Data Collection and the Identity Solution

As identity data collection gets more complex, agile companies are shifting to a composable strategy.

In 2020, COVID accelerated the trend of people spending more time online. As consumers were shuttered to their homes and relieved of commutes, Americans spent an hour per day more with media in 2020 than 2019. In response, it’s no surprise that companies furthered their investment in digital channels across all verticals.

Those that moved quickly to establish effective B2C engagement methods created competitive advantages and won a brand new class of consumers. Digital-first service providers experienced fast ROI on their modernized data stack, including data warehouses, single customer views, and privacy mandates that put security first.

New retail arenas arose to provide advertising that utilized highly stratified retail media networks. Multibrand collaborations emerged across industries, powered by compliant data-sharing agreements leveraging data clean rooms. These partnerships facilitated new use cases that drove revenue via second-party data. The digital channels themselves were impacted by the needs of at-home consumers—by 2019, more Americans were paying for streaming services than cable, and this leaped in 2020. Sports, traditional TV’s last defense, began to shift with Amazon’s 2021 NFL package and will weaken further in 2025 with Amazon’s NBA media rights deal.

Capturing identity data from new channels

With CCPA enacted in 2020, following the enforcement of GDPR in 2018, brands in the COVID era were building customer journeys in the age of privacy regulations. This required them to acquire consent, or at a minimum, be more thoughtful about how they collect and manage users’ data. This increased the challenge in receiving relevant signals from non-owned platforms.

Consent and privacy regulations required new solutions, like Alternative IDs offered through Demand-side platforms (DSPs) such as The Trade Desk, LiveRamp, and Criteo. When consented, these platforms provide universally accessible identity data for brands to leverage in multi-channel approaches. For example, if brands wanted to advertise to customers watching streaming movies on Disney+, the identity data value that Disney offered through its AdTech platforms would have to be part of the brand’s first-party dataset.

In a very short time frame, data strategies needed to expand beyond the single customer view to include:

- A scalable and automated data collection capability. The key goals were to govern the collection of customer data wherever it surfaced, comply with privacy regulations, and deliver necessary information to the business.

- A federated identity strategy. Teams now need to capture both the deterministic identity values that surface in customer devices and any alternative IDs that partner systems produce.

In the initial years of this new strategy, the focus on data collection and identity strategy was largely based on business-owned touchpoints. This often included websites, digital products, mobile apps, CRM, support centers, and more. The two most widespread ones were (and still are) the brand’s website and native app. However, as the strategy matured rapidly throughout 2024 and 2025, valuable customer data began to appear on systems outside those web and app touchpoints.

Data brokers that had traditionally offered third-party data had already been diminishing over the years, due to the loss of cross-site tracking cookies on websites, and new restrictions on iOS devices that drastically reduced mobile identification and tracking. These data brokers evolved by building pools of consented, compliant first-party data. Although the audience populations of these new first-party datasets were far smaller than their predecessors, the business model was legitimate and proved its value as data management platforms (DMPs) evolved into customer data platforms (CDPs).

The case for composable data technologies

As is typical in times of significant change, the best responses came from nimbler companies in the market. The ones that never committed to massive marketing technology contracts in the first place.

