How to Calculate, Interpret & Improve SaaS LTV

Learn how to identify and boost the value of your customer base to unlock sustainable SaaS growth.

Originally published on August 5, 2022

Table of Contents

You may know how much a customer spends with your SaaS business in a year, or how much it costs on average to acquire them. But how much are your customers really worth to you?

You can discover this by looking at your lifetime value metric, or SaaS LTV. That's a measure of the average total revenue your customers generate during their relationship with your business.

SaaS LTV can help you:

- Predict revenue: Forecast future earnings from your customer base

- Optimize acquisition: Determine how much to spend acquiring new customers, especially important for product-led growth

- Identify valuable segments: Focus retention efforts on high-value customer groups

And the best part is, SaaS LTV is easy to calculate using a variety of formulas. Let's dig in and see how you can understand and improve your SaaS LTV.

Key Takeaways

- LTV measures the total revenue customers generate during their relationship with your business. A higher LTV indicates a more valuable and profitable customer base.

- Calculating LTV helps with financial forecasting and informs business strategy and resource allocation.

- There are different ways to calculate LTV, from a simple formula to an analytics chart.

- The LTV to CAC ratio helps determine customer acquisition efficiency and overall business health.

- To improve LTV, look to boost metrics like ARPU, churn rate, and product stickiness. You can also segment customers into cohorts and analyze high CLV customers for more insights.

What is LTV and why does it matter?

Lifetime value (LTV) is the total amount of money an ideal customer spends during their entire relationship with your SaaS business. Say that on average, a customer spends $500 a month on your product and stays with your business for 12 months. That means your LTV would be $500 x 12 = $6,000.

Beyond the basic financials, LTV is strategically important to your business because it's a way to measure the value of your customer base. A higher LTV indicates more a valuable customer base, because the customers are spending more, engaged over a longer timeframe, or both.

For example, say you’re trying to figure out which customer segment to focus on retaining. Looking at raw revenue numbers, you might decide to target your customers with a high profit margin. But when you look at the LTV, you see that your customers with low profit margins stay longer and generate more revenue over time. So it turns out that focusing on the low-profit customers would actually be more lucrative!

Similarly, if a particular marketing channel brings in high-LTV customers, allocating more budget to that channel makes sense.

What’s the difference between LTV and CLV?

Lifetime value (LTV) and Customer lifetime value (CLV) are often used interchangeably, but they have slightly different meanings.

LTV is an aggregate metric, showing an average of the total amount that each customer will bring in over the time they interact with your company. It provides a big-picture view of the overall revenue potential from the entire customer base.

CLV shows how much a single customer will bring in over the time they interact with your company.

Essentially, your LTV is an average of all your CLVs. While CLV is an indicator of the health of a particular customer, LTV is an indicator of the health of your business as a whole.

Why is LTV in SaaS so important vs. non-SaaS companies?

Because SaaS businesses depend on recurring revenue rather than one-time purchases, it's essential to have a sense of the value of your customer base over time. You won’t be able to recover customer acquisition costs and generate profit just from a single subscription payment.

Let’s say it costs you an average of $100 to acquire a customer for your SaaS product, and they pay you an average of $10 per month. Just to reach a break-even point, you’d need them to stick around for 10 months. Any less, and you’ve got a net loss.

In contrast, non-SaaS businesses often have a revenue model based around immediate, one-time sales instead of retaining customers over a long period. Metrics like average transaction value and immediate ROI from marketing efforts are more relevant.

How to calculate LTV for SaaS

There are a few different ways to calculate SaaS LTV, because different businesses have varying data availability and complexity needs. Choose the method that matches your data and business model:

Method 1: Simple formula

LTV = Average Revenue Per Customer x Average Customer Lifetime

Use this method when you need a quick and straightforward calculation, and when you clearly understand the average revenue per customer and average customer lifespan.

To calculate your average revenue per customer, that's MRR (Monthly Recurring Revenue) / Total Number of Accounts.

For example, if a customer on average spends $50 a month on your SaaS product and stays with your business for six months on average, the LTV is $50 x 6 months = $300.

Method 2: Churn rate formula

LTV = Average Revenue Per Customer / Churn Rate

Use this method when you have data on customer churn rates and want to understand how customer retention impacts LTV.

Churn rate is the percentage of subscribers who canceled their subscriptions during a specific period. For example, if you had 200 subscribers in the previous year and lost 10, the churn rate is 5%. The higher the customer churn rate, the lower the lifetime value.

