Customer Acquisition Cost Formula: Boost Business Performance

Learn key formulas and tips to boost business performance.

Originally published on September 30, 2022

Browse by category

Customer acquisition cost (CAC) measures how much businesses spend to attract new customers. CAC is a critical business metric for determining the resources to acquire and onboard new customers, and it helps assess your company’s overall health and profitability. A CAC formula calculates the total cost of acquiring a new customer by dividing the marketing and sales costs by the number of new customers gained.

Key takeaways

- Customer acquisition cost (CAC) measures how much businesses spend to attract new customers, helping determine the efficiency and ROI of acquisition strategies.

- Different CAC formulas—like basic, fully loaded, and paid CAC—are useful depending on the depth and specificity of the cost analysis needed.

- CAC enables you to improve business performance by comparing CAC to LTV, calculating payback periods, and analyzing different marketing channels.

- Strategies that help improve CAC include optimizing website conversions, focusing on organic channels, increasing customer value, and automating marketing.

What is CAC?

CAC stands for customer acquisition cost and refers to the total cost of resources and efforts a business allocates to acquiring new paying customers. It compares the amount of money companies spend on acquiring new customers over a specified period against the number of customers they acquire.

Calculating CAC is important for determining your customer acquisition strategies' ROI and overall efficiency. Businesses become profitable and scalable once they learn to grow their customer base while keeping their CAC low.

How to calculate customer acquisition cost

There are multiple ways to measure and interpret CAC, so it’s important to understand which formula best serves your company’s needs.

Basic customer acquisition cost formula

To calculate CAC, divide marketing and sales expenses incurred over a certain period (e.g., a month, a quarter, or a year) by the number of customers the business gained in that period. Use this basic formula for a quick and straightforward assessment of your marketing and sales efficiency. It’s especially suitable for small businesses or startups with straightforward cost structures.

CAC = Marketing and Sales Expenses / Number of New Customers

For example, Company A spent $1,000 over one month on its sales and marketing efforts and acquired 25 new customers during that month. In this case, CAC = $1000 / 25 = $40 per customer. From this simple calculation, Company A learns that it spends $40 on average to obtain a new customer.

The general CAC formula accounts for two main spending categories—marketing and sales. These are the data points that usually go into calculating CAC:

- Ad spend: The money businesses pay for advertising campaigns, including ad placement expenses and agency fees.

- Sales and marketing employee salaries: The costs of employing sales and marketing professionals.

- Content and creative services: Internal creative team salaries or outsourced creative agency fees for design, content creation, copywriting, and editing.

- Sales and marketing tech stack: The cost of buying and maintaining the technology your marketing and sales teams use to acquire new customers. This includes CRMs and tools for email marketing, marketing automation, website management, reporting, and more.

- Production costs: The money spent on physically creating content. For example, companies rent a studio and purchase video and audio equipment to create a video that attracts new customers.

- Product costs: The costs incurred to maintain and improve products, including employee salaries and technology costs. For example, a SaaS company may need to update its software to optimize the customer experience.

The fully loaded CAC formula

The fully loaded CAC formula measures every cost of your company’s customer acquisition efforts. Use this formula to comprehensively understand all costs associated with acquiring new customers.

Fully Loaded CAC = All Costs Associated with Customer Acquisition / Number of New Customers

In addition to typical marketing and sales expenses, fully loaded-costs include:

- Overhead costs like desk space or office rent for sales and marketing employees

- Costs of legal services to create contracts for sales and marketing teams

- Special offers and discounts for new customers

This comprehensive approach to measuring CAC may be excessive for marketers, but the fully loaded CAC formula indicates how much your businesses can scale. That’s why it works well for investors and founders raising capital.

The paid CAC formula

Paid CAC is a more specific performance metric that evaluates the effectiveness of paid channels by excluding salaries and overhead expenses from the calculation. It’s useful for performance marketing teams focusing on optimizing ad spend.