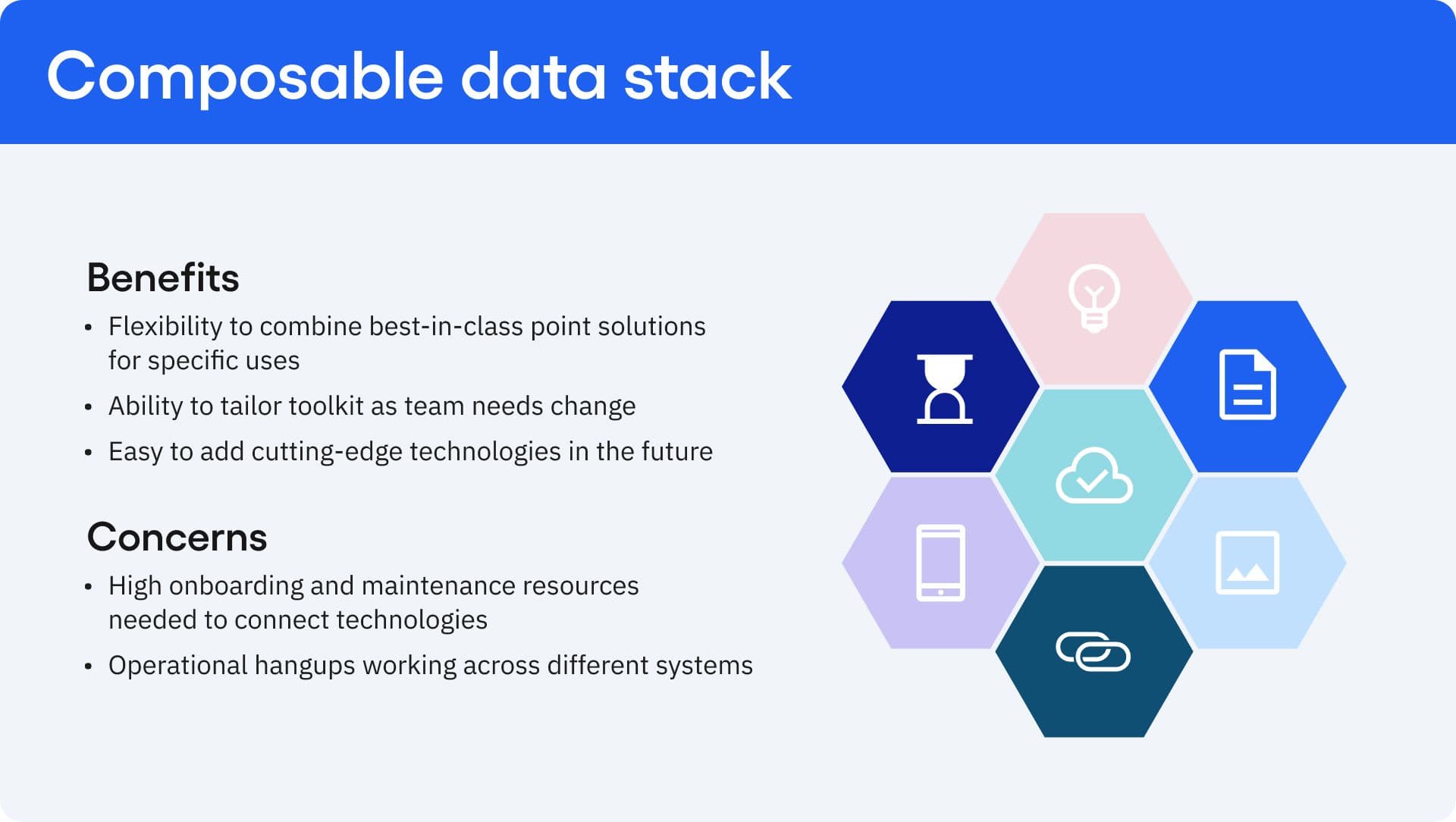

Leveraging their data cloud platforms as the single customer view, these agile companies were free to pick “best-of-breed” vendors to complement their existing methods of data management, compliance, and automation. Data collection and analysis vendors that were built with the same API-first approach simply snapped into the data cloud like a lego brick. These technologies deliver a focused, narrow functionality that seamlessly cooperates with the larger data environment.

Agile companies chose a composable approach, which allowed analytics platforms like Amplitude to be integrated for specific capabilities. A popular design that serves as an example is using Amplitude for Digital Analytics, Experimentation, and Guides & Surveys. That set of tools can then be connected to a data cloud like Azure or AWS for data unification and security. Teams can complete the composable architecture by adding an activation and journey orchestration technology like Hightouch.

