The Product Benchmarks Every Retail and Ecommerce Company Should Know

Outperform ecommerce competitors with exclusive data and strategies from our Product Benchmark Report.

When it comes to the digital transformation of the retail industry, there’s no going back.

As consumers flock online for a growing number of goods, B2C businesses are expected to reach a staggering 40 billion users worldwide by 2030, representing more than 56.4% of customers.

Our 2025 Product Benchmark Report reflects the sector’s continued expansion—and shows that much of that growth is concentrated among ecommerce’s top-performing players. In this post, we share exclusive data and takeaways from the report, including where ecommerce teams stand today, how top products win, and what to do next.

About the Product Benchmark Report

Our benchmark analysis relies on Amplitude’s behavioral database and a robust statistical methodology. It draws on anonymized performance and engagement data from over 2,600 companies across industries, regions, and company sizes. We excluded data from customers who opted out of this analysis. Data spans the months between September 2023 to September 2024.

What the numbers say: Financial services product benchmarks

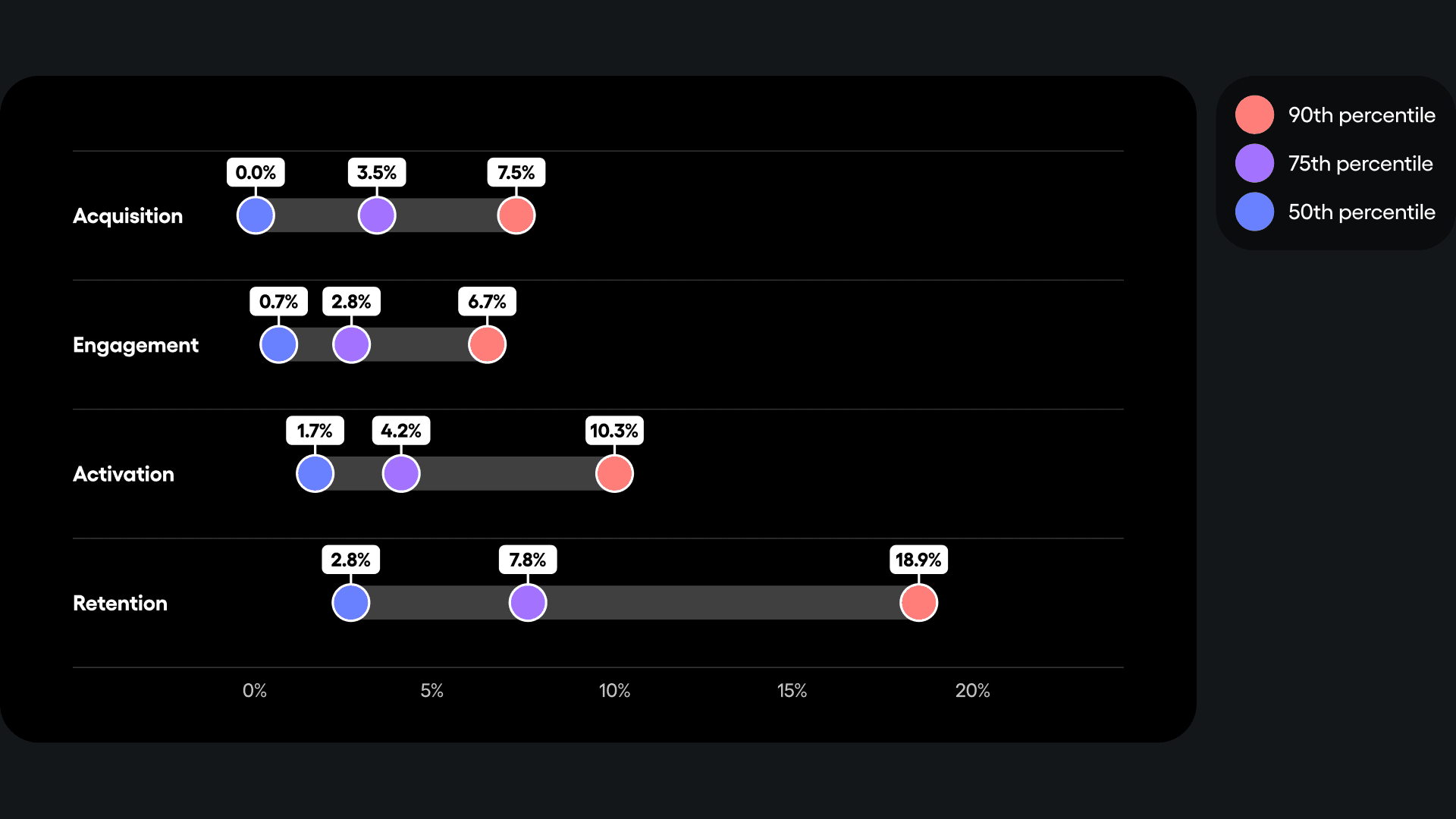

Acquisition, activation, engagement, and retention rates for the ecommerce industry’s 50th, 75th, and 90th percentiles.