Paid CAC = Marketing and Sales Expenses (Without Salaries and Overhead Costs) / Number of New Customers Gained via Paid Channels

To get the paid CAC calculation right, companies define the attribution rules for paid channels. Digital analytics tools like Amplitude enable marketers and product managers to attribute conversions across channels to the right touch points in the customer’s journey.

For instance, if a customer visits your company website after viewing a Google search ad and then a Facebook banner ad, Amplitude can assign credit for that visit to multiple touchpoints using multi-touch attribution. In this case, Google and Facebook each receive credit for the visit.

How to use CAC to improve business performance: Three use cases

Understanding your customer acquisition cost can help you improve business performance. Here are three practical ways to do this:

1. Determine if customer costs are worth the investment

To understand if CAC is worth the investment, compare it to lifetime value (LTV). CAC represents the costs companies spend to acquire new customers, while LTV measures the total revenue a customer generates during their relationship with your business.

Calculate LTV

To calculate LTV, use the following formula:

LTV = Average Value of Sale * Number of Transactions * Retention Period

Suppose you predict Customer A will purchase your product worth $1,000 twice a year over a five-year relationship with your business. The LTV of Customer A is: $1,000 * 2 transactions * 5 years = $10,000. If you have a SaaS product with recurring revenue, you can calculate SaaS LTV using a similar formula.