If your average revenue per customer is $50, and your churn rate is 5%, then your LTV is $50 / 0.05 = $1,000.

Method 3: Gross margin formula

LTV = (Average Revenue Per Customer x Gross Margin) / Revenue Churn Rate

This formula helps you see the LTV in terms of gross margin rather than revenue. It provides a clearer picture of actual profitability because it considers the costs associated with generating revenue. Understanding the true economic value of your customer base helps you make more informed decisions on customer acquisition and retention strategies.

To calculate gross margin, use Total Revenue – Cost of Goods. To calculate revenue churn rate, look at (Revenue Lost in a Specific Period – Upsells in that Specific Period) / Revenue at the Beginning of the Period

If the average revenue per customer is $50, the gross margin is 10%, and the revenue churn rate is 5%, the LTV would be ($50 * 0.10) / 0.05 = $100.

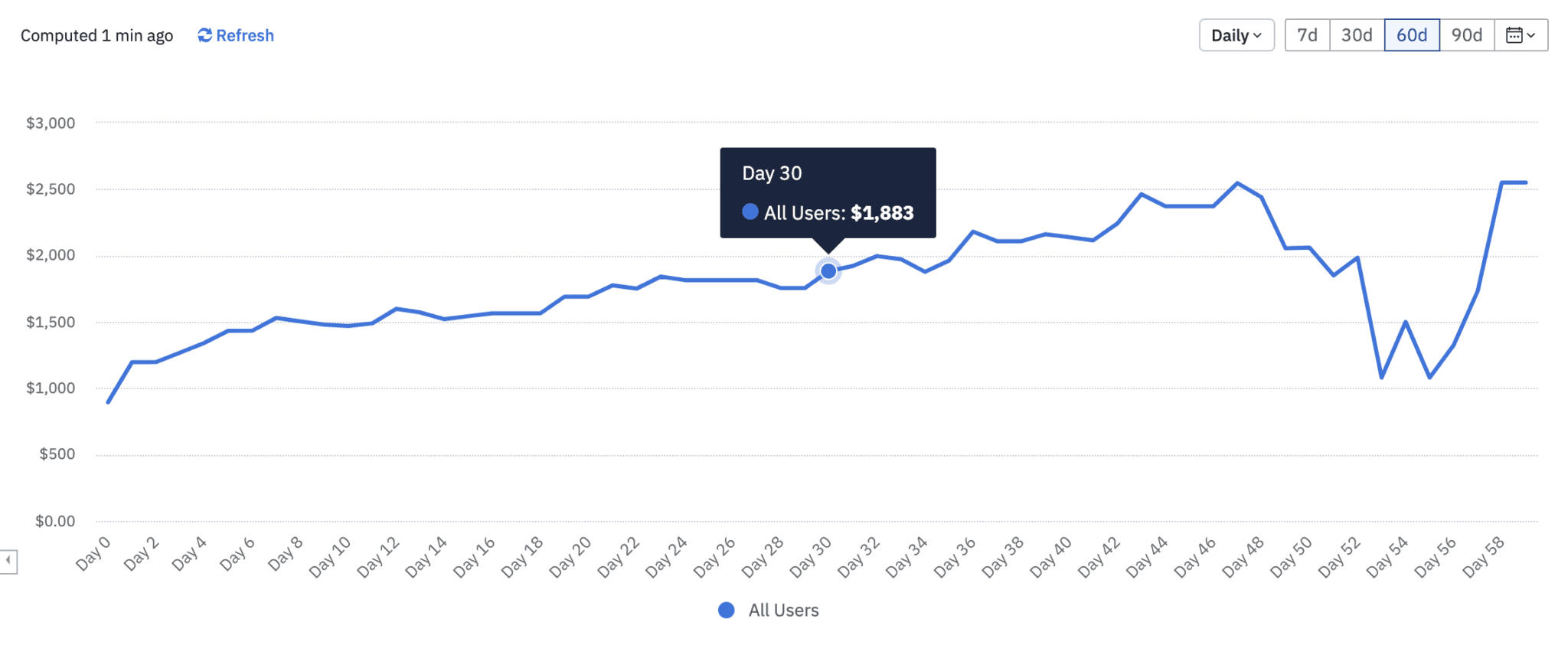

Method 4: Analytics chart

Use this method if you have access to an analytics tool like Amplitude’s Revenue LTV chart. Not only can you easily find your SaaS LTV, but you’ll also be able to identify trends, dig into insights, and share your findings with the rest of your team.