Our analysis shows just how much it pays to be the best. While ecommerce products at the median level saw small, sustained gains with a monthly new user growth rate of 0.03%, top performers told another story, with a growth rate of 7.5%. That gap is a big deal when you consider that it means top products grew 250 times faster than their median counterparts. And that speed adds up: Top ecommerce products saw an annual acquisition rate of a whopping 138%.

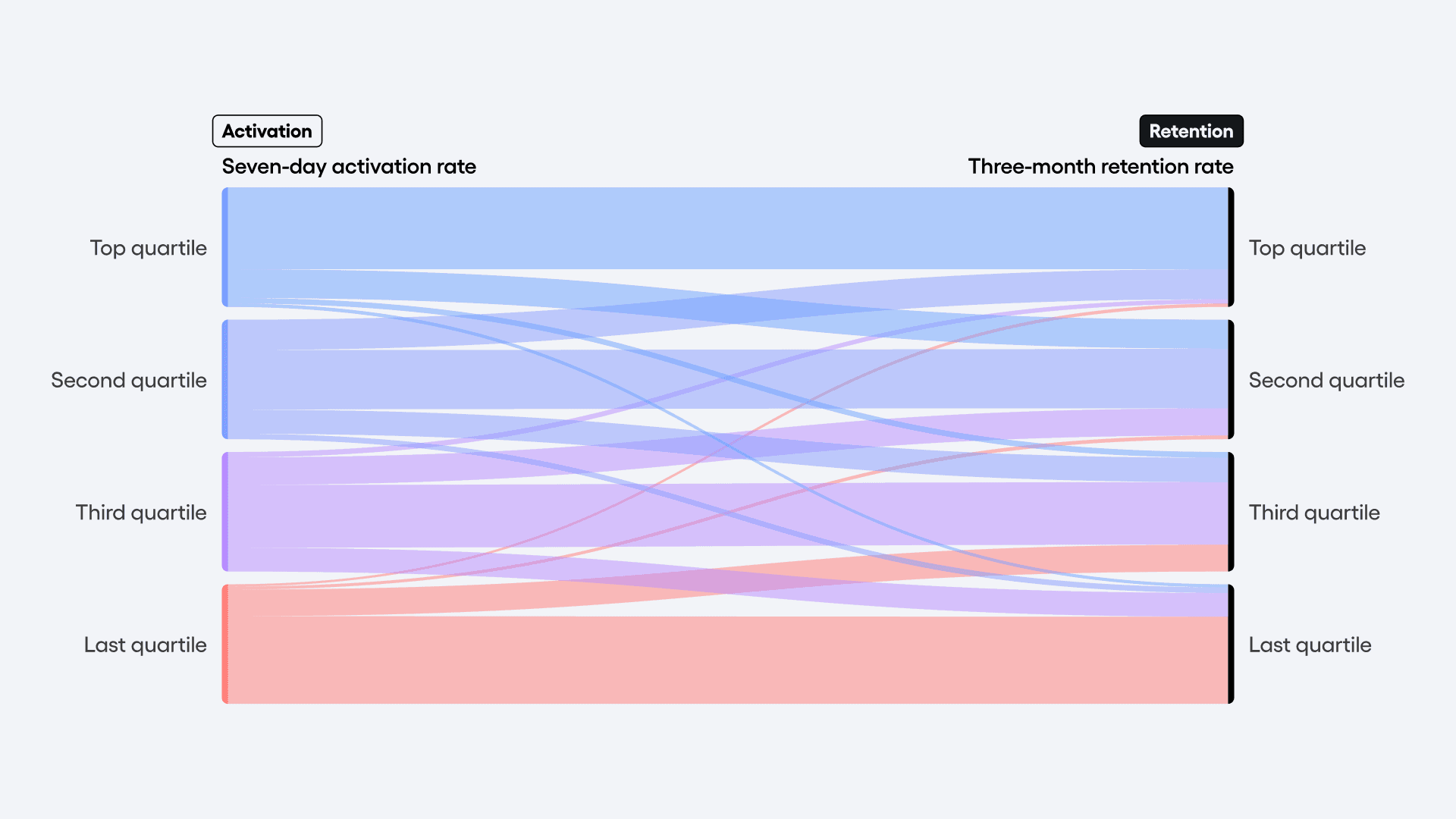

But adding new users will only take you so far. Our analysis of companies across all industries found that the leaky bucket problem is real. In fact, there was no relationship between products in the top quartile for adding users and those in the top quartile for retention. That means solely focusing on the top of the funnel won’t guarantee you repeat customers.