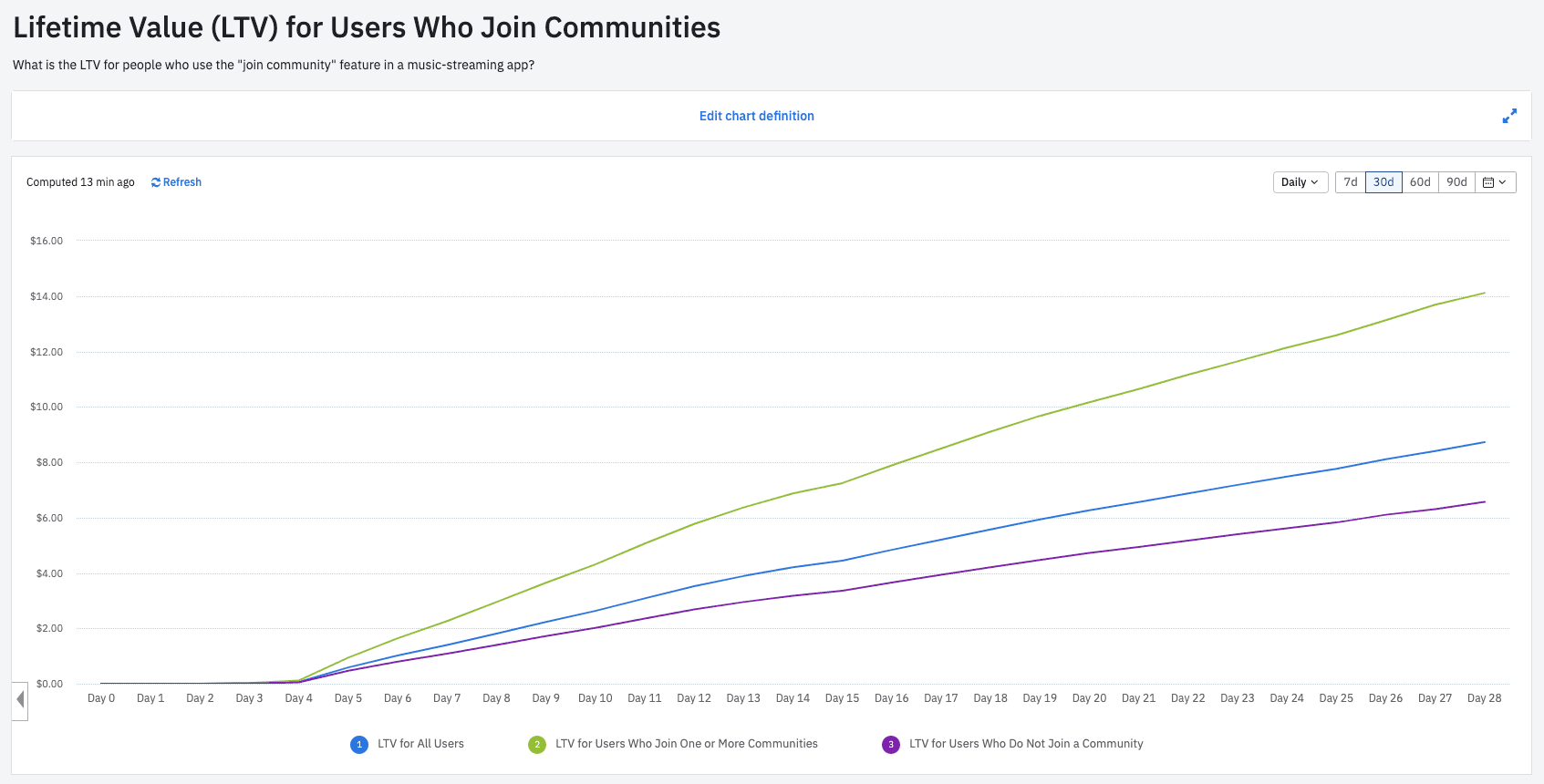

Calculating each customer’s LTV manually is time-intensive and complex. To simplify this process, Amplitude offers a Revenue LTV Chart that measures each customer’s revenue over time and tracks how well companies monetize new users. You can also use this chart to identify which product features correlate with higher LTV.

The Revenue LTV chart above shows the LTV for users who join a community in a hypothetical music-streaming app. The LTV for those who use this feature and join a community (green) is higher than that of those who do not (purple).

Explore this chart yourself by getting started with Amplitude for free.

Compare CAC to LTV

By comparing CAC to LTV, you can assess if your customer acquisition strategies are profitable. A 3:1 ratio is a common benchmark, meaning you gain three dollars in revenue for every dollar spent on acquiring a customer. Ratios below 3:1 suggest excessive spending on acquisition or poor customer retention, while ratios above 5:1 indicate you can spend more on sales and marketing to boost growth.

Need to improve your LTV/CAC ratio? Read our post on increasing customer LTV.

2. Assess financial health with the CAC payback model

The CAC payback period determines how long it takes to earn back the costs of acquiring new customers. Knowing this period enables businesses to plan their financial strategies and evaluate the efficiency of their marketing spending.

To calculate the CAC payback period, divide the CAC per customer by the monthly revenue per customer.

Payback Period = CAC / Monthly Revenue

For example, if you run a subscription business where customers pay $50/month and your CAC is $500 per customer, the payback period is 10 months. In other words, it takes 10 months for you to break even and profit from each new customer. Based on the payback period, you might adjust your acquisition strategies or increase your subscription price to improve profitability.

3. Improve marketing efforts by comparing CAC across channels

To maximize your marketing budget, compare the CAC across different marketing channels. This analysis helps identify the most cost-effective channels so you can allocate your budget to those with the highest return on investment.

If your social media campaigns have a CAC of $50 per customer, while paid search ads have a CAC of $100 per customer, and both channels bring in 1,000 new customers monthly, social media is more cost-effective. By investing more in social media, you can acquire the same number of customers at half the cost.

Five ways to improve CAC

After performing the CAC calculation, you may realize that your customer acquisition cost is too high, negatively affecting your overall profitability. Let’s think about the two inputs to the CAC formula—the number of new customers and the total marketing and sales costs. That means there are two levers you can pull to improve CAC:

- Increase the number of new customers

- Reduce the sales and marketing expenses associated with acquiring those customers

Sounds simple, right? But it’s important to remember that customer acquisition involves an entire end-to-end process, from lead generation to lead acquisition to lead conversion. Here are five actionable tips to help you make customer acquisition more efficient.