For example, the chart above shows that LTV was steadily increasing for customers in this cohort for their first 46 days. Then it had a large dip around day 52 before spiking up again—investigating what caused that dip could lead to higher LTV overall.

Investigate your SaaS LTV by getting started with Amplitude for free.

What is a good SaaS LTV?

A good SaaS LTV for your company depends on your customer acquisition cost (CAC). Your company will be more profitable with a higher LTV, but you also need that revenue to efficiently balance out what you spend acquiring customers. Because of this, when aiming for a good SaaS LTV, it’s often better to think in terms of your LTV-to-CAC ratio.

To find your CAC, calculate Total Amount of Marketing and Sales Expenses / Number of Customers Acquired in a Given Period. For example, if you spent $20,000 on marketing and sales and acquired 500 customers over a two-year period, your CAC is $40.

A popular benchmark for LTV:CAC is between 3:1 and 5:1. If your ratio is below 3:1, you’re probably spending too much to acquire customers relative to their value. If your ratio is above 5:1, you are likely underinvesting in growth and could be acquiring more customers.

The LTV to CAC ratio helps inform SaaS business decisions like:

- Which type of customer is the most profitable to acquire?

- How much should I invest to acquire a given type of customer?

- How many sales reps should I hire to acquire customers?

3 ways to improve SaaS LTV

There are three proven strategies can significantly improve your SaaS LTV. Focus on these high-impact areas to increase customer value and business growth:

1. Boost the metrics that impact SaaS LTV

Improving the metrics that feed into LTV will help to improve LTV and boost the profitability of your SaaS product. The five core metrics for this are:

- Monthly Recurring Revenue (MRR): This is the revenue a company expects monthly from its subscribers. Higher MRR indicates more revenue per customer, directly increasing LTV.

- Average Revenue Per User (ARPU): ARPU measures the average revenue generated per user over a specific period. Higher ARPU signifies more income per customer, thereby raising the LTV.

- Number of Accounts: This refers to the total number of active customers or subscriptions. More accounts typically mean more revenue, which can boost the overall LTV if retention rates are high.

- Churn Rate: The churn rate is the percentage of customers who cancel their subscriptions during a specific period. A lower churn rate means customers stay longer, increasing the LTV.

- Product Stickiness: This metric gauges how frequently and consistently customers use a product. High product stickiness often leads to better customer retention and increased LTV, as satisfied customers are less likely to churn.

Example: Increase ARPU

Increasing the average revenue per user (ARPU) directly raises LTV. To achieve this, consider periodically increasing your prices. Explore and test your pricing structure to determine what your users are willing to pay. Additionally, you can grow revenue from existing customers by upselling, cross-selling, or upgrading them to higher pricing plans.

Laura Granahan, Principal Customer Success Manager at Amplitude, explains that she uses the Amplitude platform to identify upsell opportunities by checking feature usage. “Say I notice a group of users on an account who are exceeding their maximum number of free syncs and hitting a paywall. I can use that information to let the company know there is a segment of users on their account who would get value from a higher-tier plan,” explains Laura.

Example: Reduce Churn

One way to increase LTV is to extend the customer lifetime, which can only happen by reducing churn. You can reduce churn by rewarding customer loyalty, offering top-tier customer support, and enabling customers with educational resources and training. Helping customers become proficient users of your SaaS product will keep them engaged and retained.

Calculating customer churn provides a starting point for investigating why customers cancel their subscriptions. You can identify and address the root causes of churn by analyzing customer feedback and usage patterns. For example, solving product issues causing customers to leave or offering new content and features can help retain them. Once you have a hypothesis, you can A/B test it and take steps to prevent further churn. In the meantime, continue listening to your customers and serving their needs.

2. Analyze LTV by customer cohorts

You can use SaaS cohort analysis to determine where and how to optimize your acquisition efforts by breaking your customers into cohorts or segments. For example, customers using macOS are more likely to continue using your product over long periods since your product is more compatible with macOS than Windows. From there, you might focus your acquisition efforts on MacOS users or work on improving the product experience for Windows users to help retain them longer.

