

- Develop or pick KPIs that address the chosen business and product goals.

The chosen product management KPI could be a percentage, a number, a cumulative figure, a comparison, or a rate. For instance, if you’re a mobile gaming app, a business goal might be to ensure your new users are engaged while playing your game. A good KPI to measure that would be the number of in-app purchases a users makes because that shows that they are interested in playing the game at a higher level.

Avoid choosing vanity metrics that don’t make a real difference to your business results and only look good superficially. For example, the number of likes on your Facebook page would not be a good product management KPI because it does not make any difference to your business results.

Be mindful of how many product KPIs you choose to track and why. Don’t just track KPIs because you can track them because that might lead to information or metric overload and you risk getting lost in unhelpful data.

KPIs for forecasting financial success

These product KPIs are helpful in understanding the overall financial health of the product. They point to how much money the product generates. Some important metrics that help in forecasting financial performance include:

Monthly recurring revenue (MRR)

This is the product revenue that repeats every month. The higher this number is, the more stable your product revenue will be since the money is added to the business on a regular basis.

How is it calculated?

Average revenue per customer × Total number of active customers = Monthly recurring revenue

So, if you have 100 customers paying you $10/month on average, your MRR is $1,000. If your customers sign up for an annual subscription, divide the annual subscription amount by 12 to arrive at the average revenue per customer per month, before using the formula.

How is it helpful?

MRR is useful for subscription-based businesses like a B2B SaaS company or a B2C music streaming app like Spotify because it helps gauge revenue stability. It shows if your business or product is growing or shrinking over a period of time. It helps calculate cash flow each month and also forecast future cash flow using a historical growth rate to assess whether you can build a sustainable business in the long term.

Average revenue per user (ARPU)

This is the revenue generated from each active customer or user. Typically, companies calculate this on a monthly basis, but it can also be on a yearly or quarterly basis.

How is it calculated?

Total revenue of the product / Total number of active customers or users = ARPU

How is it helpful?

ARPU helps you understand revenue on a more granular, individual customer level for both B2B and B2C businesses. It also helps you assess the scalability of your business. If you have a low ARPU with high customer support and customer acquisition costs (CAC), that means it costs you more to support and acquire each customer than the amount of revenue they generate, which will impede your ability to scale. On the other hand, a high ARPU combined with low customer support and acquisition costs will enable you to scale your business rapidly.

Customer lifetime value (CLV)

Customer lifetime value is the total revenue a business generates from one customer account over the customer’s entire time with the business. Say a customer stays with the business for five years and contributes $10,000 per year to the business. This makes their CLV $50,000.

How is it calculated?

It’s easy to calculate CLV after a customer leaves your business by simply adding up all the revenue generated from that customer during their entire time with the business.

To estimate CLV for customers who are new to your business or have been with your business for a while, you can use the formula below:

Average purchase value × Average number of purchases × Average customer lifespan = CLV

Calculate these figures based on historical data available for your customers.

How is it helpful?

The longer a customer transacts with your company, the higher their lifetime value will be and the more revenue your business will earn. If the CLV is high, that means your customers are loyal to your product. If the CLV is low, it could mean you aren’t retaining customers successfully, which is an opportunity for you to find product improvements that will help reduce churn.

KPIs for measuring user growth

For your product to grow, your user base must grow sustainably and incrementally. Your users should feel engaged and wanting to repeat business with you. Some key metrics for measuring user growth include:

Daily/monthly active user ratio (DAU/MAU ratio)

The DAU/MAU ratio tells you what percentage of your users are daily active users, when compared to your monthly active users. It’s important to define what active means to your business, whether it means that a user simply logs into an app or performs other important actions like making downloads or purchases.

How to calculate it?

Number of Daily Active Users / Number of Monthly Active Users = DAU/MAU ratio, expressed as a percentage

For example, if you have 100 daily active users and 500 monthly active users, your DAU/MAU ratio is 20%, which means that 20% of monthly users are actively using your product on a daily basis.

How does it help?

Not every product needs to be used on a daily basis, which is why this metric is more useful for products that need to be used on a daily basis to be considered successful (e.g., a social media platform). This metric helps you determine how sticky your product is, which is useful for B2C startups in particular. If people are dropping off and the number of daily active users declines, look into developing new features that keep users coming back.

Session duration

This is the amount of time users spend on a product, from the time they launched it to the time they left it. It tells you how long users use your product, or more specifically, the duration of use.

How to calculate it?

Time user left your product or became inactive – Time product was launched = Session Duration

How does it help?

Session duration can tell you how engaged users are while using your product. The longer the session duration, the more time they spend on your product, and the more engaged they are. You can also determine if they’re staying long enough to complete critical events in your product.

