The Leaky Bucket Problem: More Users Don’t Mean More Long-Term Growth

Losing users as fast as you acquire them? Get exclusive insights from our 2025 Product Benchmark Report on how to fix the leaky bucket problem and drive lasting growth.

Browse by category

- What is the leaky bucket problem in product growth?

- Data insight: no correlation between acquisition and retention

- The cost of chasing acquisition without retention

- How top products plug their funnel drop-offs

- Strategies to improve customer retention

- Measuring success: from vanity metrics to value metrics

- How to benchmark your product performance

- From leaky buckets to lasting growth

We all know how easy it is to chase new users above all else. You obsess over acquisition numbers (often vanity metrics), celebrate milestones, and assume that more users automatically equals more long-term growth. It’s an intuitive belief that feels right—until you look at the data.

Our 2025 Product Benchmark Report, analyzing over 2,600 companies, reveals a startling truth: There’s no meaningful correlation between how well you acquire users and how well you keep them. Even companies achieving exceptional results in acquisition are losing users consistently over time.

That disconnect between bringing users in and keeping them around costs businesses millions in wasted marketing spend and missed growth opportunities.

What is the leaky bucket problem in product growth?

When a bucket has holes, no matter how fast you try to fill it, the water level barely rises.

That’s exactly what’s happening to most digital products. Teams pour users in through acquisition campaigns, but those same users leak out through poor retention. The result? Flat growth despite impressive acquisition numbers.

The symptoms of this are everywhere: Marketing teams hit their new user targets while product usage stays stagnant, customer acquisition costs keep rising while lifetime value flatlines, and growth teams celebrate sign-up victories while the business struggles to scale.

Notably, even top-performing companies with big budgets and sophisticated marketing operations fall into this trap. They have the right resources, but they stop short once they get the initial acquisition win.

Our 2025 Product Benchmark Report on digital product performance across industries reveals the extent of the leaky bucket problem.

Key findings from the 2025 Product Benchmark Report

- The top 10% of products account for over 80% of all new users, leaving the remaining 90% competing for limited opportunities.

- The growth gap is significant: The top 10% acquisition performers achieve 8.7% monthly growth compared to just 0.11% for median performers.

- There’s no correlation between acquisition prowess and retention success: Companies that excel at bringing users in are scattered across all retention performance levels.

- Even enterprises follow the same pattern: Large organizations with deep resources see the same disconnect between acquisition and retention.

These findings are particularly striking because they challenge everything we’ve been taught about growth. The assumption that “more users equals more long-term growth” simply doesn’t hold up when you analyze thousands of products across different industries and company sizes.