1. Know your target audience

Every effective customer acquisition strategy starts with customer segmentation to identify your target audience, create detailed buyer personas, and establish your ideal customer profile (ICP).

Use cohort analysis to create customer segments that fit your ICP. A cohort represents a group of users with similar traits or behaviors. Behavioral cohorts group users into segments based on their actions throughout their customer journey. For instance, you might find that customers acquired through your newsletter convert better than those acquired from social media, then optimize your acquisition strategy accordingly.

Focusing on customer segments most likely to become high-LTV customers ensures that you concentrate your efforts and resources on the right audience. It also helps avoid situations where you allocate your budget to ineffective channels and activities that increase customer acquisition costs.

2. Optimize website conversions

To ensure a site visitor transitions into a paying customer, invest in conversion rate optimization (CRO). CRO aims to increase the proportion of customers who perform a desired action on your website. CRO practices include:

- Improving site speed

- Optimizing your website for mobile users

- Improving landing page copy and layout

- Running A/B tests to enhance CTA flows throughout your website

- Reducing shopping cart abandonment through ecommerce analytics

CRO can significantly affect CAC—the better you optimize your website for conversions, the more paying customers your businesses will acquire.

Data-backed website decision-making

The Amplitude team uses funnel analysis in the Amplitude platform to identify friction points on the Amplitude site and test out design improvements. Product Manager Katie Geer explains that, through analysis, the team discovered that the video in the website sign-up flow distracted people from moving to the next step. They decided to remove the video to improve website conversion.

3. Focus on organic channels

Generating high-quality, high-converting traffic is the biggest challenge companies face. Paid channels convert well but come at a cost—once businesses stop paying for ads, the traffic flow also stops. For companies that rely heavily on paid traffic, making large reductions to CAC is challenging.

Investing in organic channels like SEO, email marketing, content marketing, and social media is a good idea for businesses looking to lower their CAC. Organic channels may take longer to demonstrate results but bring consistent and sustainable traffic over time.