Traffic

This is the number of visitors your website or app receives. Visitors can come from a variety of sources. For example, they can come organically through search engines, through paid mediums like ads or paid social, or through referrals from other websites.

How to calculate it?

There is no formula for traffic because it’s a number collected by your analytics tool. Your analytics tool counts how many visitors your product attracts and reports it as a metric on its dashboard.

How does it help?

Traffic numbers help determine which marketing channels are most effective in generating traffic. Your analytics dashboard will show you the traffic from different sources, so you can determine where to invest your time and money to generate the most traffic. Generally, the larger the traffic numbers are, the more people you have visiting your product, which optimizes the chances of success. Be wary of relying too heavily on traffic though because it can often turn into a vanity metric.

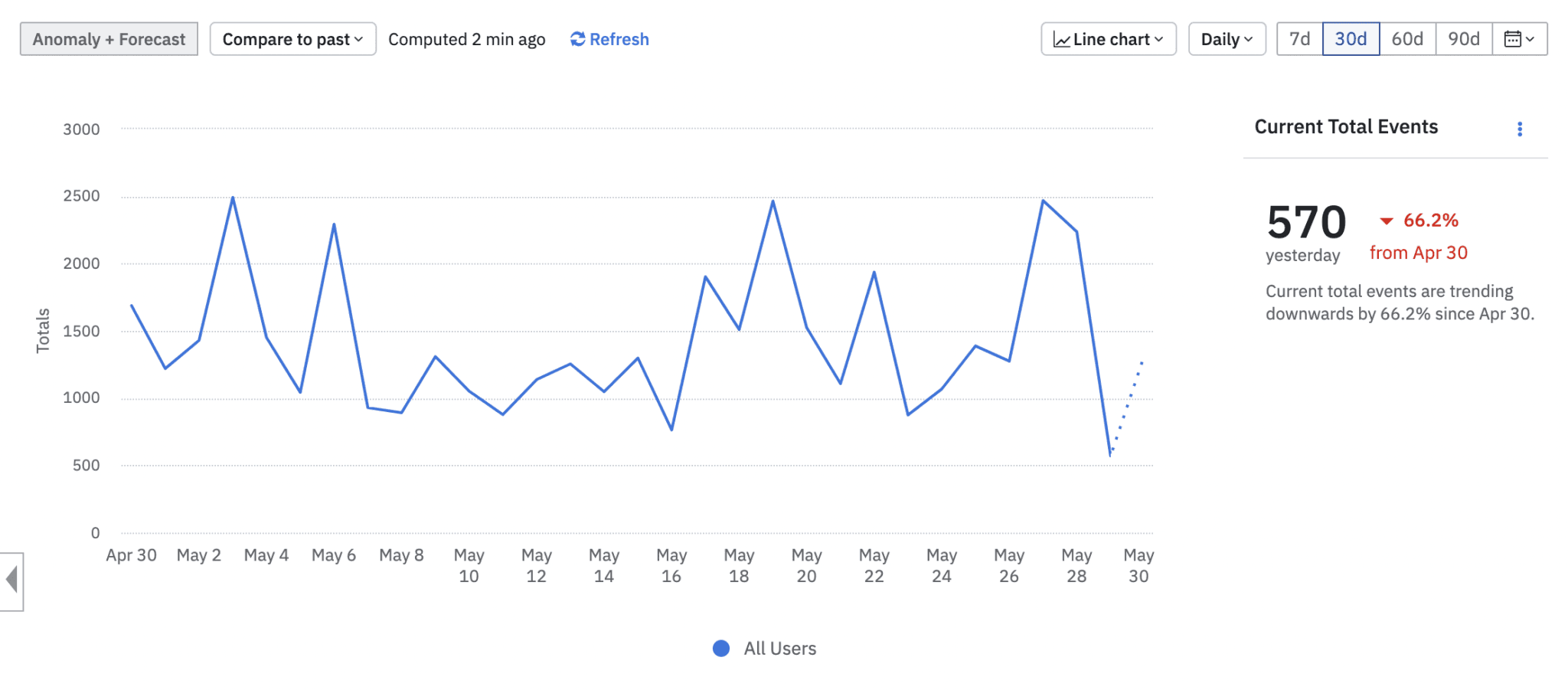

An Event Segmentation chart showing web traffic using Amplitude Analytics.

KPIs for customer engagement

It’s important users feel engaged while using your product, so they feel like doing business with you in the future. Some KPIs to measure whether your customers are engaged include:

Retention rate

Retention rate is a measure of how many customers stay with your business for the long term. It’s what demonstrates your business’ ability to stimulate customers to make repeat purchases and spend more money on your product over time.