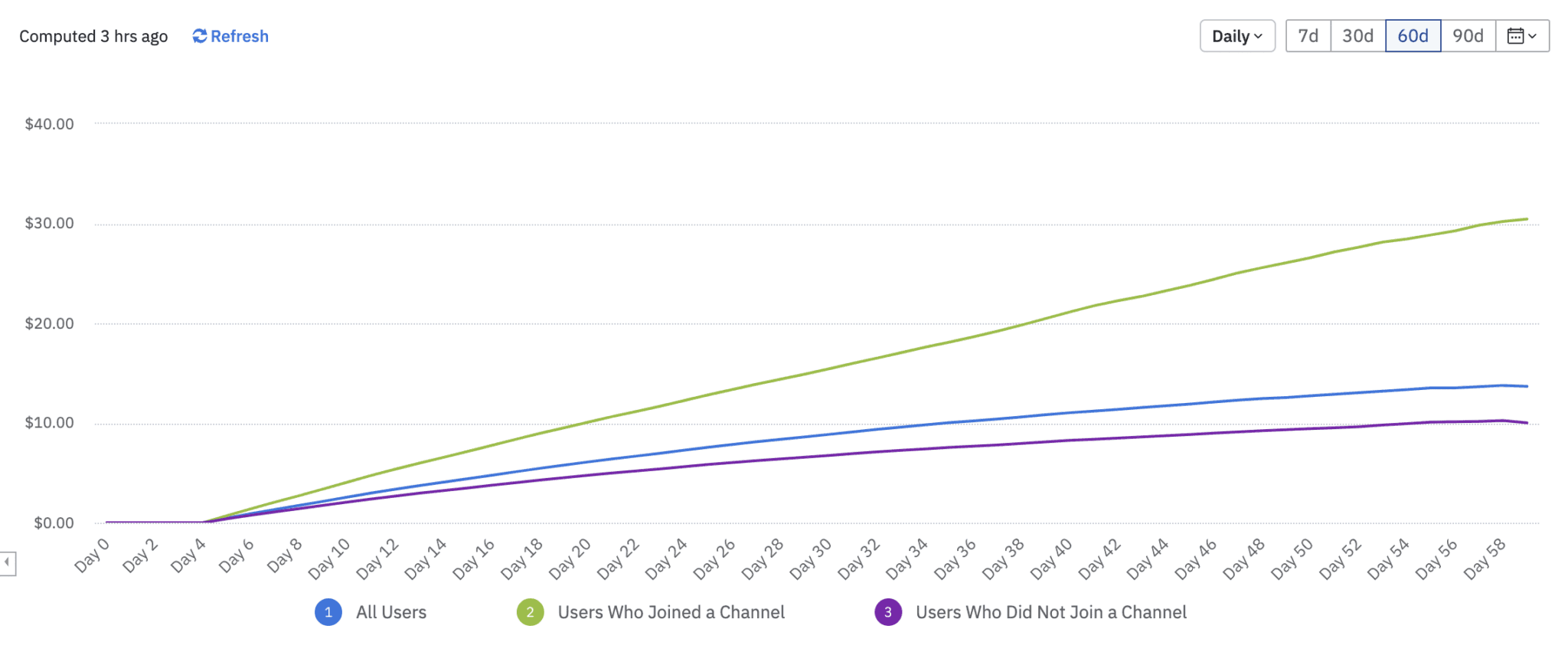

You can also use behavioral cohorts to analyze groups of customers based on their behaviors in your SaaS product. For example, the Amplitude chart below compares LTV in a B2B SaaS messaging app for users who joined a channel and those who did not. Those who join a channel have higher SaaS LTV, so it would benefit your business to surface the join channel feature during onboarding.

Users who joined a channel (green) have higher SaaS LTV than those who did not (purple). Try creating this chart yourself in our self-service demo.

3. Understand high CLV customers through interviews and analytics

Identify customers with a high CLV since they will have an outsized effect on your overall LTV.

They're likely customers who have been with your business for a long time. Interview them to find out why they’ve stayed so long and what would make them want to continue using your product.

An analytics tool will help you learn which product features are most popular and your best marketing channels to connect with high CLV customers.

Get started with SaaS LTV tracking

By calculating LTV, analyzing the metrics that drive it, and implementing improvement strategies, you can make smarter decisions about customer acquisition, retention, and resource allocation.

Ready to start tracking your SaaS LTV? Sign up for a free Amplitude account to access powerful analytics tools that help you measure, analyze, and improve your customer lifetime value.

Noorisingh Saini

Global Content Marketing Manager, Amplitude

Noorisingh Saini is a data-driven marketer managing global content marketing at Amplitude. Previously, she managed all customer identity content at Okta. Noorisingh graduated from Yale University with a degree in Cognitive Science.

More from Noorisingh