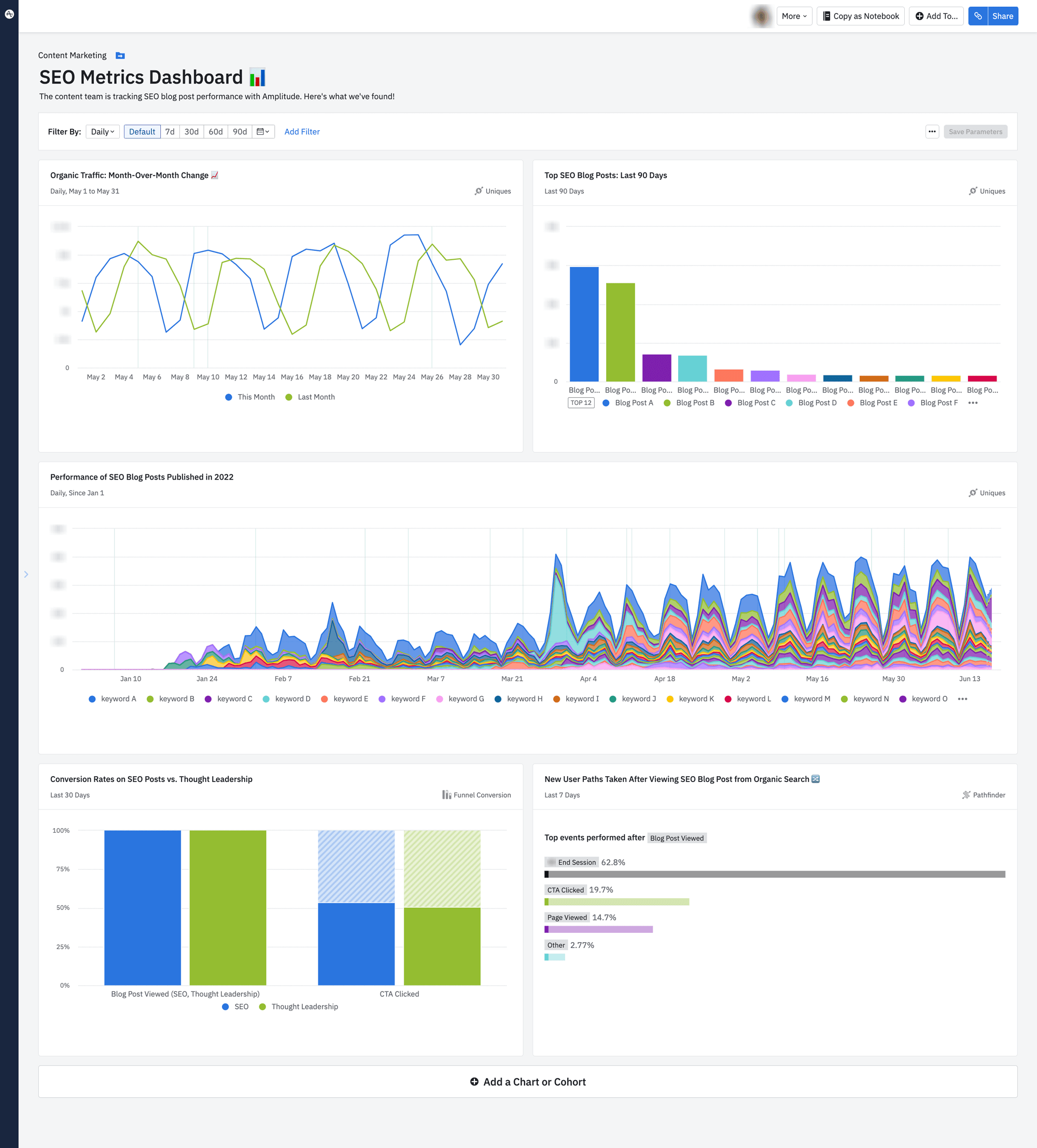

You can track your organic content marketing efforts through an SEO analytics dashboard like the example below. Try it yourself for free in Amplitude.

4. Increase customer value

No amount of marketing can make up for a poor product. To keep your customer base growing, ensure your product delivers real value to users. Use a product analytics platform like Amplitude to optimize your customer journey and identify:

- How quickly customers are reaching the aha moment

- Where customers are experiencing friction and dropping off

- Which features are the most sticky and lead to higher retention

Gathering customer feedback is another tactic for factoring customer needs and wants into product updates, features, and offerings. The more value customers get from using your product, the more likely they are to stick with it and make repeat purchases.

Experiment and iterate your way to success

Henry Shi, co-founder of Super.com, attributes its billion-dollar growth to the Super team consistently running experiments to iterate on and improve its product for customers. The Amplitude platform is a key part of its tech stack that makes it easy for everyone to gather the data it needs to make smart decisions. “We’re constantly iterating, running experiments, and compounding wins,” says Henry.

5. Use marketing automation

Marketing automation software, such as CRMs and tools for email, social media, and reporting, can lower employee costs and free up your team’s time for more creative, strategic tasks. Automation tools not only help nurture businesses but also help optimize overall sales and marketing spending.

Amplitude offers seamless integrations with leading martech tools, which makes it easier for marketers to automate marketing personalization. For example, by syncing Amplitude data to Braze, teams can send automated messages to certain customer cohorts when they trigger specific events.

Learn more about CAC and other critical product metrics in The Amplitude Guide to Product Metrics

References

Noorisingh Saini

Global Content Marketing Manager, Amplitude

Noorisingh Saini is a data-driven marketer managing global content marketing at Amplitude. Previously, she managed all customer identity content at Okta. Noorisingh graduated from Yale University with a degree in Cognitive Science.

More from Noorisingh