A better bet? Focus on delivering value, ideally within the first week. We found 69% of products with strong early activation were also strong three-month retention performers, demonstrating that speed matters. And that difference compounds. For example, at three months, the top ecommerce products retain 18.9% of their customers while the median ecommerce products retain 2.8%—a nearly 7x difference.

The power of early activation

The real challenge for most products, regardless of industry, isn’t attracting users; it’s keeping them around long-term. A seamless customer experience that quickly gets users to that first aha moment is key. Indeed, if your users come back after one week, there’s a good chance they’ll still be around months later.

This chart illustrates how activation (left) relates to retention (right). The thick blue bar at the top shows that users in the top quartile of activation are also in the top quartile of retention. The thick pink bar at the bottom shows that the opposite is true. This suggests a strong correlation between activation and retention.

Want to know how your product stacks up? Compare your data with our product benchmarking tool.

3 strategies to perform like the best ecommerce companies

So now you know how important early activation is to long-term retention. How do you go about boosting it? Borrow these winning strategies from top ecommerce companies.

1. Curb cart abandonment by optimizing your checkout flow

Minimize friction in the final steps before purchase. To refine your user experience, start by analyzing drop-off points in your checkout flow and A/B testing alternatives that offer a more seamless experience.

Do it in Amplitude: Use quantitative and qualitative data you get from funnels and Session Replay to identify friction and drop-off points. Then use Amplitude Feature Experimentation to test ways to improve the flow.

2. Boost upsells and cross-sells

Increase shopper conversion with personalized experiences based on behavioral insights. Try tactics such as delivering timely banners about relevant offers, upgrades, and promotions, encouraging key shopping behaviors with personalized conversion paths, and targeting customers with customized messages to increase transactions and revenue.

Do it in Amplitude: Use Guides and Surveys to act on trends and hypotheses with personalized customer experiences, such as unobtrusive popups nudging users toward a purchase or highlighting a cross-sell opportunity.

3. See who returns, and how often

Learn which customer segments, actions, and paths to purchase are most correlated with customer loyalty. Group users as new, active, resurrected, or churned. Explore which actions predict loyalty, who returns after a specific action, and what traits your high-value audiences share.

Do it in Amplitude: Drive repeat purchases with Amplitude’s retention analysis chart, which enables you to see how often shoppers return after a specific action—like an initial purchase. Understanding shopper loyalty helps you gauge the health of your business.

How Fender uses Amplitude to boost conversions

When legendary instrument maker Fender made its Fender Play app free for 90 days, it was a huge hit—but users weren’t converting. Using Amplitude’s funnel analysis chart, the Fender team uncovered key moments of friction, including prompts to leave a review during the checkout process. Adjusting the checkout flow boosted overall conversions by 27%—equating to more than $3 million in additional sales.

Put your product on the path to growth with benchmark insights

The outlook for financial services businesses continues to be promising. Smart strategies, such as focusing on activation, can help them make the most of that advantage.

Product Benchmark Report

Discover what else our Product Benchmark Report reveals about the way the best-performing companies win and the lessons you can apply at your own organization.

Noorisingh Saini

Global Content Marketing Manager, Amplitude

Noorisingh Saini is a data-driven marketer managing global content marketing at Amplitude. Previously, she managed all customer identity content at Okta. Noorisingh graduated from Yale University with a degree in Cognitive Science.

More from NoorisinghRecommended Reading

Founders’ Awards: Celebrate the Winners of 2025

Mar 6, 2026

12 min read

Behavioral Analytics for Fraud Teams: From Signals to Action

Mar 5, 2026

5 min read

@Amplitude Has Entered the Chat: Agents in Slack and Teams

Mar 4, 2026

3 min read

From Chaos to Clarity: How to Scale Your Analytics Taxonomy

Mar 3, 2026

11 min read