Each of the three vendor components works in a federated manner when required. Otherwise, they operate autonomously with respect to their cost structure, maintenance, and labor needs. This optimizes functionality by including only the best tools and reduces costs by limiting contracts to only necessary technologies. The composable stack is scalable, effective, and agile. Enterprises consider the composable approach to be the future of technology investments.

The case against large, inflexible data technologies

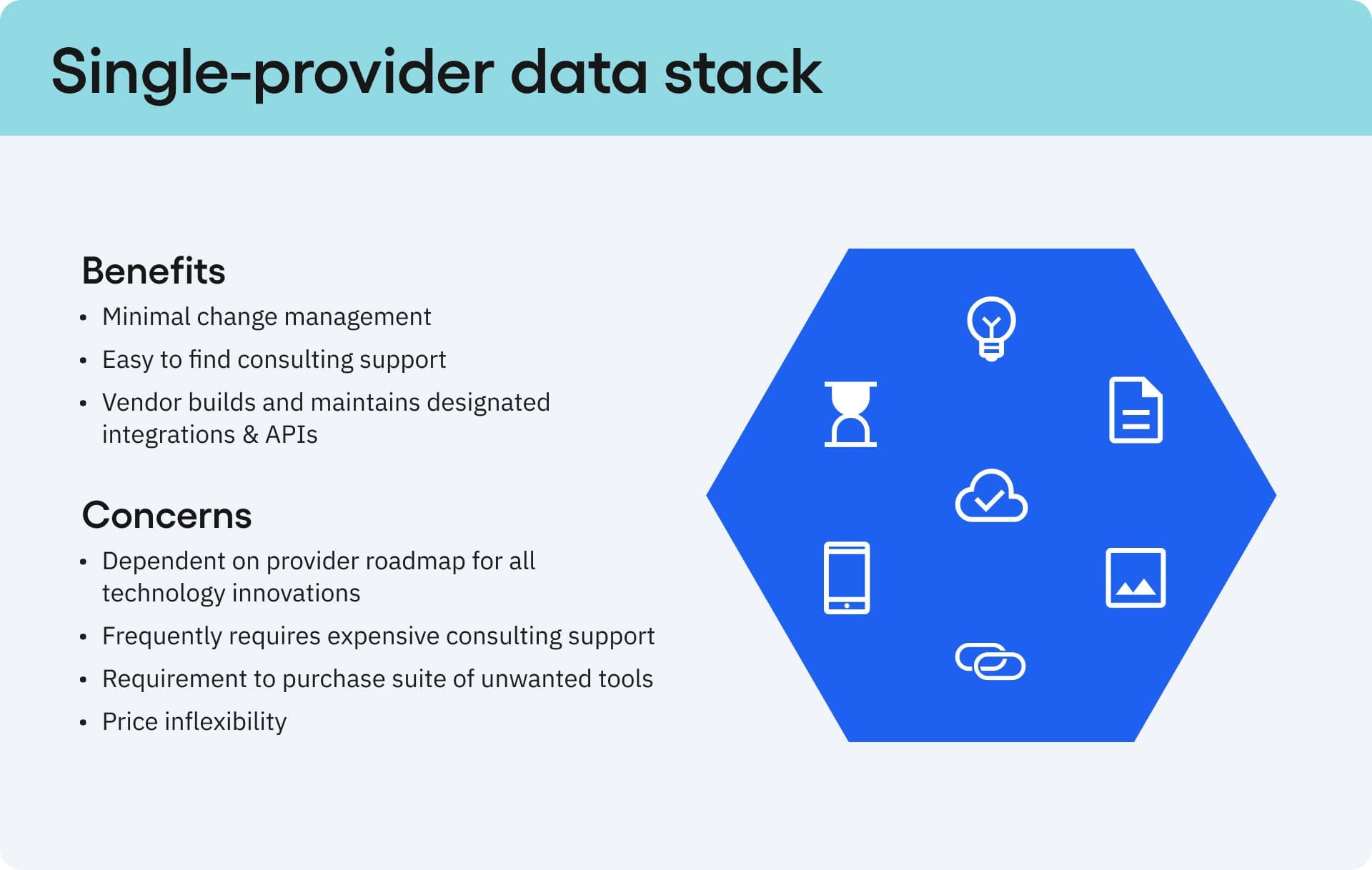

To illustrate the value of a composable stack, consider the counterexample: A marketing stack like Google or Adobe includes solutions that manage data collection, enrichment, processing, validation, activation, and measurement. Organizations have to pay an enormous annual fee for that technology and the behemoth won’t run well without additional accompanying services.