How is it calculated?

[(E – N)/S] × 100, where E is the number of customers at the end of a time period, N is the number of new customers gained within the same time period, and S is the number of customers at the beginning of the time period. Here are three additional ways you can visualize and measure user retention.

How does it help?

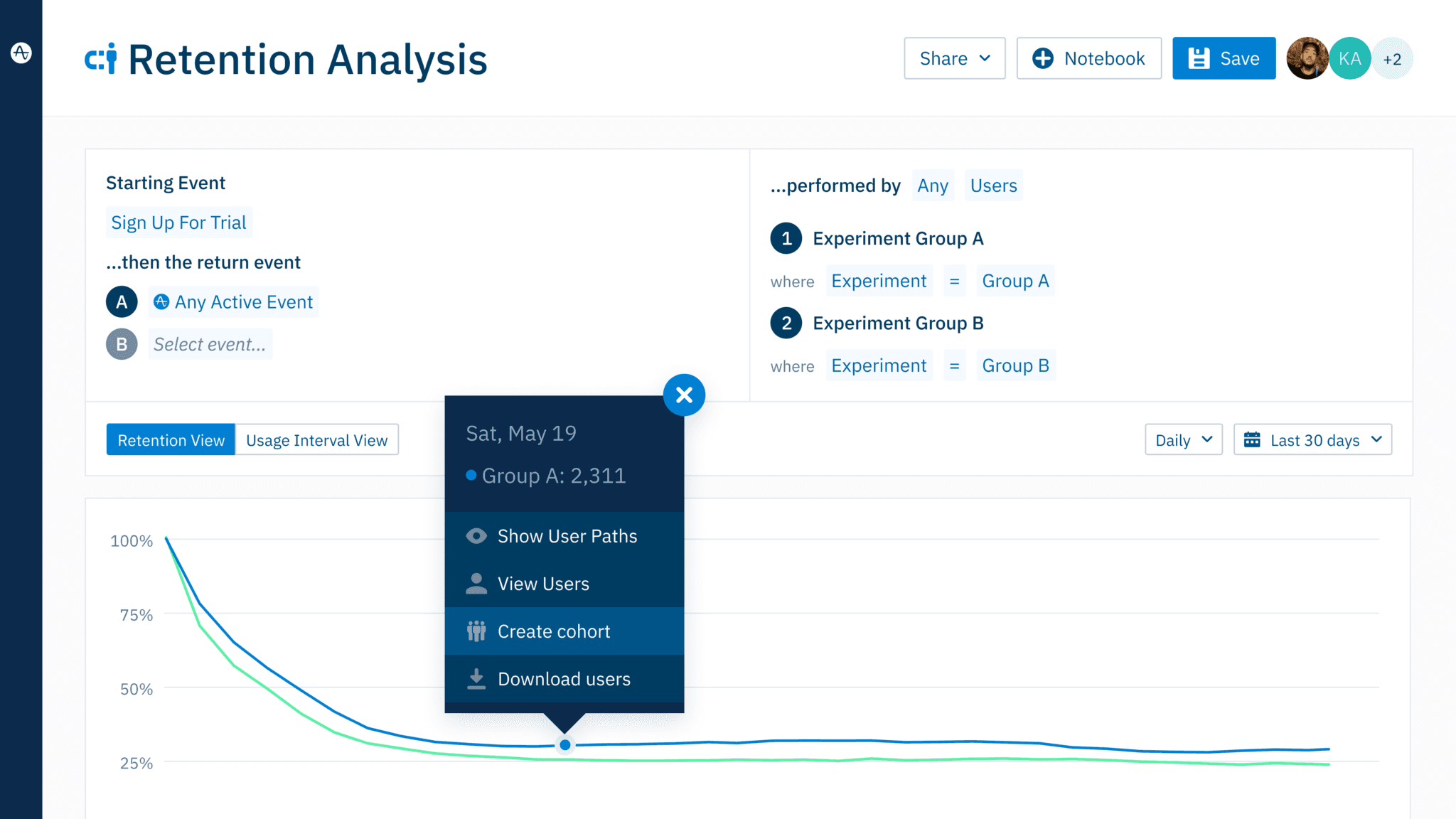

This metric is an indicator of engagement and stickiness, as you can only retain customers who find enough value in your product to keep using it. Conversely, you’ll easily lose customers who feel bored using your product. It’s particularly helpful to analyze customer retention by cohorts to better understand user behavior. You’ll be able to figure out which groups of customers are feeling engaged, which ones aren’t, and why.