Data insight: no correlation between acquisition and retention

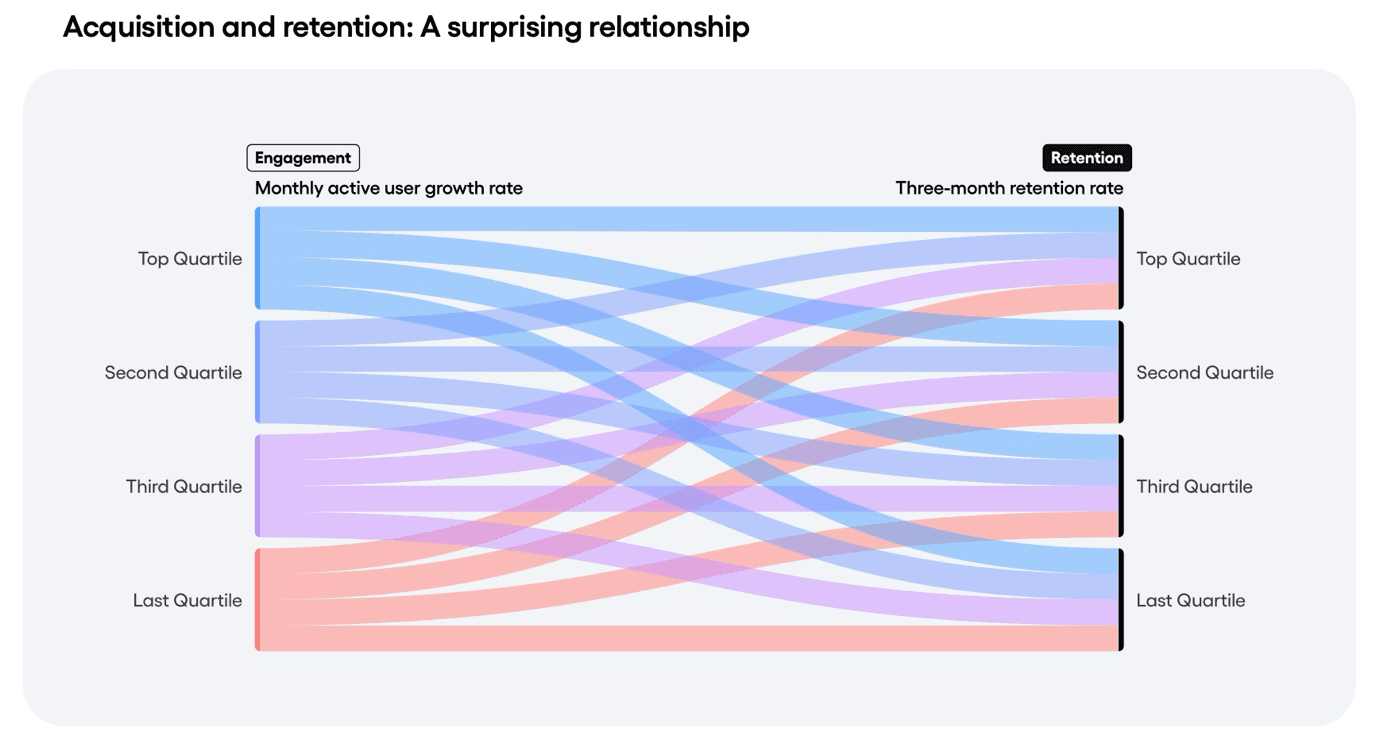

The most revealing insight from our benchmark analysis comes from examining how acquisition performance relates to retention performance. When we plotted the two metrics against each other, we expected to see some correlation. After all, companies that are great at attracting users should have some advantage in keeping them.

But that’s not the case. The data shows that only a small number of products that excel at acquisition also excel at retention. Every acquisition performance quartile is distributed almost evenly across all retention quartiles, which means there’s no meaningful relationship between the two.

This chart illustrates how acquisition (left) relates to retention (right). Only a slender strand of the products in the top quartile for acquisition flowed into the top quartile for retention. Conversely, only a sliver of the products in the lowest quartile for acquisition were also in the lowest quartile for retention.

Think about what this means: A company in the 90th percentile for acquisition (growing new users at 8.7% monthly) is just as likely to have poor retention as excellent retention. Meanwhile, companies with modest acquisition numbers might be quietly building incredibly loyal user bases.

This pattern holds true across industries, from high-growth fintech products to established ecommerce platforms. The fundamental challenge remains the same.

The travel and hospitality industry provides a perfect example. Despite seeing the highest median retention rates across all sectors (10% three-month retention), individual companies within the industry still show the same scattered relationship between acquisition and retention performance.

The cost of chasing acquisition without retention

The financial impact of the leaky bucket problem extends far beyond wasted marketing dollars. A recent McKinsey study shows that the most successful growth companies earn 80% of their value from existing customers. That means when you’re constantly losing users, you’re essentially throwing away up to 80% of your potential value.

Here’s how the math works against you. Customer acquisition costs are steadily increasing across most digital channels (one recent study shows an average increase of 7.6% year-on-year, with individual sectors seeing up to 15%). At the same time, if your retention stays flat, your customer lifetime value remains stagnant. So you’re paying more to acquire customers who are worth the same amount—or worse, paying more to acquire customers you’ll lose within weeks.

The competitive disadvantage compounds over time. While you’re churning through users and constantly needing to refill your pipeline, competitors who solve retention are building sustainable moats. Their users become advocates, their product-market fit strengthens, and their unit economics improve with every cohort.

For investors and stakeholders, unsustainable growth is a red flag. It signals underlying product issues, weak value propositions, and teams that don’t understand their users’ needs. Eventually, the market catches up, acquisition costs become prohibitive, and growth stalls.

How top products plug their funnel drop-offs

The companies that successfully solve the leaky bucket problem share a few key characteristics. They don’t just excel at acquisition or retention—they design their entire growth strategy around the relationship between the two.

Take the financial services sector, which saw standout performance in our benchmark analysis. The top 10% achieved both a 10.2% monthly acquisition rate and a 19.5% three-month retention rate. These companies understand that trust is everything in fintech, so they invest heavily in frictionless onboarding and fast time-to-value experiences. They get users to sign up and successfully transact within days, not weeks.

Our data reveals a critical insight about timing: 69% of top performers in week-one activation were also top performers in three-month retention. This isn’t a coincidence. Companies that can show new users clear value within the first week create a foundation for long-term retention.

How do you do that? The secret is to understand your customers and their journeys. Top companies use behavioral segmentation to understand exactly which acquisition channels and user types lead to retained, valuable customers. Then, they double down on those channels and optimize everything else.