These stacks are designed to be difficult to replace, not because of their capabilities but by how they position their architecture. Both Google Tag Manager 360 and Adobe Tags (Launch) are technically free, but they require you to license other products in their stack.

Both Google and Adobe know the platform switching costs rise when data collection is centralized through products that don’t incur any extra fees. They know they’ll still be paid in other ways.

Although Google Tag Manager 360 can run independently, there are very few instances of standalone GTM usage decoupled from Google’s advertising platform. Google’s business strategy isn’t to help your company collect data, it’s to sell ads. Their technology offerings reflect those priorities.

Most businesses that advertise today are forced to advertise with Google. It makes sense for marketers to use Google Tag Manager and Google Analytics because they are free. However, they are only free because the revenue that Google generates from the ads subsidizes these tools.

These free offerings have artificially skewed analytics and data collection markets. That’s a dangerous game, leading to antitrust lawsuits with teeth, since Google is extending into new markets using the monopolistic power it has earned in search and ads. As of this writing, the results of Google’s antitrust lawsuit remain to be seen, but the advocates of the technology industry at large are building momentum behind the alternative: Composable architectures that provide brands a choice and eliminate legacy costs of doing business. In the Google lawsuit, the terms “old” and “outdated” are used to describe the marketing stacks and their attempt to make built-in products work like a modern solution. While that is surprising—it’s only been 12-15 years since these stacks organized their products through acquisition—it speaks to the speed of innovation in the industry at large.

The future is composable

Today’s enterprises are optimizing for flexibility. Amid a series of fluctuations caused by the pandemic, the rise of AI, evolving privacy regulations, and ever-changing consumer expectations, it’s become harder and harder to predict future market shifts. The best strategy is to give your team a toolkit that can adapt quickly and efficiently when changes are necessary. The last decade has given businesses all the evidence they need to come to the same conclusion.

Making a long-term investment in a monolithic marketing stack will forfeit that critical technology agility. It will also require increasing spend on consulting services to manage increasingly complex operations. On top of all that, your team has to commit to operating by the limits of that stack. You won’t control your strategy anymore, they will. The industry has changed, and composable strategies have proven successful with companies of all sizes. In my most recent client-side role I partnered with data and engineering teams to create a stack that used one solution provider for CDI (customer data infrastructure), an internally built CDP for identity resolution and profiling, Amplitude for self-service behavioral analytics, and an activation platform that sat on top of our own data warehouse. This best-of-all-worlds approach provided the tools we needed to move quickly, while maintaining the flexibility to swap components of the stack as the marketplace evolved.

Whether you’re a large enterprise or a smaller company with a tighter budget, a composable strategy lets you operate according to your unique needs and requires all of your technology providers to earn their keep.

Jim Kultgen

Product Strategist & Evangelist, Amplitude

Jim Kultgen is Amplitude's Product Strategist and Evangelist, delivering analytics expertise to clients worldwide. Jim partners with Amplitude's product team to build solutions for the industry's biggest challenges.

More from JimRecommended Reading

Founders’ Awards: Celebrate the Winners of 2025

Mar 6, 2026

12 min read

Behavioral Analytics for Fraud Teams: From Signals to Action

Mar 5, 2026

5 min read

@Amplitude Has Entered the Chat: Agents in Slack and Teams

Mar 4, 2026

3 min read

From Chaos to Clarity: How to Scale Your Analytics Taxonomy

Mar 3, 2026

11 min read