A Retention Analysis chart showing customer retention using Amplitude Analytics.

Churn rate

Customer churn rate is the percentage of customers who stop doing business with the company over a specific time period. It’s basically the inverse of the customer retention rate. The churn rate is important because it helps you understand how effectively you’re able to retain customers.

How is it calculated?

[Y/X] × 100, where Y is the number of customers lost during that time period and X is the number of customers at the start of the time period. You can use a churn analysis to help improve customer retention.

How does it help?

If many customers leave after trying your product, you may have issues with usability, customer experience, price, or product-market fit. A high churn rate, especially one that’s compounding, indicates that you need to pay close attention to your customer retention strategies.

Number of sessions per user

A session is when a user engages with your website or product over a given time period, usually starting with a website visit or app login. The number of sessions per user tells you whether users want to use your product repeatedly. If people have multiple sessions with your product on a single day, that’s an indicator that they want to keep coming back to it.

How is it calculated?

Total number of sessions / Total number of users = Number of sessions per user

How does it help?

A higher number of sessions per user indicates that the user is highly engaged with the product. On the other hand, if the number of sessions per user is low, you might need to explore feature development ideas to keep users coming back and better meet their needs. Be careful of focusing too much on this metric without understanding how many sessions actually make sense for your product. Some products are meant to be used frequently, whereas others are not, and you need to determine your product usage interval to know where your product falls.

KPIs for measuring customer satisfaction

The KPIs below have traditionally been the standard in determining how satisfied your customers are with your product. Now, most executives consider real-time engagement with their digital products to be more indicative of how customers feel.

Net promoter score (NPS)

NPS is a score that tells you how many of your customers are likely to recommend your product or service to someone else. It’s a tool for measuring customer loyalty and how popular your product or service is among your customers.

How is it calculated?

NPS is a score that’s generated when customers pick a number on a scale of one to ten while rating how likely they are to recommend your product to someone else. This is done via NPS surveys.

To calculate NPS, you can subtract the percentage of detractors from the percentage of promoters, using this formula: NPS = % promoters – % detractors.

How does it help?

A low NPS means your customers aren’t likely to recommend your product to someone else and signals a low rate of customer satisfaction, posing a risk to your business. Knowing this score might help you predict churn even before it happens so you can take proactive actions to prevent it.

Customer satisfaction score (CSAT)

CSAT is a score that measures the level of satisfaction customers receive from your product or service. Customers are requested to complete a survey asking for a rating after they’ve engaged with your product over some time. For instance, they could be asked to rate the level of satisfaction derived from your product on a scale of 1 to 5, with 1 being dissatisfied and 5 being completely satisfied.

How is it calculated?

CSAT is the percentage of all the CSAT survey responses you receive which are positive.

(Number of positive responses / Total number of responses) × 100 = CSAT, expressed as a percentage

For example, if you receive 200 positive responses out of 400 total responses, the CSAT score would be 50% because 200/400 × 100 = 50%

How does it help?

This metric is useful for tracking the product experience. Products should provide user friendly experiences, and a high CSAT score means users are satisfied. A low score, on the other hand, could provide a great opportunity to discover why customers are feeling dissatisfied and point out the areas for improvement in the product or service being provided to the customer.

Customer effort score (CES)

This score helps to determine how easy it was for customers to use your product or service.

How is it calculated?

It’s calculated by asking customers to complete a survey where they answer questions like “How easy was it to solve your problem?” or by asking them to rate the level of effort needed to use your product on a scale of 1 to 10.

The formula is: Total sum of customer effort survey scores/Number of survey responses = CES

How does it help?

CES helps you know if your product is user-friendly so you can make important product decisions regarding customer experience. If your CES is good and CSAT is high, it indicates that you’re making the product experience convenient for customers. A low CES score coupled with a lower CSAT suggests there’s room for improvement to make the experience easier.

Learn more about the 15 most important product metrics you should track to boost engagement, retention, and revenue with The Amplitude Guide to Product Metrics.

References

- Customer Effort Score (CES). Gecko Board

- Customer Satisfaction (CSAT). Gecko Board

- The Amplitude Guide to Customer Retention: 40+ Resources to Increase Retention. Amplitude

- What is customer retention? 11 examples and strategies to retain customers. Zendesk

- DAU/MAU Ratio. Gecko Board

- Metrics Quotes. Good Reads

Wil Pong

Former Head of Product, Experiment, Amplitude

Wil Pong is the former head of product for Amplitude Experiment. Previously, he was the director of product for the Box Developer Platform and product lead for the LinkedIn Talent Hub.

More from Wil