Instead of casting a wide acquisition net and hoping users stick, they build sophisticated feedback loops between their retention data and acquisition targeting. If users from certain channels churn quickly, they adjust their targeting. If users who complete specific onboarding actions retain better, they optimize for those actions during acquisition.

Strategies to improve customer retention

Ready to plug the leaks in your growth strategy? Here are four proven approaches that top-performing products use to align acquisition with retention:

- Track behavioral cohorts, not just sign-ups. Stop celebrating vanity metrics and start measuring what matters. Use behavioral segmentation to understand which users complete key actions that correlate with retention. Segment your acquisition reporting by these behaviors, not just by raw numbers.

- Optimize for activation, not just acquisition. Your job doesn’t end when users sign up. Map out what successful users do in their first week and build your acquisition messaging around getting users to those moments. If retained users typically connect three friends in their first week, make friend connections a key focus of your onboarding flow.

- Build retention into acquisition channels. Create lookalike audiences based on your highest-retaining users, not your highest-converting users. These might be different groups. Use the behavioral patterns, demographics, and acquisition paths of retained users to inform your targeting strategy across all channels.

- Create feedback loops between retention and acquisition. Set up dashboards that show acquisition performance alongside cohort retention data. If a new campaign drives lots of sign-ups but has poor day 7 retention, pause it and investigate why. Use this data to continuously refine your ideal customer profile and messaging.

Measuring success: from vanity metrics to value metrics

The shift from leaky bucket growth to sustainable growth starts with measuring the right things. As one of our product leaders says, “retention is a mirror that reflects, with brutal honesty, whether your product is delivering lasting value.”

Instead of tracking new user growth in isolation, you need metrics that capture the relationship between acquisition and retention.

- Start with your ratio of new vs. churned users. If you’re adding users at 10% monthly growth but losing them at 8% monthly churn, your net growth is only 2%. That’s sustainable. If your churn matches or exceeds your acquisition, you’re running on a treadmill.

- Track cohort retention alongside every acquisition metric. For each marketing channel, campaign, and user segment, measure not just how many users you acquire but how those users behave over time. A channel that drives half the sign-ups but twice the retention might be your most valuable acquisition source.

- Set up your digital analytics to surface activation and retention insights automatically. Use tools that show you which user actions in the first week correlate with three-month retention. Build dashboards that highlight when acquisition and retention trends diverge, so you can investigate and course-correct quickly.

The goal is to shift your entire growth conversation from volume to value. Instead of asking “How many users did we acquire this month?” start asking “How many valuable users did we acquire this month, and how can we acquire more like them?”

Smart product leaders go further—they use retention data not just to measure performance but to guide their roadmap decisions. They prioritize features that correlate with loyalty and deprioritize those that don’t move the retention needle.

How to benchmark your product performance

Understanding whether your product has a leaky bucket problem starts with knowing where you stand relative to your peers. Industry benchmarks give you the context to evaluate whether your acquisition and retention metrics represent healthy, sustainable growth or hidden trouble.

Use our free benchmarking tool to compare your product performance against similar companies in your industry, region, and company size. You’ll get specific percentile rankings for acquisition, activation, engagement, and retention—and more importantly, you’ll see how these metrics relate to each other for top-performing products.

The benchmark data can reveal patterns you might miss when looking at your metrics in isolation. You might discover that your acquisition numbers are strong but your retention lags behind industry medians, or that you’re excelling at retention but underperforming on activation compared to similar companies.

For a deeper dive into industry-specific insights and detailed methodology, check out the complete 2025 Product Benchmark Report. You’ll find comprehensive data on how top products across six major industries approach the acquisition-retention challenge, plus practical strategies you can implement immediately.

From leaky buckets to lasting growth

The path to sustainable growth isn’t about choosing between acquisition and retention but aligning them. The most successful products don’t just fill their buckets faster—they plug the holes first. When you can acquire the right users and keep them engaged, true growth multiplies.

So while it’ll always be a thrill to see those new user numbers rising, it’s important to remember that acquisition is just the first step of the customer journey.

With data-driven insights from Amplitude, you can connect acquisition, activation, and retention, building long-term growth strategies that create lasting value for your users and your business.

Learn more surprising trends and actionable strategies in the 2025 Product Benchmark Report.

Noorisingh Saini

Global Content Marketing Manager, Amplitude

Noorisingh Saini is a data-driven marketer managing global content marketing at Amplitude. Previously, she managed all customer identity content at Okta. Noorisingh graduated from Yale University with a degree in Cognitive Science.

More from Noorisingh